Vietnam: RCEP to beat drum for further trade

With the Regional Comprehensive Economic Partnership expected to enter into force early next year, more prospects could open up for Vietnam to woo additional investment and expand its trade with international partners.

As scheduled, the second session of Vietnam’s 15th National Assembly will officially ratify the hallmark Regional Comprehensive Economic Partnership (RCEP), meaning the next step for Vietnam to further embrace investment from and trade cooperation with the agreement’s partners.

Deputy Minister of Foreign Affairs Nguyen Quoc Dung told VIR, “The RCEP will be a big success for all 15 members. It has taken years for the nations to negotiate and ink the agreement. This means the RCEP is very important to the region, especially in the current context that the whole world is badly affected by the pandemic, with the disruption of many supply chains.”

According to the Ministry of Industry and Trade (MoIT), the RCEP is expected to fully take effect in early 2022. Under the agreement, it can be implemented within 60 days after at least six ASEAN countries and three non-ASEAN nations complete their domestic procedures.

Last November, the 10 ASEAN member states and the bloc’s partners (China, Japan, South Korea, Australia, and New Zealand) inked the RCEP. China, Japan, Thailand, and Singapore have approved the deal so far.

“ASEAN nations such as Brunei, Cambodia, Thailand, and Laos will likely complete all ratification procedures before November this year while Indonesia, Malaysia, and the Philippines are also expected to follow suit at the end of this year,” said Deputy Minister of Industry and Trade Tran Quoc Khanh.

Over a week ago, South Korea’s government handed in a bill to its National Assembly to ratify the RCEP. Once implemented, the partnership is expected to help South Korea further diversify its trade portfolio. The combined amount of exports to the participants of RCEP came to $254.3 billion in 2020, taking up around half of South Korea’s total outbound shipments, according to the data provided by this nation’s Ministry of Trade, Industry, and Energy.

The RCEP’s member states accounted for a quarter of the combined amount of foreign investment in South Korea last year.

“Amid the complicated pandemic, all ASEAN nations and the bloc’s five partners want the RCEP to take effect as soon as possible,” Khanh said. “It will help further regional investment and trade cooperation, contributing to economic recovery.”

Beefing up investment

Encompassing a third of the world’s GDP, the RCEP marks the world’s largest free trade agreement by population, as well as the first time China, Japan, and South Korea have entered into such a deal together.

The RCEP seeks to eliminate up to 90 per cent of import tariffs between member states within 20 years of it taking effect, while promoting the flow of services and investment and setting out regulations around rules of origin and intellectual property.

According to experts, under RCEP impacts the investment from South Korea, Japan, and Singapore – the three largest foreign investors in Vietnam – is expected to increase in this country and beyond.

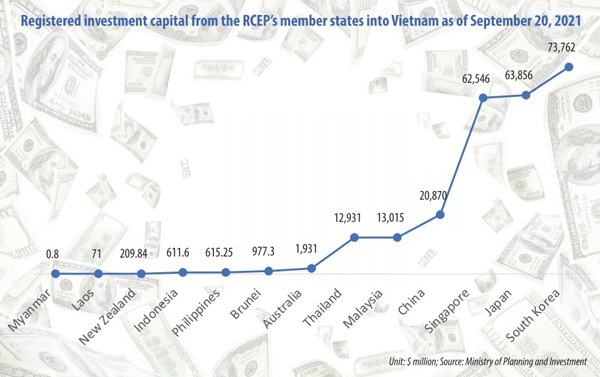

Statistics from Vietnam’s Ministry of Planning and Investment (MPI) showed that as of September 20, registered investment capital from South Korea, Japan, and Singapore into Vietnam totalled $73.76 billion, $63.85 billion, and $62.54 billion, respectively.

According to analysis by the Peterson Institute for International Economics, Indonesia, Malaysia, Thailand, and Vietnam stand to benefit the most from the RCEP, which will add between $2-4 billion each year to their respective economies by 2030.

Global analysts FocusEconomics explained, “Panelists that we surveyed see Vietnam as the ASEAN country set to benefit most from the RCEP, likely due to its highly competitive export sector that will benefit from being plugged even more tightly into regional value chains.”

The harmonisation of tariffs and rules of origin and simplifying of customs obligations under the RCEP offer the principal benefit to ASEAN economies. As a result, manufacturing is set to gain from relocation of labour-intensive industries to ASEAN countries, particularly those with competitive employment costs such as Vietnam.

Vietnam is now considered a global manufacturing hub for South Korea’s Samsung, which is focusing funding on manufacturing electronics products in the northern provinces of Bac Ninh and Thai Nguyen as well as Ho Chi Minh City in the south, with a total capital of over $17.7 billion.

“Samsung Vietnam is extending its role beyond a vital global manufacturing stronghold in Vietnam, which includes the building of a research and development centre in Hanoi in order to raise mid- and long-term capabilities,” said Samsung’s president in Vietnam, Choi Joo Ho, at a recent talkshow on foreign direct investment. The centre is expected to be inaugurated at the end of 2022.

In another case, Vietnam in late August awarded a licence to LG Display that will see it raise its investment in the northern port city of Haiphong by $1.4 billion. This new investment has expanded its total investment in the country to $4.65 billion, manufacturing plastic OLED screens for mobile devices, OLED TV screens, and LCD screens.

The investment will boost the company’s OLED display output at the Haiphong factory to 13-14 million units per month, from the current 9.6 million to 10.1 million monthly units.

Southeast Asia is now Vietnam’s fourth-largest export market, with the export turnover totalled $24.7 billion in 2018, $25.3 billion in 2019, and $23.1 billion last year. The figure in the first nine months of 2021 was $20.6 billion, up 20.8 per cent on-year.

Meanwhile, Southeast Asia is also Vietnam’s third-largest import market. The country’s import turnover from other member states was $32 billion in 2018, $32.1 billion in 2019, and $30 billion last year. The figure hit $30.3 billion in the first nine months of 2021, up 39.7 per cent on-year.

As of September 20, Vietnam attracted $91.38 billion in registered investment capital from ASEAN member states (see chart), according to the MPI.

Expand trade

Next week, at the 38th and 39th ASEAN Summits and Related Summits hosted by Brunei, regional nations will focus their discussions on swelling trade and investment ties within ASEAN, and between the member states and the bloc’s partners, and pore over how to benefit from the RCEP’s commitments.

The deal will establish high-quality rules for the supply of services between the parties, including obligations to provide access to foreign service suppliers, to treat local and foreign suppliers equally, and to treat foreign suppliers at least as well as suppliers of any other non-RCEP country. Service suppliers from the member countries will benefit from commitments to enhance the transparency and predictability of domestic regulation affecting trade in services, improving the business environment across the region.

The signatories have committed to opening their doors to goods, services, and investments, simplifying customs procedures, setting up rules of origin, and removing barriers to enhance trade facilitation.

In a specific case, Vietnam’s TH Group has been boosting the presence of its sterilised milk and modified milk products to China, where it is enjoying good growth in export turnover.

Three years ago, TH Group was allowed by China’s General Administration of Customs to export these products to this market. Last year, the administration also granted codes to another two Vietnamese companies, Hanoimilk JSC and Bel Vietnam Co., Ltd., for exporting fermented milk, flavoured milk, and other dairy items. Vinamilk has also been allowed to do so in China.

The administration is now also appraising dossiers on obtaining export codes from some other Vietnamese companies. At present, the average import tax rate for Vietnam’s milk products in the Chinese market is 10-15 per cent.

However, the rate is expected to be removed following the entry into force of the RCEP, meaning that Vietnamese milk products will have a bigger niche in China, which is the world’s largest consumption market with 1.4 billion people.

According to the MoIT, Vietnam’s export turnover from ASEAN, China, South Korea, and Japan has also increased strongly, sitting at $20.6 billion, $38.5 billion, $16.1 billion, and $14.7 billion – up around 21, 18, 11, and 5 per cent respectively on-year for the first nine months of 2021.

Also in this period, Vietnam’s import turnover from the same four markets hit $30.3 billion, $81.2 billion, $39.8 billion, and $16.3 billion, up approximately 40, 41, 21, and 11 per cent on-year, respectively.

Source: VIR

Thailand

Thailand