Analysts raise Singapore export forecasts after surprisingly strong March data

SINGAPORE – Analysts are pencilling in higher full-year exports for Singapore after a better-than-expected first quarter showing, and are tipping the official forecast of 0 per cent to 2 per cent growth to be lifted at a review in May.

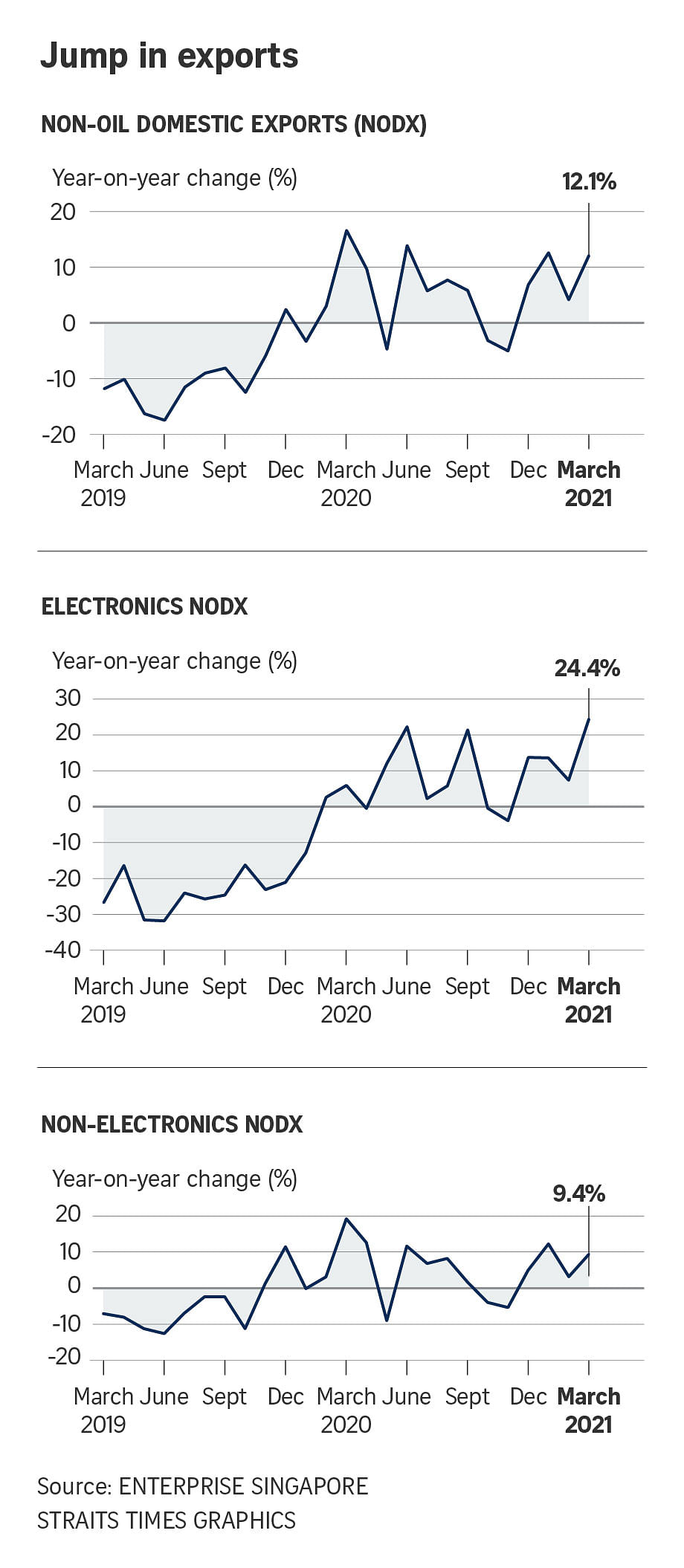

Non-oil domestic exports (Nodx) surged 12. 1 per cent year on year in March, mainly due to higher demand for chips and non-electronics such as petrochemicals, specialised machinery and pharmaceuticals, according to data released by Enterprise Singapore (ESG) on Friday (April 16).

The performance was better than the 4.2 per cent rise in February, and blew past the 2.6 per cent growth forecast by analysts in a Bloomberg poll.

Electronics shipments expanded 24.4 per cent from a year ago in March compared with the 7.3 per cent year-on-year growth seen in February.

This was from a low base a year ago, but also came on the back of strong demand for the likes of integrated circuits (ICs), amid strong global semiconductor demand and media reports of chip shortages, said ESG. Electronics exports a year ago in March 2020 were at the lowest monthly level compared with the average for the whole year.

OCBC Bank head of treasury research and strategy Selena Ling noted that there was double-digit growth recorded in PCs, diodes and transistors, and IC shipments.

“This is a clear indication that Singapore’s semiconductor industry is benefiting from the ongoing global chip shortage,” she said.

Meanwhile, non-electronics Nodx grew 9.4 per cent last month, compared with the 3.2 per cent year-on-year increase in February. In particular, petrochemical exports leapt 51.4 per cent, while specialised machinery expanded 35.1 per cent.

Nodx to the top 10 markets as a whole grew in March, though exports to Thailand, the United States, Japan and Hong Kong declined. China, the European Union and Malaysia were the largest contributors to export growth.

Shipments to emerging markets rose 67.9 per cent, continuing the encouraging 45.6 per cent growth the month before, due to higher demand from South Asia and Latin America, as well as regional countries Cambodia, Laos, Myanmar and Vietnam.

“Firming global economic activities and robust chip demand may keep Singapore’s exports humming in 2021,” said Maybank Kim Eng analysts Chua Hak Bin and Lee Ju Ye, who lifted their Nodx full-year forecast to around 5 per cent to 6 per cent growth, up from a 3 to 4 per cent increase.

They added that supply and logistics bottlenecks such as port congestion and the Suez Canal blockage have not dampened exports, and that a S&P Global Platts report has noted that delays in Singapore’s port eased marginally in March from the peak in February.

Dr Chua and Ms Lee are predicting that the official Nodx forecast of 0 to 2 per cent growth will be raised in the review in May.

Ms Ling added that assuming the global vaccine-aided recovery theme continues to bloom into the second half of the year, Singapore’s Nodx could grow 2 to 4 per cent in 2021, up from OCBC’s existing forecast of a 2 per cent increase.

UOB economist Barnabas Gan said March’s encouraging expansion in Nodx suggests a strong rebound in global trade demand, and the bank has upgraded its forecast for full-year Nodx growth to 5 per cent, up from 1 per cent.

He added: “The improving global economic backdrop, uptick in semiconductor demand, and rising oil prices are strong drivers to lift Singapore’s export momentum in 2021.”

Year on year, total trade expanded 19.6 per cent in March, reversing the 3.3 per cent decline seen in February, which ESG attributed to the increase in both electronics and oil trade.

Oil shipments grew 14.7 per cent year on year in March, reversing the 28 per cent contraction the previous month on the back of higher exports to China, Australia and Indonesia.

Total exports increased 21 per cent compared with the 2.1 per cent dip in the previous month. Overall imports also grew 17.9 per cent, following February’s 4.6 per cent decrease.

On a month-on-month seasonally adjusted basis, total trade saw an uptick of 7.1 per cent, extending the 6 per cent rise seen in February.

On a seasonally adjusted basis, total trade reached $98.4 billion in March, higher than the $91.8 billion in February.

Total exports grew 8.4 per cent in March, while total imports rose 5.6 per cent.

Singapore’s encouraging trade performance in March came alongside its surprise economic growth for the first quarter of 2021, according to advance estimates released by the Ministry of Trade and Industry on Wednesday.

Gross domestic product rose 0.2 per cent year on year, an unexpected turnaround after three quarters of contraction amid the coronavirus pandemic.

But while growth could continue for another quarter on the back of low base effects, the pace of expansion is expected to taper off in the second half given slack in the labour market and international travel restrictions.

Source: https://www.straitstimes.com/business/economy/singapore-non-oil-exports-surge-121-in-march-beating-forecasts

English

English