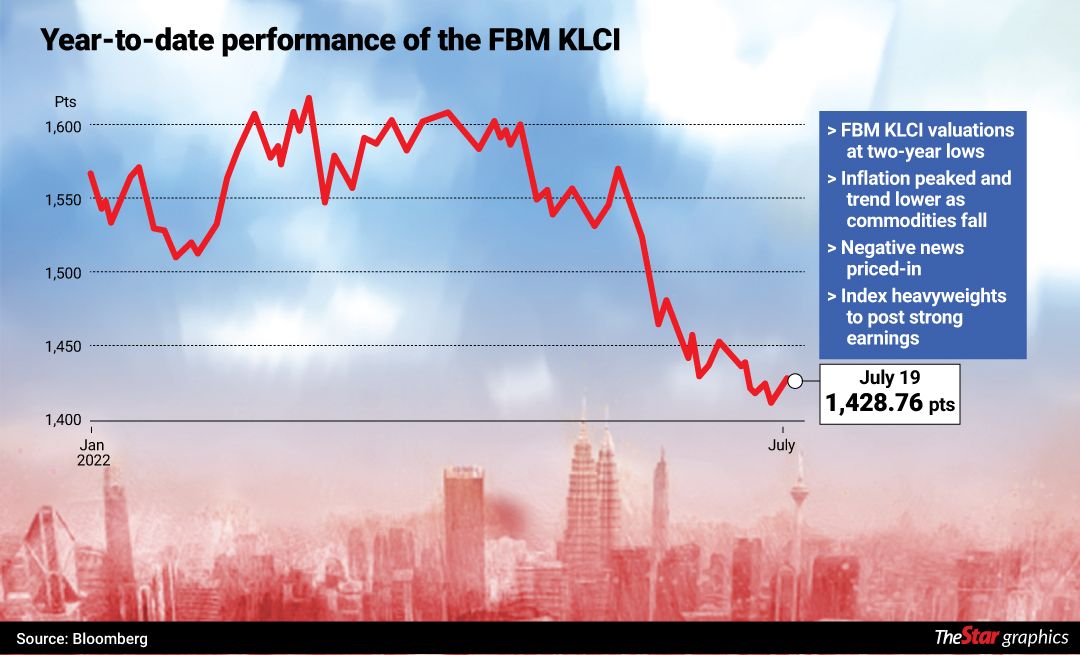

Bursa Malaysia likely to have hit bottom

PETALING JAYA: Bursa Malaysia has likely found its bottom at current levels with negative news priced in but the gloom in investor sentiment has yet to lift until volatile global markets attract fresh buying interest.

While timing an entry or exit from the equity market is a key skill in investing, very few analysts are prepared to confidently call the upturn but most analysts believe that at current levels, many will not go wrong investing in value or growth stocks.

“We are at or near the bottom as far as the FMB KLCI is concerned but investor sentiment is correlated to external markets.

“The June consumer price index (CPI) number of 9.1% in the United States is likely to fall in July and this will give the Federal Reserve (Fed) more room to maneuvre towards a soft landing after its rate hike this month,” Trident Analytics Sdn Bhd chief research officer Peter Lim Tze Cheng told Starbiz yesterday.

Lim, who also doubles as a fund manager at Areca Capital Sdn Bhd, said the US June CPI number looks high on a year-on-year basis due to low base effect but when seen from a month-on-month basis, price pressures were milder at 1.1%, suggesting inflation had likely peaked and could go lower in the months ahead.

He added that the price rally in commodities has retraced while freight rates continue to weaken but the Fed’s move to further tighten monetary policy in July to slow down inflation at a 40-year high could trigger a technical recession in the United States as consumers pull back.

“All is not doom and gloom but timing an entry or exit is a key skill of investing. But if you are a value or growth investor, current valuations are compelling,” said Rakuten Trade Sdn Bhd head of equity sales Vincent Lau.

Noting inflation drives investors to value stocks that offer stable dividends like banking stocks, Lau said the deep 40% correction in the tech index makes local growth tech stocks very compelling as well, more so when inflation falls and foreign tech stocks rebound.

Investors and analysts will, however, have an eye on the upcoming earnings season for leads as a majority of listed companies announce their quarterly results this month and in August.

That said, foreign outflows appear to be easing on the local exchange. After enjoying inflows of over RM6bil (US$1.4bil) in the first five months of the year, Bursa Malaysia registered a net outflow of RM1.3bil (US$291mil) in June but has narrowed

to a net outflow of RM160.2mil (US$36mil) in July to date.

A check with a local brokerage revealed the value of short-selling positions on the local exchange has fallen to RM1.2bil from an average of RM4bil in a rising market, further suggesting market sentiment could turn in the near future.

Lim is not worried about the lower trading volumes on the local exchange as he expects many are opting to hold cash.

“You can go to malls on weekends and see how full they are with locals spending on shopping, food and entertainment. I suspect retailers and institutions will return once the market turns,” he said, adding that now is as good a time as any to buy.

The benchmark FBM KLCI closed marginally lower by 0.78 points at 1,428.78 points yesterday, with current valuation of 13.7 times forwards price earnings rated cheap compared to historic average of 16 times.

After a significant jump in earnings growth of 46% in 2021, the benchmark poor performance is also partly due to analysts’ expectations the FBM KLCI will post flat growth year-on-year in 2022, due to the impact of Cukai Makmur and fall in earnings from the healthcare sector, especially glove makers.

Sectors like banking, materials and consumer-related index counters, however, are expected to post growth due to the higher overnight policy rate, growing economy, higher commodity prices and pent-up demand.

China’s US$1.2 trillion (RM5.34 trillion) proposed infrastructure spending plan and monetary stimulus could help boost trade and investments for countries like Malaysia.

“What would be more important is for China to reopen fully as there is pent-up demand for services like tourism to countries like Malaysia,” said iFast Capital research manager Jason Wong Jia Jun.

He said the debt issue with Chinese property developers will be continued and its central bank has significant policy room to support the economy.

Wong added that China’s four trillion yuan (RM2.64 trillion) fiscal spending after the 2008 global financial crisis helped lift the world economy.

Source: https://www.thestar.com.my/business/business-news/2022/07/20/bursa-malaysia-likely-to-have-hit-bottom

English

English