Thailand: Choosing a year-end piggy bank

As the new year approaches, Thais often look to make long-term investments for tax benefits and to feather their nest.

In the fourth quarter of every year, investors regularly check for available funds that offer tax advantages. Based on 2021 data, roughly 40 billion baht was invested in such funds, with analysts predicting a similar amount for this year, in part because of the gloomy economic conditions for most of 2022.

In the fourth quarter of 2021, more than 10 billion baht flowed into “Super Savings Funds” (SSFs) as well as retirement mutual funds (RMFs), while inflows across all asset classes amounted to 20-30 billion baht.

According to Chavinda Hanratanakool, chair of the Association of Investment Management Companies, the net inflow into SSFs for the first nine months this year was roughly 4 billion baht, slightly higher than the amount recorded for the whole of 2021.

The net asset value for SSFs totalled 38 billion baht for the same period, a decrease of 4.7% from the end of last year.

RMFs posted net inflow of 2.7 billion baht in the first nine months of 2022.

RMF net asset value for the same period was down by 7.3% from the end of 2021 to 370 billion baht, she said.

Equity funds recorded a net outflow as investors sold high-risk debt instruments in the country, said Mrs Chavinda, who is also chief executive of Krungthai Asset Management.

“What is left is investors who have not left the market, although conditions are volatile and there has been a decline in the value of many assets,” she said.

“This indicates investors are starting to understand investment in this market, especially long-term options available for retirement.”

Every time the market declines or there is an asset that investors are interested in, a steady stream of investment flows in, including from ordinary investors waiting for the right time, said Mrs Chavinda.

“We are seeing more investors consistently cut recurring investment. It shows the growing discipline of Thai investors who have a better understanding of investment, particularly the long-term options,” she said.

UNDERSTANDING YOUR OPTIONS

SSFs and RMFs are investment vehicles that offer tax benefits.

There are many such funds to choose from and individual investors can learn more details from banks or asset management companies that issue these funds.

The SSF is a new long-term fund that was introduced in early 2020 as a tax-deductible alternative to long-term equity funds, which expired in 2019.

The RMF promotes savings for retirement. It is similar to a private company’s provident fund or the Government Pension Fund.

At the beginning of 2020, the rules for RMFs were revised to provide investors with more tax benefits.

SSFs can invest in any asset, including Thai stocks, foreign stocks, bonds, gold funds and real estate funds. Investors can invest in SSF units for a tax deduction of up to 30% of taxable income, but not more than 200,000 baht.

When combined with other retirement savings deductions, the amount must not exceed 500,000 baht and investment units must be held at least 10 years from the date of purchase.

There is no requirement for minimum purchase value, nor a condition requiring annual purchases.

RMFs can invest in any asset, including Thai stocks, foreign stocks, bonds, gold funds and real estate funds. Individuals can purchase investment units for a tax deduction of up to 30% of taxable income, but not more than 500,000 baht.

When combined with other retirement savings, the value must not exceed 500,000 baht.

Each RMF unit must be held for at least five years from the date of purchase and can be sold when the holder turns age 55. There is no minimum purchase required, but annual purchasing is required.

RMF holders can exercise their rights according to the new criteria for investment years starting from 2020.

INVESTMENT GUIDE

INVESTMENT GUIDE

Choosing the appropriate fund depends on your investment needs.

The tax deduction is similar, which must not exceed 500,000 baht when combined with other types of fund deductions.

However, an investor’s time horizon and investment needs may determine if a fund type is suitable.

In terms of the holding period, the two types of funds differ. RMFs are the obvious choice for investors saving for retirement.

For those willing to invest for at least 10 years, SSFs are a good option.

If an investor is younger than 45, they can redeem their investment in SSFs before they reach 55, which is the earliest age for redemption of RMF units. Again, the choice depends on when an individual anticipates they will want to redeem the investment.

A 50-year-old investor can redeem RMF units in five years, but an SSF investment in SSF investment could not be redeemed until age 60.

THE RIGHT PRODUCTS

Even though the market is highly volatile, the investment values of SSFs and RMFs are not much different compared with last year, said Mrs Chavinda.

According to Morningstar Research (Thailand), of the total market, savings funds from Kasikorn Asset Management had the largest market share with a net asset value of 9.6 billion baht in the first nine months.

SCB Asset Management had a market share of 23.5%, with the highest inflow of 1 billion baht in the third quarter.

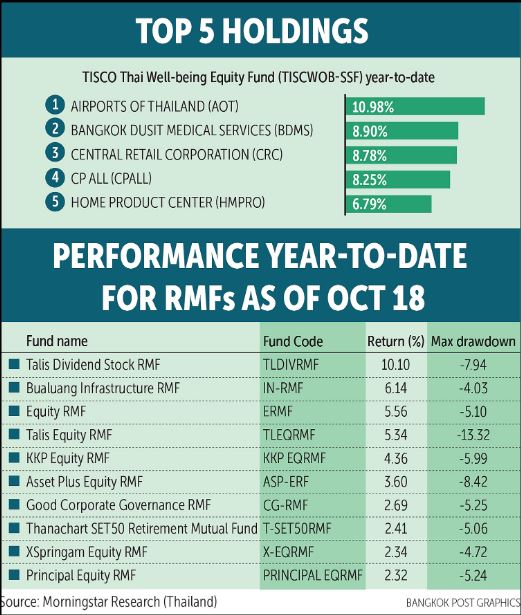

The top five SSFs in terms of return year-to-date are: TISCO Thai Well-being Equity Fund (TISCOWB-SSF) at 10.3%; KKP Dividend Equity Fund (KKP DIVIDEND-SSF) 1.69%; Bualuang Thai Equity Super Savings Fund (BEQSSF) 1.31%; LH Strategic Equity Fund (LHSTRATEGY-ASSF) 1.27%; and KKP Active Equity Fund (KKP ACT EQ-SSF) 0.34%.

Source: https://www.bangkokpost.com/business/2426190/choosing-a-year-end-piggy-bank

English

English