Cambodia: Gov’t must embrace debt, keep cash flowing

A leading international monetary organisation has advised regional governments – including Cambodia – to not become debt adverse and ensure working capital is available during and after the COVID-19 pandemic, in an effort to ensure liquidity is kept in the market for commercial lenders to flow through to small and medium enterprises.

The comments have been made in direct response to reports of a large number of businesses struggling to repay current loans, cover essential business costs – such as rent and electricity – and pay worker entitlements and salaries in the face of a sudden collapse in cash flow and tighter credit.

According to the International Monetary Fund (IMF), while the government has provided some incentives for lenders to refinance debt through regulatory forbearance, this will most likely not be enough.

The financial institution outlined that both the government and central bank will need to go further to address the massive need for new working capital to keep citizens employed as cash flows dry up.

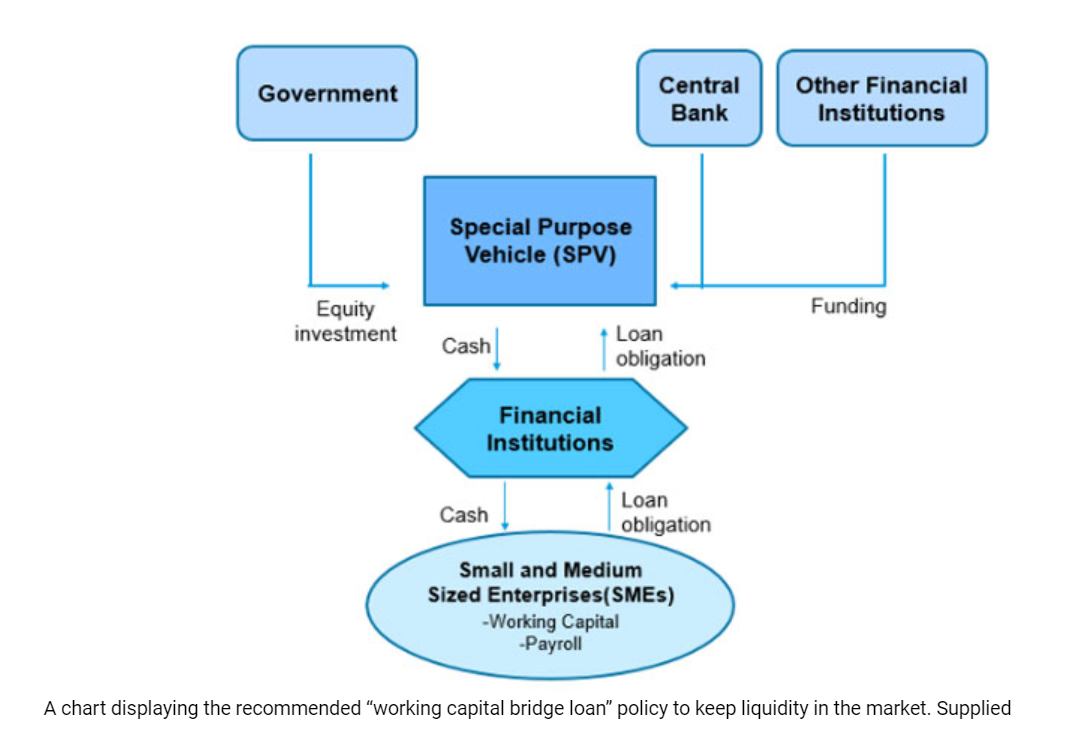

To this end, recommendations made have included a “working capital bridge loan” be made available to stop the COVID-19 downturn from spiralling into a prolonged depression that permanently damages the economy. Another recommended measure is the creation of a “special purpose vehicle” to make funding accessible by commercial lenders and increase their liquidity and have the government guarantee these loans to reduce risk.

There is a caveat, however. Such a loan could only apply to those businesses able to prove their stability pre- pandemic through some form of approved criteria. The loans would not be due for repayment until until after the pandemic, but businesses need to agree to keep a certain percentage of employees onboard and continue trading as per usual.

In response to the crisis so far – in early March – Prime Minister Hun Sen announced he had allocated between $800 million to $2 billion to address the economic impacts of COVID-19, stating the lower end of the allocation would help deal with the economic slowdown over the next six months, while the $2 billion has been reserved if the outbreak lasts more than one year. Much of the stimulus package is to be administered in the form of tax cuts and loan exemptions, not through hard cash payments.

However, Cambodia’s large informal economy will prove difficult to include in any formal government scheme as highlighted in a previous discussion between Khmer Times and Meas Soksensan, spokesperson for the Ministry of Economy and Finance, with the ministry bluntly stating, “Any official stimulus packages announced will only be given to those businesses that are legally registered and are formally verified”.

Cambodian businesses do currently have access to the SME Bank, a $100 million fund dedicated to the SME sector, funded by the Government and operated by the Ministry of Economy and Finance – its main objective is to help SMEs “to flourish”.

To do this, it will put programmes in place to educate the operators of SMEs on banking and other financial matters, while also promoting the creation of new startups in the country’s four main sectors: agriculture, manufacturing, tourism and digital startups, for both domestic and export markets.

Source: https://www.khmertimeskh.com/50718953/govt-must-embrace-debt-keep-cash-flowing/

English

English