Thailand: Demand for office space remains robust

Though the pandemic has affected many tenants, demand for office space in Bangkok in the first quarter remained strong, driven by the growth of e-commerce, tech and logistics businesses.

Phattarachai Taweewong, research and communication director at property consultant Colliers Thailand, said demand for Bangkok office space remained robust, although there was a drop in the first quarter this year compared with the fourth quarter last year.

“Key drivers of demand are e-commerce, technology and logistics operators, which are generating more income and need to grow their business by expanding office space,” he said.

Mr Phattarachai said demand for new office space in the first quarter also came from financial institutions, online travel agents, retailers and wholesalers of electronics products.

The impact of Covid-19 led many firms to scale down office space, relocate to new office towers in the same location where rents are lower, or renovate their existing space to be more modern, he said. In the first quarter this year, new demand in Bangkok’s office market totalled over 32,000 sq m.

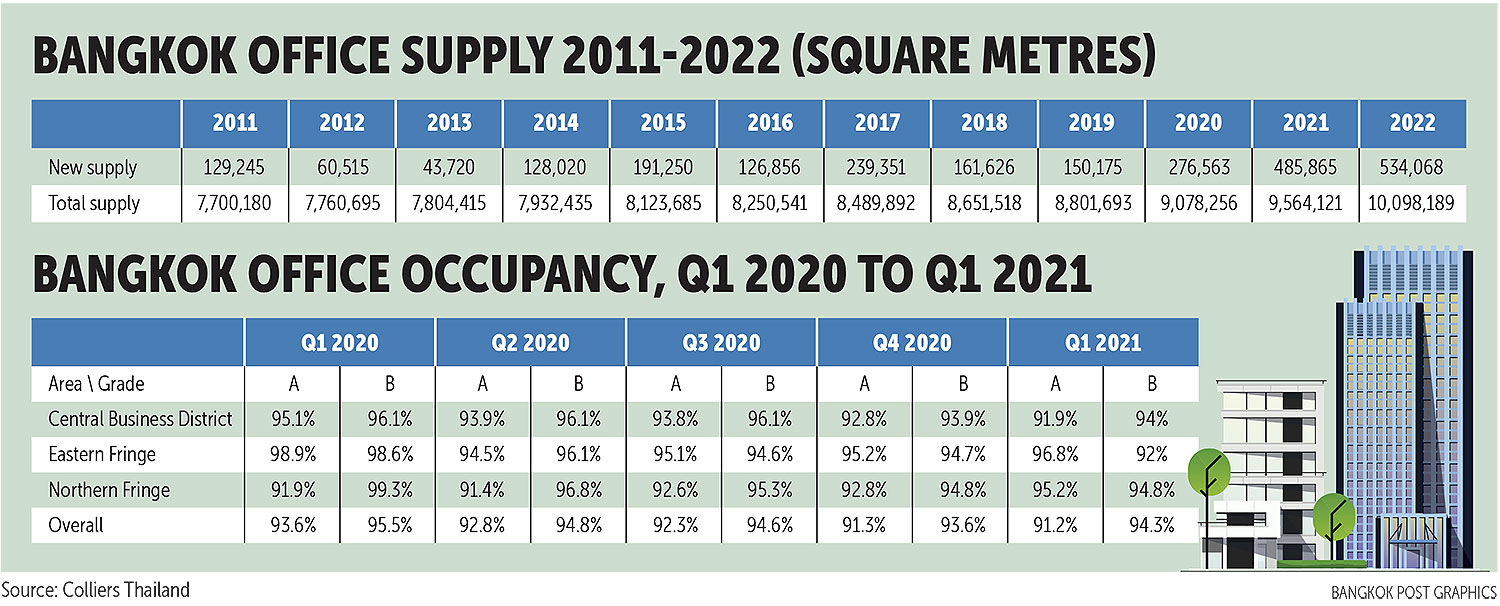

At the end of the first quarter, Bangkok office occupancy rose by 0.2 percentage points to 93.8%. The highest demand was seen in the central business district (CBD) of Sukhumvit, where occupancy is 94.5%, down from the fourth quarter of 2020.

Meanwhile, Bangkok’s northern fringe had the highest occupancy rate amongst outer city locations at 95.3%.

During the same period, Bangkok office supply grew to a total of 9.098 million sq m, up by 0.2 percentage points from 9.078 million sq m at the end of last year.

New supply in the first three months came from the completion of the new headquarters of Bangkok Insurance Plc on Krungthep-Nonthaburi Road in the Wong Sawang area, with a lettable area of 20,000 sq m.

Another new office was completed in the first quarter just outside of Bangkok. The WHA Tower, a 25-storey grade-A office with a lettable area of 24,023 sq m, is located on Bang Na-Trat Road KM7 in Samut Prakan.

“Many companies are looking at Bang Na-Trat Road as it links the inner city and the eastern seaboard. Demand in this area will rise when the Eastern Economic Corridor is officially launched,” said Mr Phattarachai.

Meanwhile, three new office projects with a combined lettable area of 105,000 sq m postponed their launches.

Colliers forecast more than 485,500 sq m of new office supply will be completed the remainder of 2021, followed by 534,000 sq m in 2022.

Of the office towers slated for completion by 2025, 58% are in CBD areas such as Rama IV, Sukhumvit, Silom and Sathon roads, of which 82% will be grade-A spaces, he said. The average asking rental price rose 0.4% to 745 baht per sq m per month, compared with the fourth quarter last year, said Mr Phattarachai.

The cost to rent a grade-A space in the CBD dropped by 0.5% to 1,108 baht from 1,103 baht. However, the average office rent in Bangkok’s fringe locations rose marginally as many tenants relocated from the CBD.

Source: https://www.bangkokpost.com/business/2101727/demand-for-office-space-remains-robust

English

English