Thailand: Ageing office buildings feeling stronger impact from rising competition

With growing competition in the Bangkok office market, fueled by a large amount of new supply that is coming, ageing office buildings are losing their ability to retain and attract occupiers.

This trend is putting pressure on landlords of these buildings to become more proactive and find ways to enhance the value and competitiveness of their assets, according to property consultancy JLL.

“JLL’s leasing activity data shows that the majority of new leases are being signed within modern office buildings, showing a clear preference amongst occupiers. Consequently, buildings that are built before 2002, which are referred to as ‘ageing’, are typically struggling to attract new occupiers,” says Jeremy O’Sullivan, Head of Research and Consulting at JLL.

“Compared to the top-grade new supply coming to market, ageing buildings generally have an inferior design, facilities and technology. Some were previously prime grade buildings that have been downgraded to the secondary tier in recent years,” he adds.

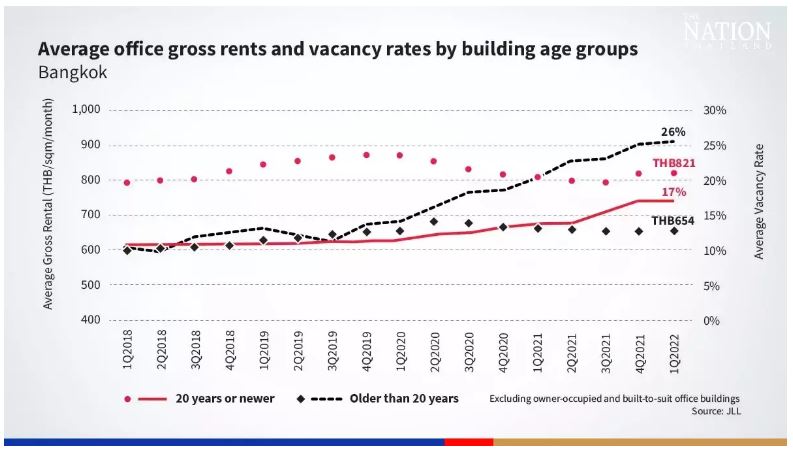

The latest study by JLL reveals that the total stock of office space in Bangkok is standing at 9.97 million sqm at present, of which nearly 70% are buildings aged over 20 years. Findings from the study also show that office buildings aged not more than 20 years saw the average vacancy rate at 17% and the average rental at THB821/sqm/month at the end of the first quarter of 2022, while older buildings witnessed the average vacancy rate at 26% and the average rental at THB654/sqm/month over the same period.

Between now and 2026, the Bangkok office market will see an additional 2.2 million sqm of new space. Of this, more than 1.7 million sqm or 81% will be from prime grade developments. JLL expects this to raise vacancies and put further downward pressure on rents in ageing, secondary-grade office buildings.

Thananun Ruengveeravich, Head of Office Leasing Advisory at JLL, says “The growing availability of new prime office supply means that occupiers now have more options when it comes to site selection for their workplace. We have seen an increasing number of occupiers taking this opportunity to review their office efficiency and considering relocation to newer buildings.”

Findings from JLL’s study show that between the second quarter of 2021 and the first quarter of 2022, the Bangkok office market saw a negative net absorption of -82,000 sqm. However, office buildings whose construction was completed in 2011 or later continued to see positive net absorption of 99,000 sqm in total versus -181,000 sqm of negative take-up in older buildings.

“In response to the flight-to-quality trend of occupiers, some landlords of older, secondary-grade buildings are considering to offer rental discounts to maintain or boost occupancy while more proactive landlords are looking for a strategy to enhance their ageing assets to stay relevant and meet evolving demand from occupiers in the long term,” says Thananun.

Natcha Taepongsorat, Head of Asset Enhancement at JLL, says “Other than a pricing strategy, landlords of ageing office buildings can consider an asset enhancement as a longer-term solution to improve the performance of their assets, reduce operating costs, increase revenue and avoid obsolescence. This includes a wide range of strategies from operational efficiency improvement, property management and sustainability enhancement through to revitalization.”

JLL’s observations show revitalization has gained popularity among well-located secondary-grade office buildings whose landlords look to improve cash flow and net operating incomes of their assets. Investment costs typically range from THB 30 million to 200 million, depending on each individual asset and renovation scale. Some landlords may also get their ageing office buildings renovated to become more sustainable or meet green building standards such as LEED or TREES in order to attract a growing number of corporations with a net-zero target and reduce utility bills in the long run.

“The optimal building upgrade helps futureproof assets and allows them to remain competitive in the challenging market, which is reflected in the rental improvement and reduction in operation costs. With higher income and building quality, enhanced projects are generally appraised with higher values, benefiting landlords and forthcoming investors,” says Natcha.

“Asset enhancement strategies and scales vary. It is critical for landlords and investors to evaluate their asset performance, expectation of their target occupiers and their own expectation of return on investment before making any asset enhancement decision. This will help ensure the most impactful and cost-effective option and prevent overinvestment,” she concludes.

About JLL

JLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. JLL is a Fortune 500 company with annual revenue of $19.4 billion, operations in over 80 countries and a global workforce of more than 100,000 as of March 31, 2022. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com

Published : August 02, 2022

English

English