Vietnam: Technology M&A to retain booming growth in 2022

Mergers and acquisitions (M&As) in the technology sector are expected to continue with their escalating activities in 2022, helping to allure foreign capital influx into tempting sectors.

Nguyen Cong Ai, partner at consulting firm KPMG Vietnam, said that the country has the potential to grow into an up-and-coming startup centre in Southeast Asia, buoyed by favourable macroeconomy, a burgeoning middle-class with ever-increasing income, and abundant tech-savvy human resources, as well as the government’s supportive policy.

“Foreign investors are showing particular interest in Vietnam’s tech field. Lately, we are receiving growing proposals from South Korean and Japanese investors towards Vietnam’s internet economy, fintech, edutech, and media,” he said.

KPMG forecasts that investment into tech would shoot up 150 per cent in 2022, hitting $2 billion.

Nguyen Thanh Tuyen, deputy head of the Information Technology Department under the Ministry of Information and Communications, said that many sizable deals took place in the M&A scene during 2019-2021. For instance, VNPay received $300 million from SoftBank Vision Fund and GIC Fund, Temasek pumped $100 million into Scommerce, and Affirma Capital injected $34 million into Siet Viet Group.

“In last two years, digital technology application has been pushed significantly, similar to the overall digital transformation, fuelling M&A in IT,” Tuyet noted.

In his view, digital technology would emerge as a very lucrative segment to investors in the forthcoming time, in which e-commerce, driven by the development of payment intermediary apps, would attract the freshest capital. Fintech is also forecast as an investment highlight in the ongoing digital transformation.

Tuyen, however, pointed out some limitations for M&A in the tech field, as local tech firms are mostly in their infancy. “These companies might have good ideas for product development but have yet to evolve into true businesses with well-conceived operations and sound platforms as they face limitations in strategy planning, management expertise, and financial capacity,” Tuyen said.

KPMG South Korea noted that many investors of that country are exhibiting keen interest in e-commerce, fintech, and logistics in Vietnam, driven by ever-increasing attention to e-commerce and finance tech on the back of the growing presence of touchless businesses. Hence, the long-term economic perspective of the sector, as well as internet and smartphone users, is forecast to be on a steady rise.

Ho Phi An, CEO of EI Industrial JSC, said that augmenting cases of M&A in tech are very upbeat, helping firms to approach fruitful capital sources from large foreign venture funds.

An assumed that tech firms feature a quick life cycle and should not hold fear of being acquired when reaching the global market.

“Many venture funds have chosen Vietnam as their key market in 2022, focusing on business-to-business firms. The country could have at least five unicorns in the next three years,” An commented.

According to Vo Tri Thanh, director of the Institute of Branding and Competition Strategy, the Fourth Industrial Revolution comes integrated with multiple technologies, yet in Vietnam digital technologies are mostly in traditional fields.

To globalise M&As, Thanh proposes to “rationally fix the issues related to cross-border data transmission and taxes, capital raising methods, intellectual property rights, core technologies, and national security.”

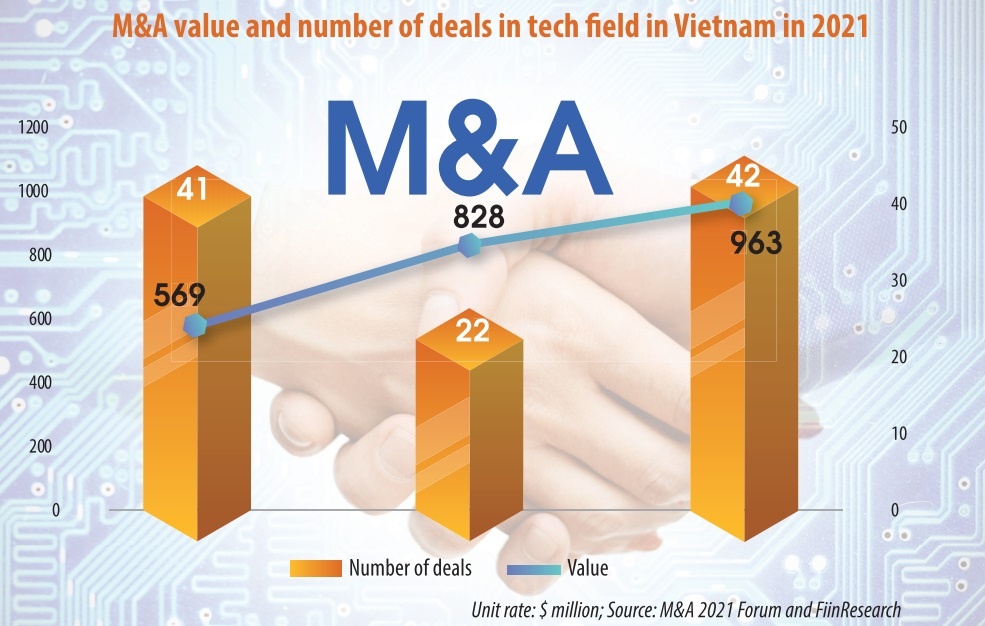

KPMG Vietnam figures showed that technology became one of the sectors ushering in a booming growth in M&A cases, from 22 cases in 2020 to 42 in 2021, contributing nearly $1 billion to overall capital volume, a three-fold increase against 2020. Many local startups like Loship, Citics, Sky, and Mavis had successfully raised capital twice last year.

Source: VIR

English

English