Thailand: Four major banks delay sale of non-performing loans

Payong Srivanich, president of Krungthai Bank, said KTB’s priority was to maintain asset quality and look after debtors. He expects the bank’s non-performing loans to remain flat at the 4.21 per cent of total loans registered in the third quarter.

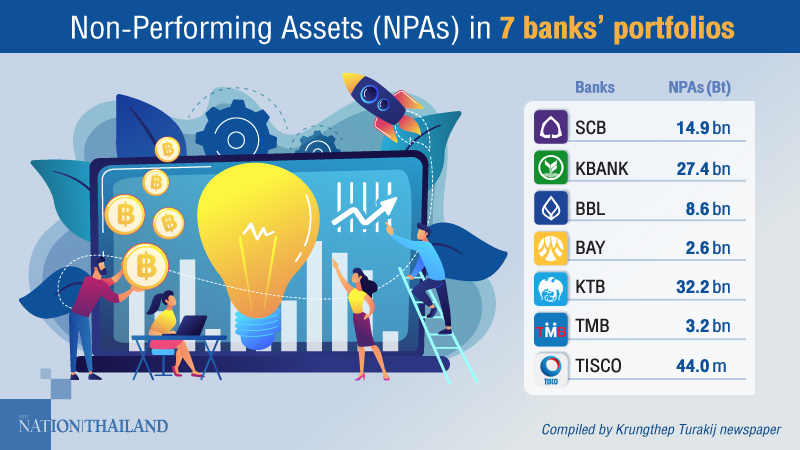

He said KTB regularly sells its non-performing asset (NPAs) as part of debt management measures, but the large volume now being sold made the market unfavourable.

“If we can’t get good prices for our NPAs, we will not sell them,” he said.

The bank is also cutting its exposure to concentrated risks. For example, it is reducing the proportion of total industrial loans to the rice sector from 60 per cent, and has cut lending to cooperatives from Bt70 billion to Bt30 billion, all of which must be backed by collateral.

Kasikornbank CEO Kattiya Indaravijaya said it, too, was choosing to manage bad debts rather than sell them on. The bank is supporting customers by restructuring their loan conditions to manage bad debt.

“We are confident that we can manage bad debts better than in the past when we usually chose to sell them on,” said Kattiya.

Deja Tulananda, chairman of Bangkok Bank’s board of executive directors, said its priority was to preserve asset quality rather than sell bad debt. By doing so, the bank could cover loans and also benefit borrowers, he assured.

“We remain focused on debt management and, under the central bank’s supporting policy, we are confident that we can take better care of our debtors and prevent bad debt from rising,” he said.

Piti Tantakasem, CEO at TMB Bank, said the bank will maintain its push for provisions against risk assets begun in the third quarter. Currently, NPLs were not high, accounting for just 2.3-2.4 per cent of total loans and should not exceed 3 per cent by the end of this year, he said.

The bank will delay selling NPAs this year in order to avoid flooding the market, he added.

Source: https://www.nationthailand.com/business/30399542?utm_source=category&utm_medium=internal_referral

English

English