Trade deal expected to stimulate Vietnamese coffee exports to EU

On September 16 Vinh Hiep Co. Ltd of Pleiku City shipped 296 tonnes of coffee to Belgium and Germany at zero tariff.

Under the EU-Vietnam Free Trade Agreement (EVFTA) that came into force on August 1, tariffs on all coffee products from Vietnam were eliminated.

Earlier roasted and unroasted coffee attracted 7-11 per cent import tax, and processed coffee, 9-12 per cent.

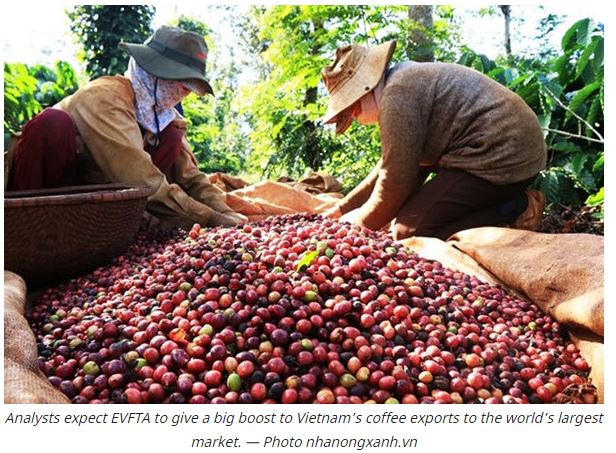

Analysts expect EVFTA to give a big boost to Vietnam’s coffee exports to the world’s largest market.

They pointed out that Vietnamese coffee has geographical indication and is protected in the EU under the trade deal, creating a huge competitive advantage.

According to the latest estimates, the EU is likely to import an additional two million 60kg bags of coffee this year, increasing its total imports to 40.5 million sacks.

Despite the Covid-19 pandemic, many European countries have increased their coffee imports from around the world this year, with Poland, Belgium, Germany, and Italy being the biggest importers from Vietnam.

Coffee is one of the country’s 13 major agricultural exports, and contributes 3 per cent of its GDP and creates more than 600,000 jobs.

Vietnamese coffee is exported to over 80 countries and territories, with the EU being the second biggest importer, buying 38 per cent of the country’s total exports.

But experts said to fully exploit the EU market and capitalize on the EVFTA, coffee producers need technical support and consultancy to improve quality and should further invest in processing and brand building.

By undertaking deep processing, coffee enterprises would add value to their products, which would enable them to increase their own exports and the industry’s, they said.

To achieve these goals, the industry must increase the scale of coffee farming and use high-quality seedlings and advanced farming, harvesting and processing technologies, they said.

Besides, they need to build brands, strengthen trade promotion in local and overseas markets and improve linkages in the value chain, they said.

The experts also stressed the need for coffee enterprises to diversify export channels to include traditional and online ones, supermarkets and F&B outlets if they want to deeply integrate into the EU market.

Bank lending expected to grow strongly in last quarter

According to the latest data from the State Bank of Vietnam’s department of credit for economic sectors, as of September 16 the banking sector’s credit growth was 4.81 per cent, with the focus having been on priority areas such as exports and agriculture.

The rate was sharply down from that of the same period last year (8.4 per cent), but experts opined that credit activities are likely to recover in the fourth quarter of the year.

Dr Can Van Luc, an expert at State-owned lender BIDV, expected the rate to rise by 1 percentage point a month for the rest of the year to 9 per cent by year-end.

Many banks expect to increase the rate by pushing up lending to export, retail and wholesale, textile and garment, and construction businesses.

Their expectations are not without merit since, for instance, exports in the last eight months have been up 1.6 per cent year-on-year despite the disruptions caused by the Covid-19 pandemic, resulting in a record trade surplus.

Loan interest rates have been steadily going down as a result of several promotion programmes meant to support the business sector.

They have fallen 0.5-2.5 percentage points since the pandemic started.

But analysts said credit was not flowing into sectors that need it the most.

Most of it had been going to sectors like retail, consumer goods, essential goods, and drugs, none of which were affected much by the pandemic.

On the other hand, the worst affected firms have only wanted to have their debts restructured and not sought new loans.

Luc said interest rates had not been a factor in the banking sector’s credit growth this year.

Dr Nguyen Duc Do of the Institute of Economics and Finance said high liquidity had allowed banks to sharply cut deposit interest rates, enabling them in turn to cut lending interest rates.

Yet, credit growth had not been as rapid as expected because enterprises’ demand for funds had been weak.

To grow credit, banks’efforts would not be enough and support would be required from Government policies including rapid disbursement of the second support package for enterprises and individuals, public investment and a further stimulus for domestic consumption, he said.

In any case credit growth would not be significant until the pandemic is completely controlled, he added.

Le Minh Hung, the governor of the State Bank of Vietnam, wants credit institutions, especially finance companies and Agribank, to stimulate consumer credit amid the Covid-19 pandemic with reasonable interest rates and simple procedures.

Analysts agreed with this saying interest rates on personal loans were still very high, and acted as an obstacle to borrowing.

The pandemic had cost many people their jobs or cut their incomes, and so consumer borrowing was down.

Nguyen Quoc Hung, former director of the central bank’s credit department, said consumer credit had recently been growing at a slower rate than other segments.

Finance companies admit consumer lending had slumped in the first half.

This had been not only because of the weak demand but also caution on the part of lenders to avoid bad debts.

Trinh Bang Vu, head of Shinhan Bank’s retail business division, told Đầu tư Newspaper that risks related to consumer credit had been rising since the pandemic began and lenders were forced to be more cautious and manage their loan portfolios with greater discretion than ever.

Analysts said 2020 had been a difficult year for lending, including consumer credit, but that segment had huge potential in the long term.

Since the economy was in recovery mode, consumer credit was expected to make a comeback, they said.

But it was necessary for credit institutions, especially finance companies, to cut interest rates to reasonable levels, they added.

Large companies too need tax support: think tank

The Private Economic Development Research Board has called on the Government to reduce corporate income tax by 30 per cent for all businesses this year instead of only those with revenues of less than VND200 billion.

Late last month the Government issued a decree making the 30 per cent cut.

The board made the new proposal after doing a third survey of businesses and business groups on the hardships they had suffered since the second Covid-19 outbreak in late July.

It found that the larger the enterprises the more they suffered.

In terms of rates, 92.8 per cent of large companies were affected compared to 89.7 per cent and 91.1 per cent for small and medium-sized businesses.

Large firms, which make up 2.8 per cent of the total number in Vietnam, are usually in multiple sectors with close linkages to value chains at home and abroad, the latter being a major cause for being hit badly amid the global outbreak.

Thus, large firms should also be given the tax break, the board said.

To stimulate consumption, it suggested halving value-added tax to 5 per cent and offering companies credit on favourable terms.

The General Statistics Office (GSO) conducted a 10-day survey in September to assess the impact of the Covid-19 on business and production activities after the second wave began.

According to the first survey in April, the sectors most hit by the pandemic were aviation, tourism, catering, travel, education and training, textile and garment, leather, electronics, and auto.

The Ministry of Labour, Invalids and Social Affairs has just approved a second relief package worth VND18.6 trillion (US$803.5 million) targeted at individuals and businesses affected by the pandemic. VNS

Thien Ly

Source: https://vietnamnet.vn/en/business/trade-deal-expected-to-stimulate-vietnamese-coffee-exports-to-eu-678736.html

English

English