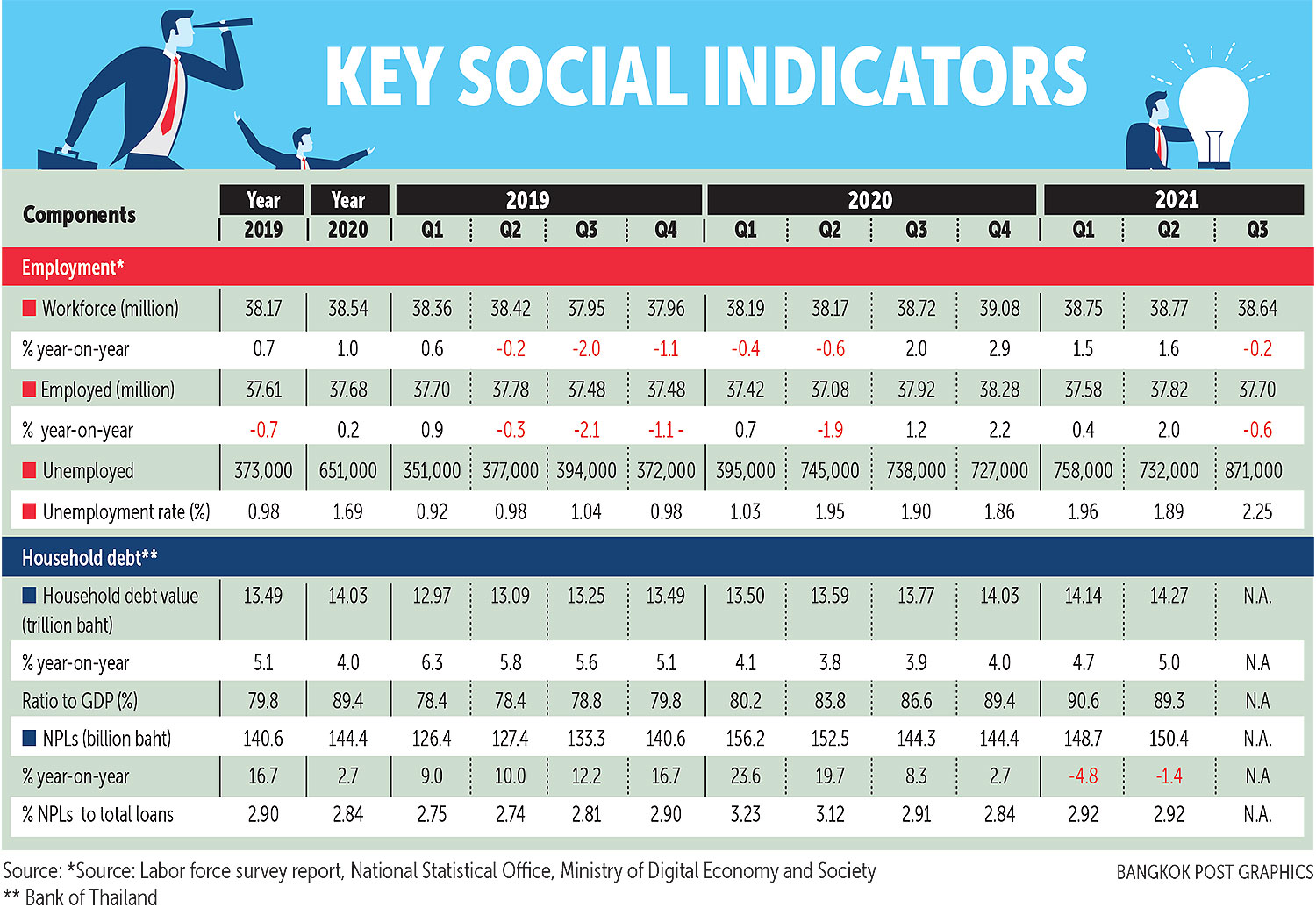

Thailand: Unemployment rate reaches 2.25% in Q3

Thailand’s labour market has been severely affected by the strict measures to control the spread of Covid-19, with the unemployment rate jumping to 2.25% in the third quarter from 1.89% in the previous three months, while household debt continued to grow.

The government’s planning unit, the National Economic and Social Development Council (NESDC), reported yesterday a total of 871,000 people were unemployed in the third quarter, up from 732,000 in the previous quarter.

The unemployment rate for those with higher education was the highest (3.63%), followed by vocational degree holders (3.16%).

In the third quarter, the NESDC reported 37.7 million employed people, a 0.6% decrease from the same period last year.

The agricultural sector’s employment has risen, with 12.68 million people, a 1% increase due to the start of the rice planting season.

Non-agricultural employment fell by 1.3%, with the construction sector losing the most jobs, followed by the hotel/restaurant sector, which fell by 7.3% and 9.3%, respectively, as a result of measures to control the opening and closing of enterprises, as well as the closure of workers’ camps and limited food sales.

Meanwhile, employment in manufacturing, wholesale/retail and transportation/storage rose by 2.1, 0.2 and 4.6%, respectively.

Manufacturing sectors that saw job growth included food and beverage production, car manufacturing, electrical equipment and medical equipment manufacturing.

Average working hours in the private sector were 43.9 hours per week, down from 44 hours per week during the same period last year.

“The employment rate in the fourth quarter is likely to improve because of the country’s reopening on Nov 1,” said Mr Danucha.

However, he noted the projection is based on the absence of a resurgence of Covid-19 infections.

In a related development, the NESDC reported yesterday household debt amounted to 14.27 trillion baht in the second quarter, up 5% from 14.14 trillion baht in the previous quarter. The figure represented 89.3% of GDP, down from 90.6% the previous quarter.

Although the non-performing loan (NPL) ratio of consumer loans was 2.92%, unchanged from the previous quarter, the NPL ratio of credit card loans accelerated for the second quarter in a row from 3.04% to 3.51%.

Bad credit card debt must be monitored, said Mr Danucha.

He warned the overall household debt will to rise due to the unstable economic situation, and expected higher debt as a result of the flood’s impact, as people repaired damaged houses and appliances.

Source: https://www.bangkokpost.com/business/2219791/unemployment-rate-reaches-2-25-in-q3

Thailand

Thailand