2019 expected to be strong year for hotel investment

THE Asia-Pacific is the only region that can expect growth in hotel transaction volumes this year, according to the latest JLL Hotel Investment Outlook.

The global real-estate consultant anticipates Asia-Pacific’s total hotel transaction volume to hit US$9.5 billion (Bt297 billion) this year, marking a 15-per-cent increase from last year.

In 2018, transaction activity was fuelled by single-asset trades, which drove more than 83 per cent of the $8.3 billion invested in the region. Developers and private equity firms were the biggest buyers, acquiring more than half of all the properties traded.

Building on 2018, investment momentum is expected to accelerate as investors look to sell assets and ride the anticipated tourism boom, especially in Japan and Singapore. The most notable buyers will be Pan-Asian private equity funds that raised capital last year, but have yet to deploy it. Listed real-estate investment trusts (REITs), particularly Japanese ones, will look to Asia’s most liquid markets for purchase, while conglomerates and owner/occupiers will buy selectively in key markets.

“Despite a series of natural disasters, Japan’s hotel market captured investor interest globally. Nearly 30 per cent of all investment into Asia-Pacific was in Japan, overtaking China in the top spot,” said Nihat Ercan, head of hotel investment sales in Asia for JLL’s Hotel and Hospitality Group.

According to the report, investor sentiment in Japan will remain buoyed by the Rugby World Cup and the Tokyo Olympics – the market has already seen an 8.7 per cent growth in tourism year-on-year. Similarly, Singapore’s hotel market pulled in 7 per cent more tourists last year, driving positive RevPAR (revenue per available room) increases across all chain scales. In China, tourism demand outstrips supply – JLL tracked record high growth in RevPAR across major Chinese cities in 2018, including Chengdu up 20 per cent, Beijing up 15 per cent, Chongqing up 13 per cent and Wuhan up 12 per cent.

“While we remain in a late-cycle environment where yields are low with limited potential for further compression, most investors do not see a major downturn ahead. After a subdued final quarter in 2018, enquiries and deal making have perked up at the beginning of the year.

“Interest rates are now stabilised, so investors can focus on income growth and in markets where fundamentals remain strong,” Ercan concluded.

JLL expects investors looking at Asia-Pacific to factor a lower upside in income in their valuation assumptions, though liquidity across key cities and lower return requirements will drive transaction volumes.

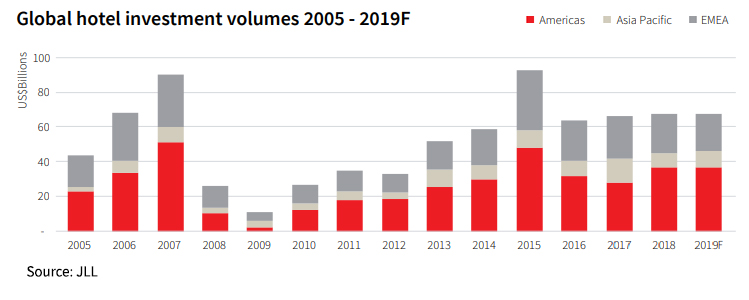

On the global front, hotel occupancy rates and underlying property performance will remain strong while travel and tourism are slated for another record year. Investors seeking more yields are increasingly turning their sights toward hotels amid slower economic growth projections and geopolitical uncertainty. “Investment activity exceeded expectation in 2018 and we believe 2019 to be another strong year for global hotel investment, with a significant amount of debt and equity liquidity and competitive bidding for assets, given continued strength in fundamentals,” Mark Wynne-Smith, global CEO for JLL Hotels and Hospitality, said.

“Notwithstanding the more cautious backdrop, ongoing large portfolio and entity-level activity, hotels’ attractive yield profile and record levels of dry powder [marketable securities that are highly liquid] will drive global hotel investment momentum.”

Source: http://www.nationmultimedia.com/detail/Real_Estate/30364399

English

English