ASEAN e-commerce hit by fraud

Southeast Asia’s e-commerce market is well on its way to exceeding Google’s prediction of hitting US$200 billion in value by 2025, with e-commerce players such as Lazada, Shopee, and Tokopedia expanding their efforts in the region to meet ever-growing customer demands. E-commerce growth in Southeast Asia is driven by a high mobile internet penetration rate, young consumers and an increase in disposable income.

According to a We Are Social Report, in 2018, there were 391 million mobile internet users in Indonesia, Thailand, Malaysia, Singapore, Philippines, and Vietnam alone. However, the rise of e-commerce also gives rise to a new problem: online fraud.

Online fraud cost retailers an estimated US$57.8 billion globally in 2017 and is especially problematic in Southeast Asia. An AppsFlyer report titled Fraud Rising: How Bots and Malware Are Compromising APAC’s Apps in 2019, found that e-commerce companies are most affected by ad fraud. According to this report, the region’s losses accounted for 40 percent of the total estimated ad fraud losses in the APAC region which totalled US$650 million.

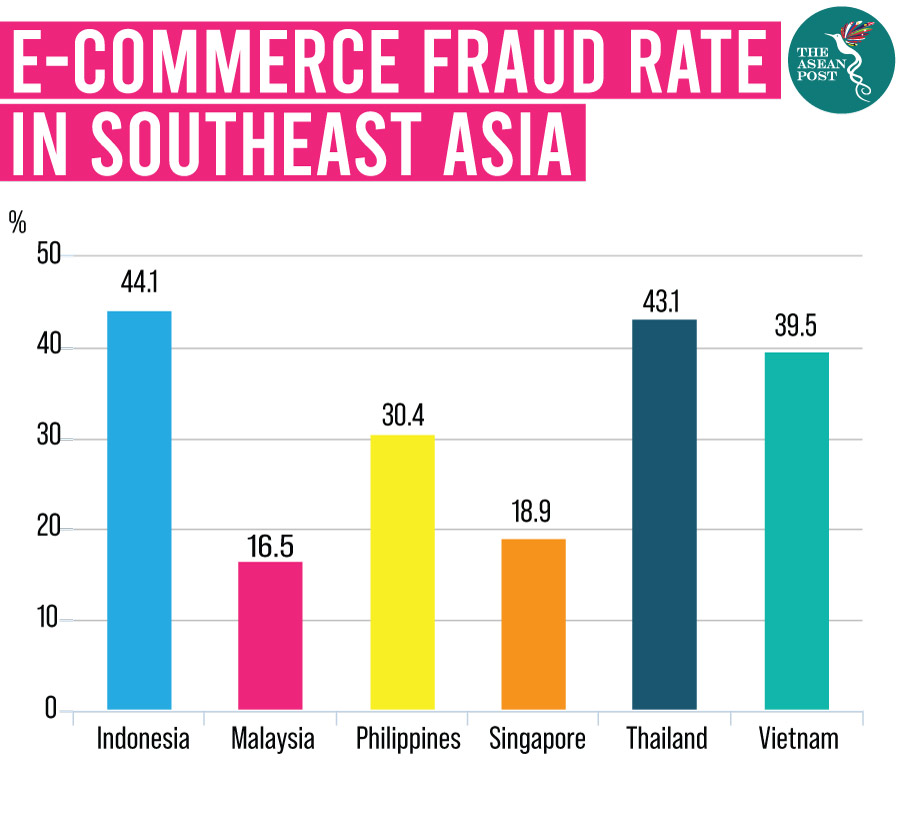

Southeast Asia stands to lose US$260 million to online fraud with Thailand, Vietnam and Indonesia expected to be the most heavily affected. The region is most likely a target due to its large user base, low awareness of fraud and the Cost-per-Install (CPI) rather than Cost-per-Action (CPA) driven markets. CPI doesn’t require an ‘action’ and is therefore easily replicable or hijackable by bots, providing a high incentive to fraudsters per install.

Susceptible to fraud

AppsFlyer identified several reasons why Southeast Asia is particularly susceptible to online fraud. Among them are the region’s talent shortage in app development, that fraud is already comparatively high in local marketing networks, and that now marketers are spending an increasingly higher volume on digital ads. At the same time, the rise of multiple electronic payment channels makes the region a profitable target.

According to information services firm Experian’s 2018 Digital Consumer Insights, there was an interplay between convenience and fraud. The growth of convenient interaction and transaction platforms, with the incessant goal to provide better and seamless customer experiences, have given opportunities for nefarious online activities. For example, Thailand’s rapidly developing e-commerce market also saw an increase in fraud cases.

“Fraud rates are also high, with an average of 19 percent of Thais having experienced fraud across various e-commerce and services segments,” said Dev Dhiman, Experian’s Managing Director of Southeast Asia and Emerging Markets.

Reports from the 2019 Global Ecommerce Fraud Management and 2018 CyberSource Online Fraud Benchmark in Southeast Asia have identified the most common types of fraud in e-commerce which are identity theft, phishing (posing as a trustworthy entity to acquire personal information like usernames and passwords), account takeover (illegally accessing someone’s account), mobile fraud and chargeback fraud.

Mobile fraud is carried out via apps and other platforms on mobile devices. According to the above reports, 57 percent of merchants believe mobile fraud risks are lower than other e-commerce fraud risks. Chargeback fraud targets merchants directly, rather than victimises customers, where customers would request a chargeback after receiving legitimately purchased goods or services.

The use of bots and install hijacking remain the most common attacks perpetrated. Bots perform fraud by hacking online ads and giving publishers fake impressions in return for nominal fees.

Reduce risk

The 2018 CyberSource report states that the biggest challenges to fraud management in Southeast Asia are the inconsistent implementation of fraud management systems and tools, cost, lack of expertise and lack of efficient overall data management. AppsFlyer claims that the current solutions of manual review and 3-D secure payments are insufficient. In the region, 42.2 percent of merchants review orders manually to ensure authenticity, where 98.5 percent of reviewed orders are accepted. These figures suggest that the time-consuming efforts are not as efficient and optimised as it can be.

Optimising fraud strategies and detection tools, improving automated detection and sorting and streamlining manual review tasks can help reduce fraud risks. But, with the acceleration of the digital economy, online fraud will continue to grow and merchants must utilise the right technologies and solutions to address the issue. It is also the responsibility of consumers to be informed on the different types of online fraud, and take necessary measures to protect themselves.

Source: https://theaseanpost.com/article/asean-e-commerce-hit-fraud

English

English