Cambodia: Deposit holders to benefit from rising interest rates: ABC

Deposit holders are expected to benefit from interest rate hikes by banks and microfinance deposit-taking institutions (MDIs), according to a senior official at the Association of Banks in Cambodia (ABC).

Phal Chalm Theany, Secretary General of ABC, explained in an email to Khmer Times that rising inflation, mostly resulting from low-interest rates over the last years, is now materialising alongside rising interest rates.

“Interest rates are most likely to go up over the next months as central banks around the world have started raising rates to counter inflation. Such increase in rates may also benefit deposit holders as banks and MDIs are now paying higher interest rates,” Theany said.

Currently, there are about 13.2 million deposit accounts and 3.5 million credit accounts at the country’s banks and microfinance institutions, according to Cambodia’s central bank National Bank of Cambodia (NBC).

The average per-annum interest rate for deposits in Khmer riel has increased faster than that in dollars by 0.6 percent to 6.2 percent in 2021 from 5.6 percent in 2020, while the interest rate for deposits in dollars has risen by 0.4 percent to 4.7 percent from 4.3 percent, according to ABC.

Sok Voeun, chairman of Cambodia Microfinance Institution, said recently that many banks and MFIs in Cambodia have increased interest rates for deposits in dollar and riel by approximately 0.5 percent and one percent per annum respectively but not decreased rates for loans in the last three months.

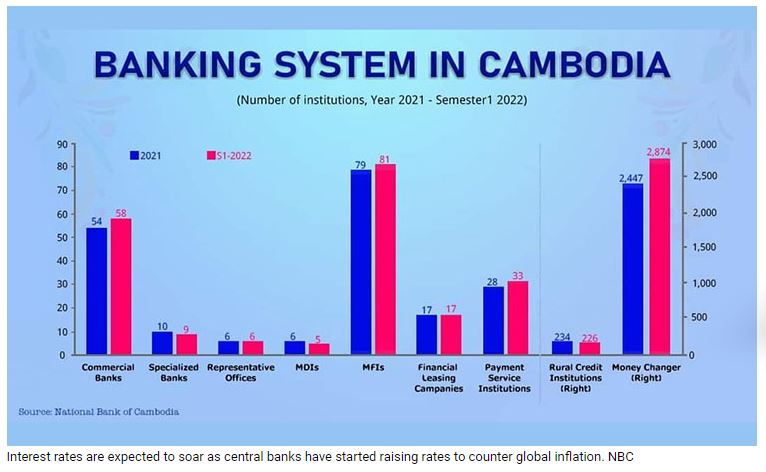

In the first half of 2022, there have been 58 commercials, nine specialised banks, six representative offices, five MDIs, 81 Microfinance Institutions (MFIs), 17 financial leasing firms, 33 payment service firms, 226 rural credit operators and 2,674 money changers, according to ABC’s data, adding that three banks newly-licensed during the period include Woori Bank, Oriental Bank and CCU Commercial Bank.

Banks and MFIs can raise their interest rates for deposits and loans in a free market economy without prior consultations with ABC or NBC as long as the interest rates are correct, for example, not exceeding 18 percent per annum for MFIs, she explained.

“Cambodia follows a free market economy. Given that Cambodia is a highly-dollarised economy, Cambodia’s interest rates are largely driven by international developments. Having said that, interest rates in Khmer riel are largely driven by NBC as well as the premise of a stable exchange rate to the dollar,” she explained.

ABC figures also show that the average annual interest rate for loans in Khmer riel and US dollar were 6.5 percent and 10.68 percent respectively from 2020 to 2021. The amount of loans and deposits were $44.03 billion — 9.8 percent in Khmer riel and 79.16 percent from banks — and about $36.75 billion respectively from January to June 2022.

Pheany added that as per the forecast by the International Monetary Fund, Cambodia’s economy would grow by 5-6 percent next year, leading to the assumption of an increase in loans. In anticipation of an economic recovery, the banking sector is expected to grow at 20 percent.

Source: https://www.khmertimeskh.com/501132350/deposit-holders-to-benefit-from-rising-interest-rates-abc/

English

English