79% Vietnamese consumers in favor of government’s initiative towards cashless society

The Hanoitimes – Nearly 75% of Vietnamese consumers expect cashless payment to grow further in the next 12 months.

A survey conducted by global payment technology company VISA revealed 79% of Vietnamese consumers are in favor of the government initiative focused on transforming the country into a cashless society.

Notably, the rate is the highest among Southeast Asian countries, with Indonesia came in second with 75%, and Thailand in third place with 73%.

VISA’s survey suggested Southeast Asian consumers are extremely optimistic about their future use of cashless payments. Close to seven in 10 consumers expect their usage of cashless payments to increase in the next 12 months, it added.

|

| Source: VISA. |

“We see this trend highest in Vietnam (74%), Indonesia (73%) and Thailand (72%),” stated VISA.

VISA’s Group Country Manager in Southeast Asia Tareq Muhmood said over the past few years Southeast Asia has become a hotbed of payments innovation thanks to its high rate of internet connectivity, large unbanked population and government initiatives focused on transforming countries into cashless societies.

“The use of digital financial services in Southeast Asia could generate up to US$60 billion in revenues for the financial services industry by 2025,” said Muhmood.

|

| Source: VISA. |

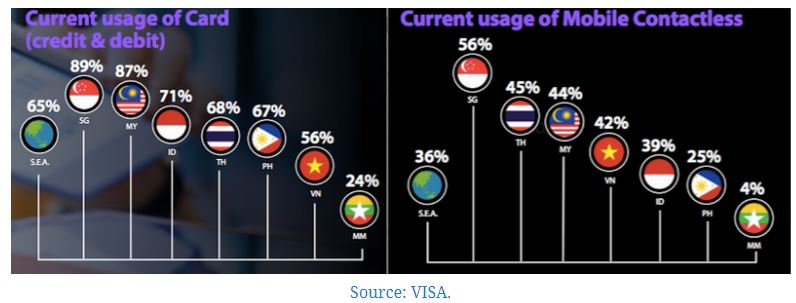

Moreover, there has been a surge in the number of people using e-wallet and digital payment methods in Vietnam over the past years, of which around 42% of local consumers are using mobile contactless for payment, higher than the Southeast Asian average of 36%.

The rate of usage of credit and debit card for payment in Vietnam, however, is at 56%, which is lower than the region average of 65%.

While these figures are still modest, there is a growing number of Vietnamese people becoming more dependent on digital services in their daily lives.

According to VISA, 81% of the respondents are interested in digital banking, the second highest rate in the region, behind Thailand (84%).

“Consumers see the benefits of digital banking, such as being able to bank at any time, saves time and effort as they no longer need to wait in line at the bank branch and view it faster than traditional methods of banking,” VISA noted.

|

VISA attributed greater openness of consumers in mobile payments to better data security measures that are in place. As a result of consumers’ high confidence in data security, they are more receptive towards sharing their data to enjoy discounts, promotions and relevant services.

In this regard, 70% of Vietnamese respondents said they are willing to share location data from their phones in order to receive special discounts, promotions and services, the third highest in the region.

Openness to data sharing is key to influencing the growth trajectory of digital banking, stated VISA. Open banking is a very possible future for Southeast Asia given nearly three in five consumers (59%) are willing to share their financial information with providers. This is led by Vietnam (75%) and Indonesia (64%), VISA informed.

Consumers are willing to adopt open banking if it ensures greater speed and efficiency in making transactions, results in more personalized financial products and services and offers a wider range of financial providers to choose from, it concluded.

Source: http://hanoitimes.vn/79-vietnamese-consumers-in-favor-of-governments-initiative-towards-cashless-society-314675.html

English

English