Thailand: Investors urged to focus on value stocks

Following a record-breaking six months of inflows into US mutual funds reaching a total of US$720 billion, Thai investors should focus their picks on value stocks reinforcing an economic recovery, says Morningstar Research Thailand.

In June alone, US mutual funds posted $100 billion in net inflows, up from $83 billion in May.

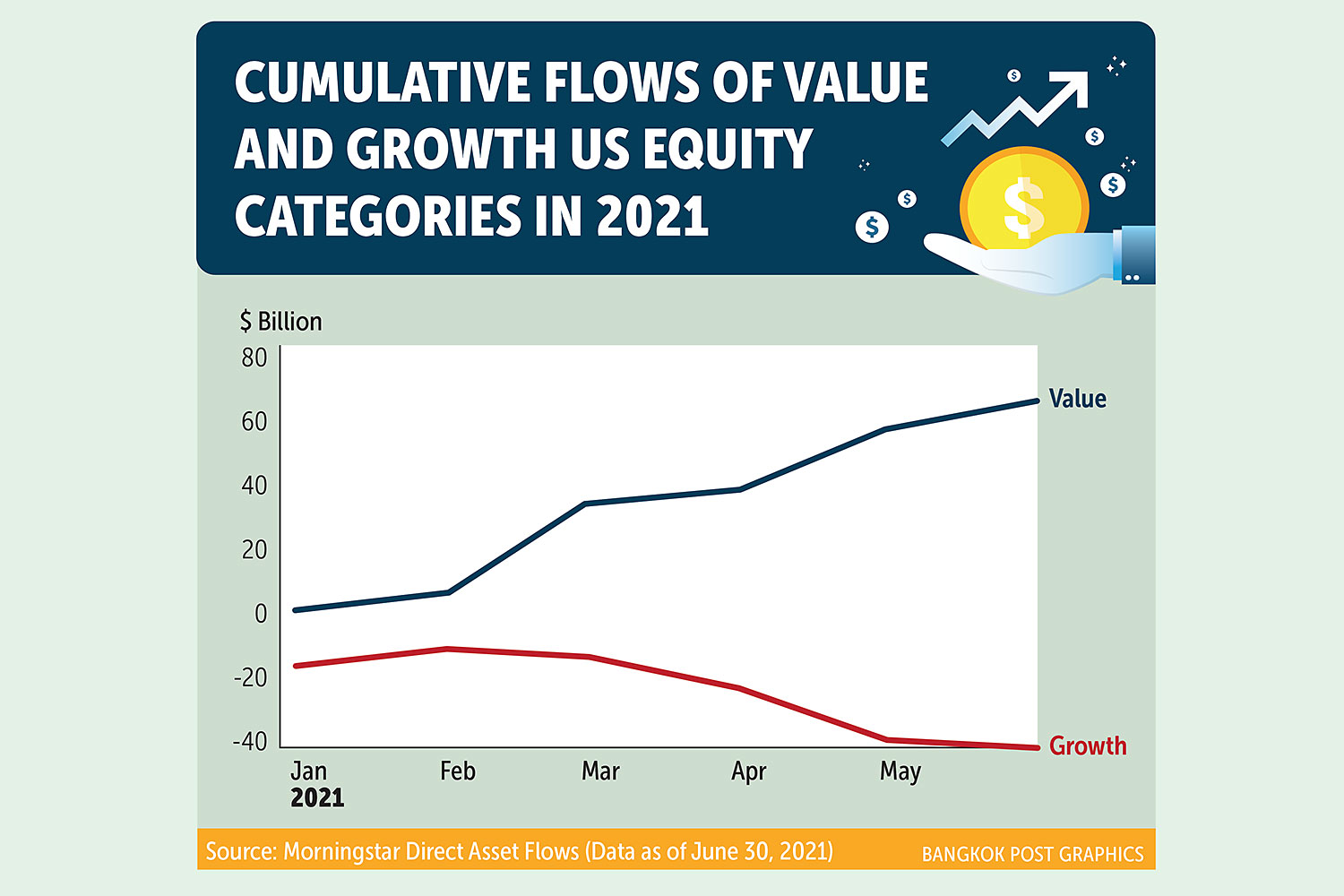

According to the Morningstar report, value stock funds have received more attention than growth stocks, with US equity funds posting $18 billion in net inflows in June after a small net inflow over the previous two months.

Large blend, a category that includes investment in large-cap stocks in both value and growth covering a variety of industries, saw the top inflows in June at $6.8 billion.

For the first six months of the year, large blend had the most net inflows with a total value of $50 billion, according to Morningstar.

Growth stock funds for the large, medium and small categories saw some outflows as investors pulled collected profit from strong returns over the past few years.

During the first six months this year, the Morningstar US Market Broad Value Index returned 16.9%, higher than the Morningstar US Market Broad Growth’s 13.4%.

Comparing active and passive funds, passive are clearly more attractive, said Morningstar.

In the first half this year, US active equity funds reported $88 billion in inflows, with ARK Innovation ETF leading the group with $7.4 billion in net inflows. Passive funds reported $16 billion in inflows, led by Vanguard 500 index VFINX with $15 billion.

International equity funds saw inflows of around $20 billion in the equity investment category (which includes US equity, sector equity and international equity).

Despite recent concerns regarding Chinese firms, China saw the second highest growth rate in the international equity category at 18.2%, similar to the diversified emerging markets group that has a high percentage of investment in Chinese stocks.

Net inflows into short-term bond funds are still greater than those from volatile interest.

Taxable bond funds remained the top category for net inflows in June at $48 billion, bringing total inflows to $340 billion in the first six months.

The direction of the Thai mutual fund market is similar to that of the US. Money is flowing into bond funds, especially short-term bonds in the US, while Chinese stock inflows slowed down in the second quarter following the US economic recovery.

Source: https://www.bangkokpost.com/business/2163987/investors-urged-to-focus-on-value-stocks

English

English