Cambodia: Cambodia eyes bond market

The Cambodian government is close to establishing a bond market in a bid to raise more funds from domestic sources and move away from dependency on foreign aid, a senior official at the Ministry of Economy and Finance said last week.

“We cannot heavily depend on external debt which is very dangerous, so it is time for us to develop a bond market,” the ministry’s secretary of state Vongsey Vissoth said.

“First we need to boost the money market to facilitate the stock market.

“For the bond market our intention is to borrow money locally. We also see that a lot of banks have ample surplus money so we will issue bonds to get a long-term fund for us to develop the country,” he said.

Mr. Vissoth said if there was any economic crisis in the country, the financial regulators would have a mechanism to deal with it.

“Besides taking external loans, we can issue bonds to take out a loan locally to deal with such an economic crisis,” he added.

Lamun Soleil, director of market operations at the Securities and Exchange Commission of Cambodia (SECC), said development of a bond market is important for the capital market and compliments the stock market in raising funds from the public.

“Companies not only need the equity capital, but also debt capital in their capital structure,” said Mr. Soleil.

“The target investors are also different. Bond investors are generally big investors and don’t want to take more risks with regard to the companies’ business performance and stock price fluctuation.”

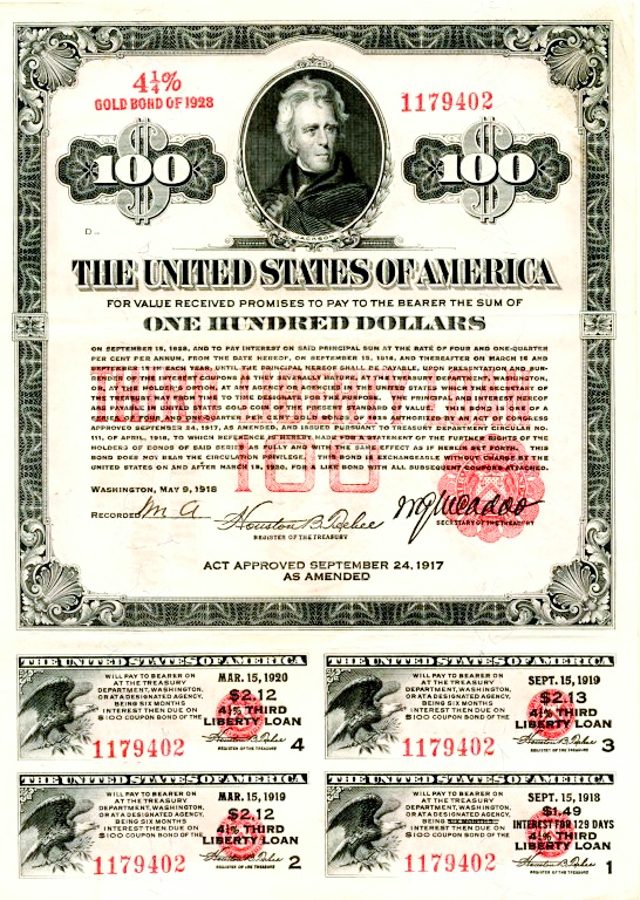

A bond is a loan that the bond purchaser, or bondholder, makes to the bond issuer. Governments, corporations and municipalities issue bonds when they need capital, and an investor who buys a government bond is lending the government money.

Like a loan, a bond pays interest periodically and repays the principal at a stated time, known as maturity.

Kyungtae Han, managing director of securities firm Yaunta Cambodia, also said that the launch of a bond market would be a factor for the development of the securities market in Cambodia in attracting more investors.

He hoped the government would make sure there were clear regulations to manage the industry well.

“I guess having the necessary and proper regulatory infrastructure in place is the key to a successful launch of the local bond market,” he said.

The ministry’s Mr. Vissoth said the establishment of a bond market would be a benchmark step towards issuing corporate bonds because the private sector also issues bonds to take loans from the market

“I think that right now is just the time for us to press on the button on which day we want to work on it.

“I think issuing bonds for domestic savings will not be in the long or medium term but it will happen very soon – or early next year – as we are already well prepared with regulations and rules.

“The timing is just when we are going to press on the button,” he said.

“That’s already set in our policy on developing the money market and the bond market.”

Source: http://www.khmertimeskh.com/news/34904/cambodia-eyes-bond-market/

English

English