Vietnam manufacturing activity hits 4-month high in April

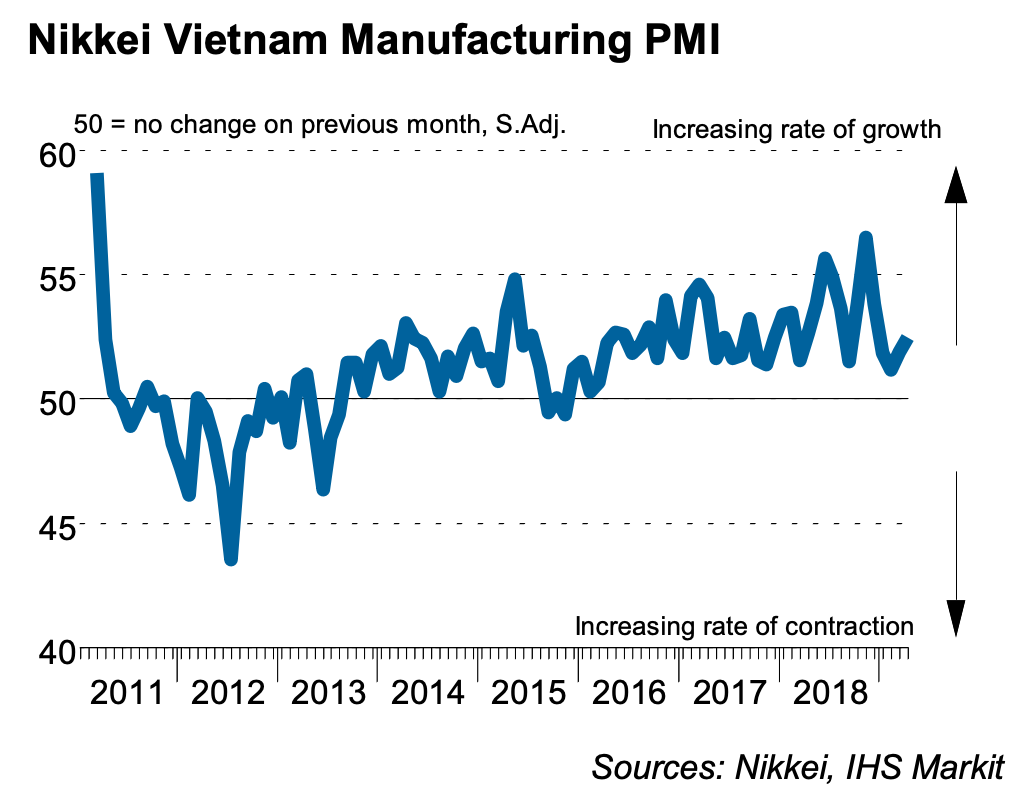

The headline Nikkei Vietnam Manufacturing Purchasing Managers’ index (PMI) rose to a four-month high of 52.5 in April from 51.9 in March, and signaled a solid monthly improvement in the health of the sector, according to Nikkei and IHS Markit.

A reading below the 50 neutral mark indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

Business conditions have improved on a monthly basis since December 2015. Firms continued to see new orders rise at a solid pace in April, with the rate of growth broadly in line with that seen in March.

A similar picture was seen with regards to new export business. In both cases, panelists mentioned improving customer demand. New order growth fed through to increases in a number of other variables monitored by the survey, including purchasing, employment and output. Manufacturing production rose for the seventeenth successive month. The rate of expansion was solid, albeit weaker than in the previous month.

Job creation was registered for the first time in three months at the start of the second quarter. The increase in employment was slightly faster than the series average. Greater operating capacity meant that firms were able to keep on top of workloads in spite of a further solid expansion of new orders. As a result, backlogs of work decreased for the fourth month running.

Purchasing activity continued to rise solidly, with the latest increase helping to support the first accumulation in pre-production inventories since January. Stocks of finished goods also expanded, albeit only marginally and to the least extent in the current seven-month sequence of accumulation. New orders are predicted to increase further over the coming year, helping to boost sentiment around production volumes. Business expansion plans are also set to support output growth. Sentiment rose to a three-month high in April.

The rate of input cost inflation accelerated to the sharpest since last November. Panelists reported general increases in raw material prices in international markets. Despite a solid rise in cost burdens, manufacturers in Vietnam continued to lower their output prices. Charges were reduced for the fifth consecutive month, linked to efforts to secure greater new order volumes. That said, the rate of decline was only marginal.

“The main positive from the latest Vietnam manufacturing PMI survey was a return to employment growth, the first rise in three months, as firms gained confidence that the soft patch at the start of the year is now a thing of the past. There was still a reluctance to raise selling prices, however, in spite of a pick-up in the rate of cost inflation, but this will likely change should solid inflows of new work continue in coming months,” said Andrew Harker, associate director at IHS Markit, which compiles the survey.

English

English