Third wave delays Thai recovery

Thailand’s economic recovery is set to be delayed by the surge in Covid-19 cases and renewed lockdown measures in April and May.

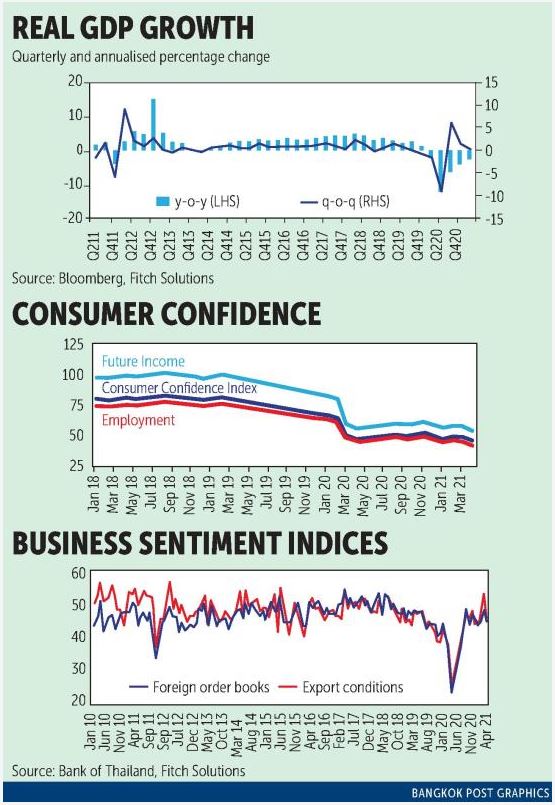

The economy has been gradually recovering from the pandemic shock in the first half of 2020, on the back of fiscal stimulus and a relaxing of domestic mobility restrictions, growing 0.2% quarter-on-quarter in the first quarter. Indeed, we expected economic output to only recover to its pre-pandemic level by 2022, following the 6.1% contraction in 2020.

However, the recovery now faces a setback. In response to the new Covid wave, officials have ordered the closure of restaurants, hotels and entertainment venues, with the severity of measures varying among provinces and by duration.

While not as severe as the measures imposed a year ago, the disruptions will send economic activity into contraction again in the second quarter. As such, we have slightly lowered our 2021 real GDP growth forecast, from 3.3% to 3.0%.

In the first quarter, the economy grew better than Bloomberg consensus expectations, at 0.2% quarter-on-quarter growth relative to an expected contraction of 1.0%. The year-on-year contraction of 2.6% was an improvement from 4.2% in the previous quarter and better than expectations of -3.3%.

Government consumption and gross fixed capital formation (GFCF) expanded by 2.1% and 7.3% year-on-year, reflecting strong fiscal stimulus measures; public investment grew 19.6%. In contrast, household consumption fell 0.5%, partly reflecting continued Covid concerns, which augurs poorly for the second quarter.

Exports continued to be hampered by the lack of tourism, but grew 8.0% quarter-on-quarter on the back of stronger demand for goods exports. Imports rebounded more strongly, by 12.9% quarter-on-quarter, reflecting the pickup in capital goods demand and inputs for export production.

CONSUMPTION WEAK

Private consumption growth will be lower than we forecast previously, down from 1.2% to 1.0% through 2021 (contributing 0.8 percentage points to headline growth). The Consumer Confidence index dipped from 48.5 in March to 46.0 in April, as concerns over the rise in Covid cases weighed on future expectations.

Indeed, confidence about employment opportunities and future income both fell, reflecting the likely increase in household savings amid the renewed economic uncertainty.

Retail sales data is likely to slump in the coming months, as suggested by Google mobility data. Retail and recreation mobility was 27% below pre-pandemic trend levels as of May 13, with mobility levels in transit stations and workplaces down 56% and 26%, respectively.

The uptick in consumer prices in April will also weaken household disposable incomes as temporary supply-side factors bolster inflation; headline inflation was up 1.4% month-on-month (3.4% year-on-year) relative to 0.2% in March.

Government consumption will continue to provide somewhat of an offset to the weakness in household demand, growing 1.8% in 2021 (revised up 1.5%). Social transfers will pick up in response to the renewed lockdown measures, and we expect fiscal policy to remain accommodative through the year given low borrowing costs and domestic political pressure to aid lower-income households and small and medium enterprises (SMEs).

The government announced a package worth US$11.2 billion in stimulus via soft loans and employee support, highlighting the willingness of policymakers to provide aid. With private sector credit uptake also subdued, we believe the government will seek to take up the slack to boost growth. SME borrowing fell 5.0% quarter-on-quarter in the first quarter and the domestic order book sentiment index fell from 54.1 in March to 45.1 in April.

Despite tightened Covid measures and some disruptions to the construction sector, the government has sought to keep the manufacturing sector in operation and push ahead with infrastructure investment. The capacity utilisation rate improved further in the first quarter, rising from 63.2% in December 2020 to 69.6% in March.

In addition, we expect private investment to be buoyed by the auto industry as Thailand ramps up its efforts to establish its place within the electric vehicle supply chain. Indeed, loose credit conditions and government tax relief for corporate investment will entice some investment in the latter stages of 2021 as the global economic outlook strengthens and as Thailand’s vaccination campaign accelerates.

We do flag the weak credit take-up among SMEs as a potential drag on investment and note that supply-chain disruptions — particularly due to semiconductor shortages — could result in postponed fixed investment.

EXPORT UPTICK

We expect net exports will contribute 2.4 percentage points to headline growth in 2021, relative to 5.3-point drag in 2020. On the one hand, improving economic outlooks in the US and Europe should provide a boost to goods exports. On the other hand, the rise in Covid cases in key trade partners such as Japan, Singapore and Malaysia could dampen demand in Asia.

Slowing credit growth in China also indicates some easing of the pace of its economic recovery, and the shortage of semiconductors globally could hamper Thailand’s exports of machines, electronics and autos.

The rise in Covid cases will likely deter tourist arrivals and potentially delay plans to allow tourists into Phuket from July, with Thailand having only fully vaccinated 1.0% of its population as of May 13.

Overall, the balance of risks to the external outlook is tilted to the downside and could lead to another downward revision to growth forecasts. Import demand also remains vulnerable, given the weaker private consumption outlook.

Moreover, the recovery in tourism could be non-existent and in turn lead to greater social unrest as the employment outlook weakens. From an external perspective, the risks around weaker Asian demand and semiconductor shortages could hamper Thailand’s recovery, given that exports account for 54% of the economy.

Source: https://www.bangkokpost.com/business/2119279/third-wave-delays-thai-recovery

English

English