Thailand: Small developers urged to maintain liquidity and diversify

With myriad challenges in the property market, small and medium-sized developers should focus on maintaining financial liquidity and diversify to non-residential development, say developers and experts.

Pornarit Chounchaisit, president of the Thai Real Estate Association, said the domestic market this year will be unfavourable because of a spate of risk factors, while the two government property tax incentives will not be as effective as expected.

“There are other sectors like medical services or elderly homes that are more attractive for investment than residential development,” Mr Pornarit said.

Non-listed developers should not take on too many projects, he said. They may consider outsourcing some jobs to reduce overhead costs and should maintain financial liquidity and minimise debt.

Competition will become fiercer because it’s now a buyer’s market, Mr Pornarit said. Despite the tax measures, buyers will not rush their decisions, bargaining more with developers.

The two property measures include a tax deduction of up to 200,000 baht for residential buyers purchasing units valued at up to 5 million baht, running from April 30 to Dec 31.

The other is a reduction of housing transfer and mortgage fees to 0.01% from 2% and 1%, respectively, for a unit priced lower than 1 million baht. The perk will run until May 31, 2020.

“Government should promote home ownership of middle- to lower-income earners with a permanent reduction of transfer and mortgage fees for first-time buyers,” said Wasant Kiangsiri, president of the Housing Business Association.

Many negative factors like the economic slowdown and new lending curbs will cause the overall property market to dip by 5% in the first half and 10% in the second, he said. The largest declines will happen for condos, down 11% and 17%, respectively, per half-year.

The low-rise (single detached house and townhouse) segment will see just 1% growth in the first half and fall 4% in the second half.

According to the Real Estate Information Center (REIC), new condo supply launched in Greater Bangkok in the first four months totalled 12,801 units, a drop of 23.3% from the same period last year.

Low-rise supply newly launched in the period declined by 17.3% to 8,127 units.

“Developers focused on selling their inventory before the loan-to-value limits took effect on April 1,” said Vichai Viratkapan, the REIC’s acting director-general. “But they should be more cautious of a new launch in the remainder of the year, as presales may not be as good as expected.”

Mr Wasant said small- and medium-sized developers should avoid competing with large developers in buying land plots because they may get too high a price. They should wait for the new land and buildings tax to take effect on Jan 1, 2020.

“As the new land and buildings tax act will be applied next year, there will be some landlords offering land plots in the fourth quarter,” he said. “Developers should be patient.”

Tananpong Suksomsak, director of the Property Valuation Office at the Treasury Department, said the office is evaluating land parcels nationwide to be used next year in time for the new land and buildings tax.

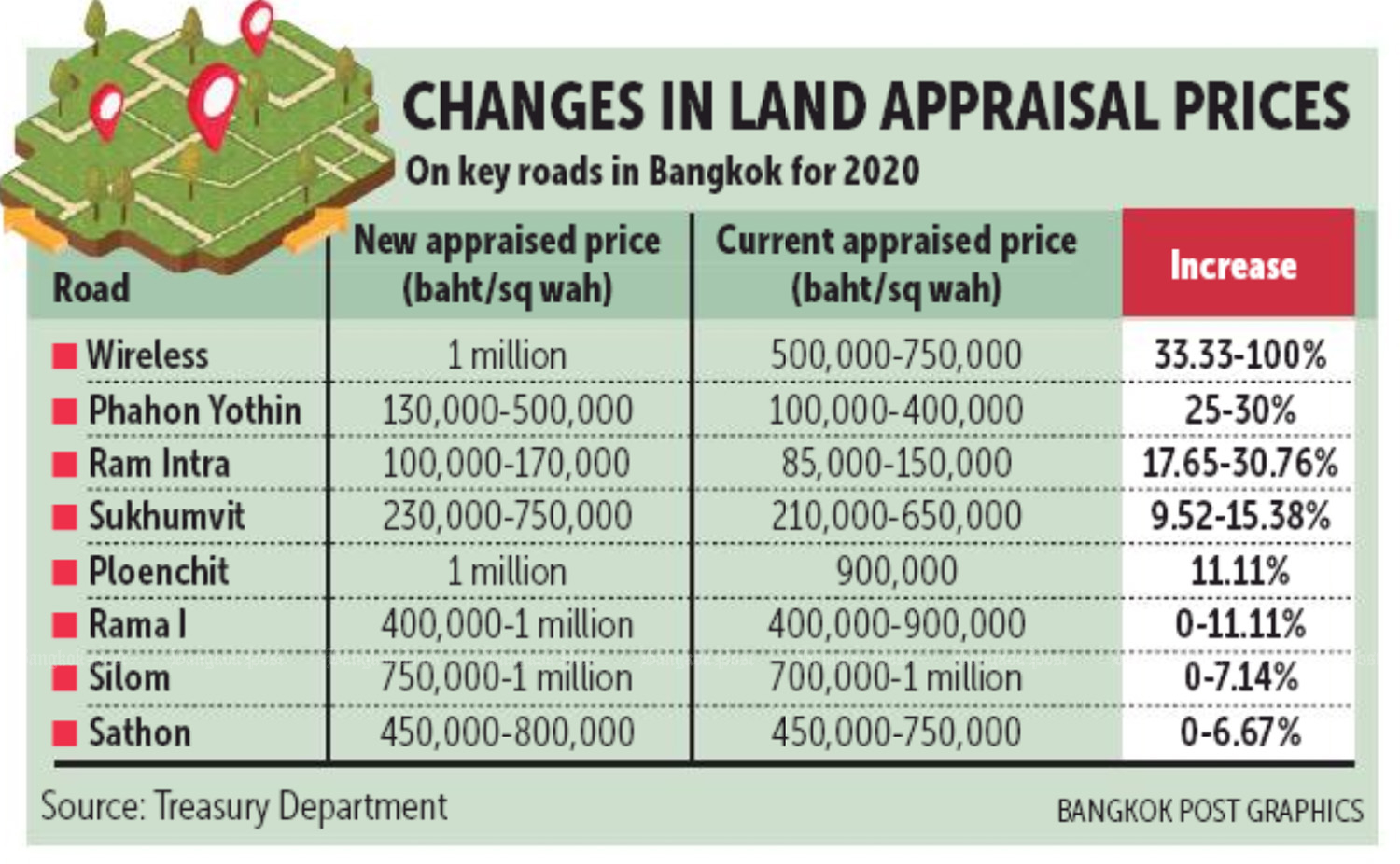

The department said newly appraised prices in Bangkok will rise by 2.45% on average compared with the current ones.

While the new tax may urge some landlords to sell their land, the new law will have a stronger impact on property developers than on other businesses because land is a raw material for property development, said Issara Boonyoung, managing director of Kanda Property Co.

Source: https://property.bangkokpost.com/news/1678452/small-developers-urged-to-maintain-liquidity-and-diversify

English

English