Thailand: Cabinet approves land windfall tax

The cabinet approved a draft bill Tuesday on the land windfall tax — a levy on inflated property prices driven by transport infrastructure projects.

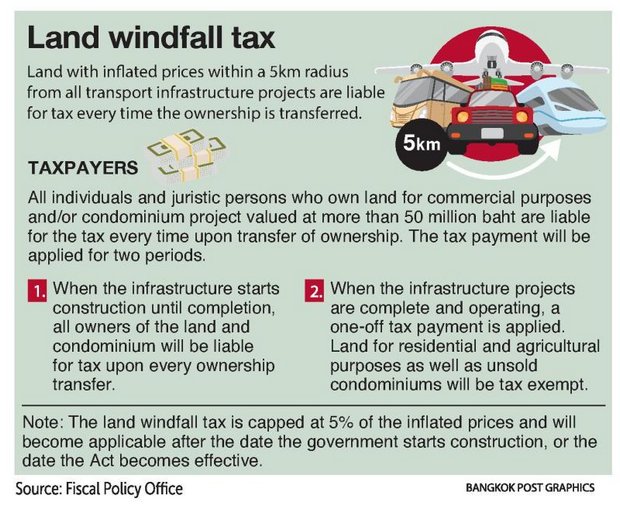

Nathporn Chatusripitak, an adviser to the PM’s Office Minister, said the new tax will charge both individual and corporate owners for commercial purposes and condominium projects worth more than 50 million baht every time their ownership is transferred from the time when the transport infrastructure project starts construction until the project’s completion.

A draft bill on the land windfall tax caps the ceiling at 5% of the inflated price, but the applicable rate will be decided on later.

Those liable for the tax must own land within a radius of five kilometres of a station serving high-speed, double-track or electric trains, or of the on- or off-ramp of an expressway. Those who own plots within 5km of building-restricted zones such as airports or ports will also be required to pay the tax.

Mr Nathporn said the government has been investing in a number of infrastructure projects that need huge budgets, while tax collection from landlord owners or property developers will help the government generate revenue to offset massive investment.

Mr Nathporn said the government has been investing in a number of infrastructure projects that need huge budgets, while tax collection from landlord owners or property developers will help the government generate revenue to offset massive investment.

The government’s transport infrastructure projects range from double-track rails, high-speed rail network, the mass-transit system, expressways, special tollways, ports and airports, he said.

The Treasury Department has been tasked with evaluating land prices over the country, while land price valuations will be revised every four years.

The Treasury Department’s land price valuations will be used to calculate the inflated prices of the land adjacent to the state projects.

“The new tax will be charged only once the owners sell their land after the state projects nearby begin construction,” he said.

For other types of properties such as shophouses, townhouses or condominiums, only the inflated land prices will be charged, he said.

The bill categorises state projects into two types — those built before the law takes effect, such as mass transit; and future projects to be built after the law comes into force, such as the high-speed train or double-track train projects.

In the under-construction project group, the tax base is calculated from the difference between valuations on the date the land is transferred and on the effective date of the law.

The tax collection for land will be conducted by the Land Department while the Local Administrative Organisation is required to collect tax from property projects that are completed.

For condos, the tax base will be the difference between sale prices and valuations on the effective date of the law. For new or under-construction units, the valuations will be 20% of the average valuation of condos in the same area.

During the construction period of a state project, the tax levied on the inflated prices will be applied every time the land or condo units change hands.

For land or condos near a state project completed before the law takes effect, the tax will apply only to commercial sales worth 50 million baht or more based on the valuation differences on the date the project is completed and on the effective date of the law.

After the state projects are completed, land sales will be taxed only once.

In the meantime, Pornchai Thiraveja, deputy spokesman of the Finance Ministry, said the land windfall tax is aimed at creating tax payment fairness.

He said the Finance Ministry will form a committee led by permanent secretary Prasong Poontaneat to set the exact distance between transport infrastructure projects and land that is subject to the new property tax.

Source: https://www.bangkokpost.com/business/news/1501138/cabinet-approves-land-windfall-tax

English

English