Thailand: What’s behind the strong baht: myth vs fact

The number 8 is typically viewed as lucky in Chinese culture. Right now, however, 8 is a hideous number for many Thai exporters, since that is how much the baht has appreciated in percentage terms since the Year of the Rooster began.

Two questions arise: (1) what are the underlying factors behind the baht’s current strength, and (2) when will we see the baht make a turnaround?

Conventional market practice is to predict the movement of the baht from the direction of the dollar index, which represents the value of the US dollar relative to a basket of major foreign currencies, including the euro, yen and pound. But this explains only part of the baht’s movement. The factors that really underlie the dynamics of the baht stem from the basic balance of demand and supply.

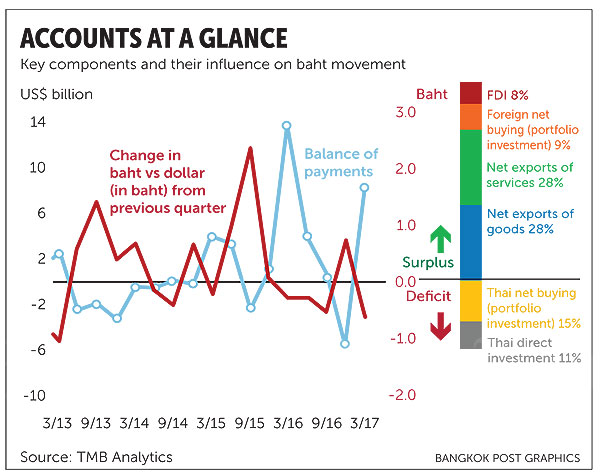

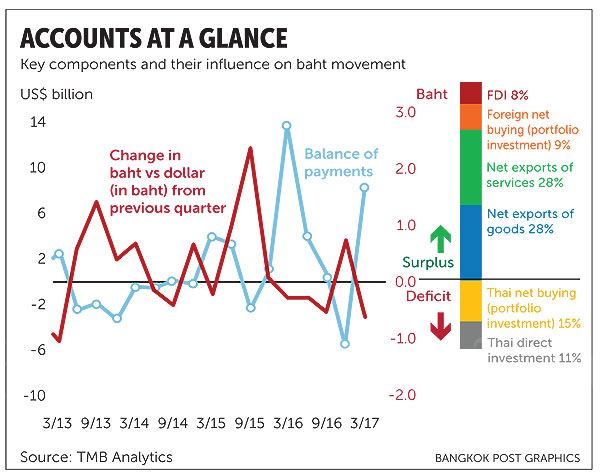

One key to deciphering the unstoppable streak of gains in the baht is the interaction between baht demand and supply, reflected in the balance of payments. This consists of two parts: the current account, showing net demand for baht from net exports of goods and services, including tourism; and the financial account, representing net demand for baht due to capital inflows and outflows from foreign direct investment (FDI), Thai direct investment and portfolio investments.

Myth: The baht is mainly driven by foreign fund flows in portfolio investments, such as stocks and bonds. This is the usual explanation in every analyst’s playbook. Well, that conviction was quite true back in the not-so-distant past when the proportion of foreign investor activity in local equities and bonds was much larger than net exports from trade and revenue from tourism.

Four years ago, baht supply from foreign portfolio investments was equivalent to US$5.25 billion, which dwarfed net demand for baht from exporting goods and services of $1.47 billion. That resulted in sharp baht depreciation of around 6% from the first to the second quarter of 2013.

As the fundamentals of the Thai economy gradually improved, however, portfolio investments from foreign investors, a significant portion of the balance of payments in the past, became smaller relative to net revenues from trade and tourism.

Steady expansion of Thai exports and tourism led to net demand for baht from net exports of goods and services equivalent to $17.53 billion, while net demand for baht from foreign investors was just $2.93 billion. The 4% appreciation of the baht against the dollar in the first quarter of 2017 can thus be explained by the hefty surplus in the current account.

Since the start of this year, the baht has strengthened because of the gargantuan current account surplus, which reflects flourishing tourism and a long-awaited recovery in exports.

Although Thai exporters have been enjoying higher revenues, the strong baht has steadily eaten into their profits, especially for companies that have not hedged their foreign-exchange risk. That is why so many people are asking the second question we posed at the beginning of this column: “When will this condition end?”

Based on our projections for exports and the growth of tourist figures, the current account will remain in surplus at least until the end of 2018. The surplus might narrow in the fourth quarter of this year, when imports are expected to grow at a faster pace than exports.

However, seasonality of tourism will raise net demand for baht again in the first and fourth quarters of 2018. Thus, without taking foreign portfolio investments into account, the period from the fourth quarter of this year until the end of 2018 could represent a bumpy downward trend for Thai baht.

From now on, analysts and business owners may need to pay more attention to movements in foreign portfolio investment. These could be influenced in large part by what major central banks do in the next few months.

The US Federal Reserve is definitely on the path to normalising its interest rate, and while another increase this year is not certain, the Fed’s plan to start selling down some of its huge bond holdings is also being closely watched.

As well, the European Central Bank and the Bank of Japan might start tapering their quantitative easing measures beginning next year.

Rising global interest rates could lead to bond market routs and large outflows from foreign portfolio investments in Thailand. As a result, the baht could fluctuate because of global monetary policies.

Next year, it will not be easy for anyone to precisely forecast the direction of the baht. However, it will be wise for exporters and importers to keep hedging risks against increased volatility in the foreign-exchange market.

Source: http://www.bangkokpost.com/business/news/1316711/whats-behind-the-strong-baht-myth-vs-fact

English

English