Thailand: Relief package wins green light

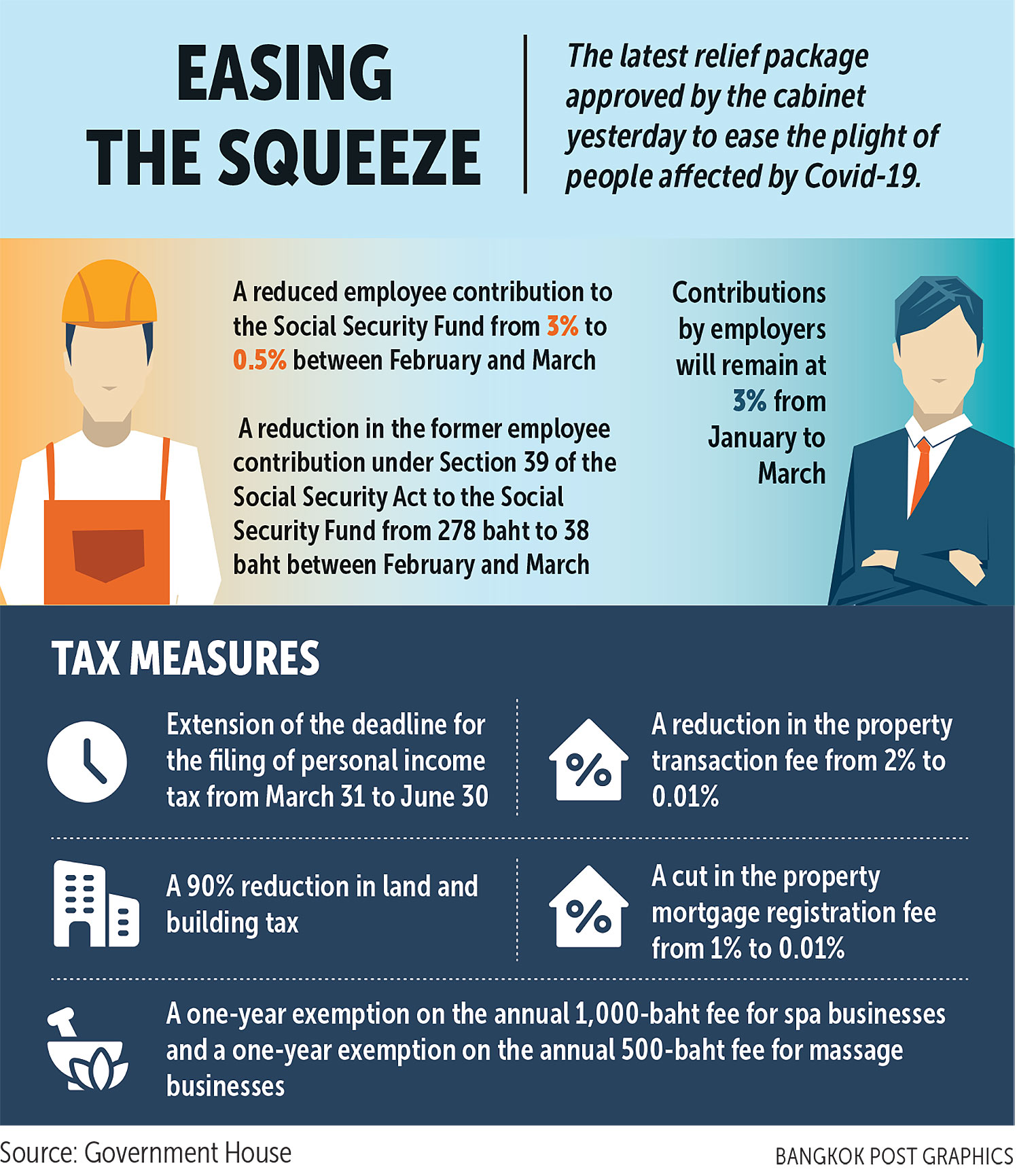

The cabinet on Tuesday approved a new relief package, including a reduction in land and building tax, a cut in property transaction fees and reduced contributions to the Social Security Fund (SSF) by employees, to ease the economic impacts of Covid-19.

Finance Minister Arkhom Termpittayapaisith said the cabinet approved a reduction in the tax on land and buildings by 90%, as it did last year.

The reduction covers residential properties, farmland, commercial and industrial land and empty land. The tax payments are due every April.

The new package, coupled with the 210-billion-baht “Rao Chana” (We Win) financial aid scheme approved by the cabinet on Jan 19, will cost the government more than 250 billion baht, Mr Arkhom said.

Under the Rao Chana scheme, the government provides 7,000 baht per person over two months to 31 million people affected by the pandemic.

The scheme does not cover social security subscribers, government officials or state enterprise employees.

Mr Arkhom said the fee for property transactions had also been slashed from 2% of the estimated property value to 0.01%. The fee for registering mortgages was cut from 1% of the loan to 0.01%.

The reductions in the fees apply only to new houses worth no more than 3 million baht and will cost the government about 5.6 billion baht in lost revenue, he said.

Government spokesman Anucha Burapachaisri said the tax on land and buildings was part of the revenue of local administrative organisations.

Therefore, the reduction in land and building tax would cost local governing organisations about 41.44 billion baht in lost revenue.

In light of this, the cabinet had ordered the Budget Bureau to allocate budgets to make up for the loss, Mr Anucha said.

He said the cabinet also approved an extension of the deadline for the online filing of personal income tax from March 31 to June 30 and approved a reduction in employees’ monthly contributions to the SSF from 3% to 0.5% for February and March.

Under normal circumstances, employees’ contributions are capped at 750 baht a month based on a maximum salary of 15,000 baht.

The new cap will be 75 baht a month for employees after the temporary deduction.

The further deduction for employees came after the cabinet last month approved cuts in the monthly contributions for both employees and employers to 3% from 5%.

As for former employees who chose to continue contributing to the SSF after they quit (the insured under Section 39 of the Social Security Act), their contributions will be reduced from 278 baht to 38 baht for February and March, Mr Anucha said.

Employers, meanwhile, will continue to contribute 3% over the next two months, he added.

Deputy government spokeswoman Traisuree Taisaranakul said the cabinet also approved a one-year exemption of the annual 1,000 baht fee for spa businesses and a one-year exemption of an annual 500 baht fee for massage businesses affected by the pandemic.

Source: https://www.bangkokpost.com/business/2057547/relief-package-wins-green-light

Thailand

Thailand