Thailand: Trends key to aiding delivery firms

Cross-border transport, the shipment of bulky goods, integrated logistics services and cold chain delivery are regarded as blue ocean fields for parcel delivery operators to tap into amid immense competition in the segment, says the Economic Intelligence Center (EIC) of Siam Commercial Bank (SCB).

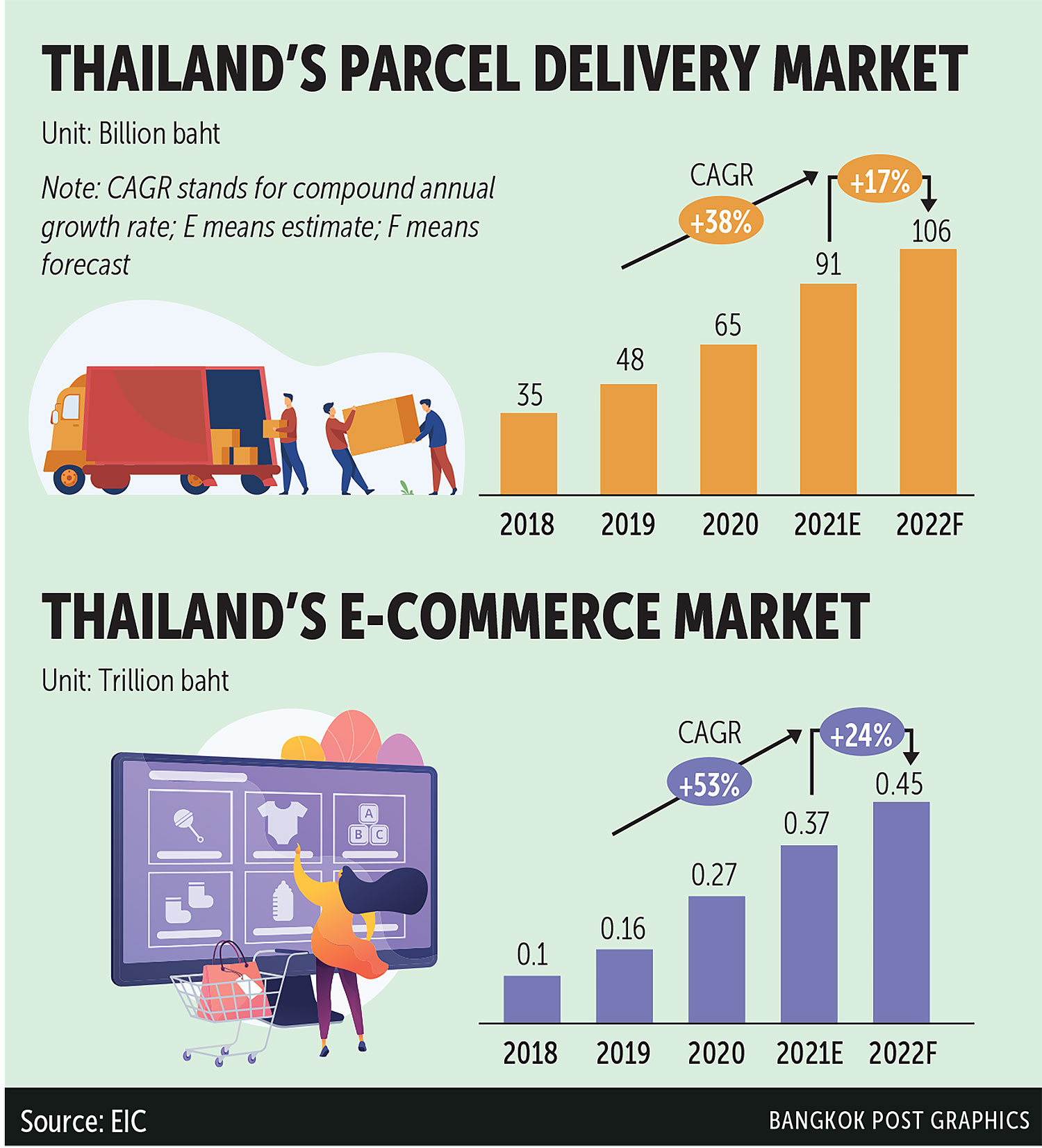

According to an analysis report by the EIC on the parcel delivery industry in Thailand, the market is expected to grow 17% year-on-year to 106 billion baht in 2022, albeit slower growth than a year before.

The volume of parcels handled by couriers is expected to surpass 7 million per day this year, driven by changes in user behaviour towards online shopping, which has become the new normal.

The report indicated the intense competition continues this year as major operators still pursue price war strategies amid a rising number of newcomers.

Operators may not be able to bring down service fees further as current rates mean that many of them face losses while some have endured continuous losses for years or have even closed.

They are also pressured by surging operational costs due to an increase in oil prices, the report said.

From 2019-2021, the parcel delivery market in Thailand attained a compound annual growth rate (CAGR) of 38% with the value reaching 91 billion baht in 2021.

The rise was driven by the lockdown when people were forced to work from home, the report said.

While the operators are ramping up efforts to gain more market share, the service fee has now gone down to a range of 15-20 baht apiece, compared with 35-40 baht between 2016 and 2018.

According to a survey by the EIC in September 2021, the top five categories for e-commerce sales were fast moving consumer goods, fresh food, home items, health and beauty products as well as fashion.

The EIC also identified four surging trends that could be new business opportunities for the parcel delivery operators.

The first concerns cross-border delivery following a rise in cross border e-commerce, particularly between Thailand and China, Japan, South Korea as well as other Asean member states.

According to Priceza, a price comparison website, 63% of products listed on the three major e-marketplaces in Thailand in 2020 were cross-border products.

Several couriers have launched cross-border delivery services, such as J&T Express Thailand, Best Inc, Kerry Express and Ninja Van.

The second trend involves shipments of bulky goods or less than a truckload (LTL). The service focuses on large and heavy items, such as large electric appliances, exercise machines, furniture and trees.

The purchase of these items surged as more people worked from home.

The third lies in integrated logistics and supply chain services, ranging from storage and packing to delivery, driven by a surging trend of business-to-customer and live commerce.

The fourth involves temperature-controlled delivery services, which is necessary for fresh food, seafood, vegetables and fruits. This service can cater to social commerce.

Source: https://www.bangkokpost.com/business/2325513/trends-key-to-aiding-delivery-firms

English

English