Philippines Inc. calls on Congress to urgently pass CREATE bill

MANILA, Philippines — With time running out, businessmen on Thursday called on Congress to quickly pass the Duterte government’s revised corporate tax reform bill, saying the measure would serve as companies’ main fix to the destruction of the coronavirus pandemic.

A “bold” and “historic economic” reform is needed to help firms recover and counter the effects of the virus, according to a statement by the Philippine Chamber of Commerce and Industry and 31 other business groups that threw their support behind the Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill.

The CREATE bill will be a “life-restoring boost to market confidence” in the country as it will provide “cost-efficient and instant” relief to businesses, they said.

If enacted into law, CREATE will immediately cut the corporate income levy to 25% from currently 30%, while keeping tax perks intact for longer periods. From there, corporate income tax (CIT) rates would go down 1-percentage point each year to 20% by 2027.

The provision, and other amendments, will be introduced to the currently-pending Corporate Income Tax and Incentive Reform Act (CITIRA) pending at the Senate, which has until June 3 to pass the measure, following the government’s schedule of the tax cut by July. The Lower House already approved CITIRA on its current form.

For the companies that signed the petition to be submitted to Congress, the instant 5-percent tax savings is a “direct infusion of financial assistance to businesses, giving them more resources to retain employees and keep up with financial difficulties.”

“As an investment-attracting move, the CIT cut drastically alters, for the better, the financial prospectus of the Philippines,” they added.

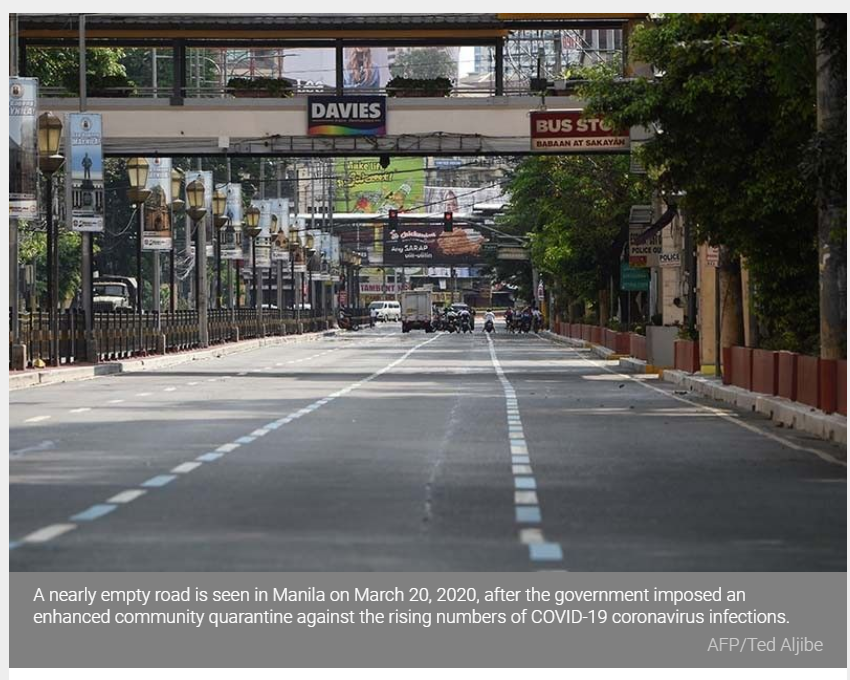

The rallying call for the passage of CREATE comes as the government debates whether when to ease tough lockdown restrictions meant to stem the virus contagion. Quarantine rules for about three months now were so stringent that a government survey showed two-thirds of businesses getting shuttered and a fifth of workers displaced in the main island of Luzon.

CREATE is expected to operate in tandem with another bill, Bayanihan II, another government-initiated economic stimulus that makes use of the existing P4.1-trillion national budget while requesting for an additional P130 billion in fresh funding. The new allocations will mostly go to government banks as fresh capital for lending.

Time is running out for both bills however, as Congress is set to adjourn the current session by June 3. Legislators also have different priorities, keeping them preoccupied with other bills containing bolder economic stimulus measures which so far received a cool reception from the Executive.

“We humbly request the Senate and the House of Representatives to move quickly and decisively to push CREATE forward and ensure its passage urgently, ideally before Congress adjourns on June 3,” the 32 business organizations said.

Aside from the instant CIT cut, CREATE also targets to incentivize firm investments by allowing companies to carry over their likely losses incurred this year to offset taxes over the next three to five years.

Another salient provision of the bill is expanding the role of the existing Fiscal Incentives Review Board, which will have the power to tailor-fit incentives for specific companies and recommend them for approval to the President. On this matter, businessmen stressed there’s a need for “proper safeguards” in order to “prevent abuse of discetion or be a political tool to grant favors to undserving recipients.”

That said, the business groups voiced out their support to the measure. “Any further delay comes at the risk of losing more jobs and hemorrhaging more investments. Pass CREATE now,” they said.

The 32 business groups that signed the joint statement were:

- ALYANSA AGRIKULTURA

- ANVIL BUSINESS CLUB

- BANKERS ASSOCIATION OF THE PHILIPPINES (BAP)

- CEBU BUSINESS CLUB (CBC)

- CEBU LEADS FOUNDATION (CLF)

- CHINESE FILIPINO BUSINESS CLUB, INC. (CFBCI)

- ENTREPRENEURS’ ORGANIZATION (EO) PHILIPPINES

- FEDERATION OF FILIPINO-CHINESE CHAMBERS OF COMMERCE & INDUSTRY, INC. (FFCCCII)

- FEDERATION OF INDIAN CHAMBERS OF COMMERCE (PHIL) INC. (FICCI)

- FINANCIAL EXECUTIVES INSTITUTE OF THE PHILIPPINES (FINEX)

- FOUNDATION FOR ECONOMIC FREEDOM (FEF)

- INSTITUTE FOR SOLIDARITY IN ASIA, INC. (ISA)

- INSTITUTE OF CORPORATE DIRECTORS (ICD)

- INVESTMENT HOUSE ASSOCIATION OF THE PHILIPPINES (IHAP)

- MANAGEMENT ASSOCIATION OF THE PHILIPPINES (MAP)

- NATIONAL REAL ESTATE ASSOCIATION (NREA)

- ORGANIZATION OF SOCIALIZED HOUSING DEVELOPERS OF THE PHILIPPINES (OSHDP)

- PEOPLE MANAGEMENT ASSOCIATION OF THE PHILIPPINES (PMAP)

- PHILIPPINE CENTER FOR ENTREPRENEURSHIP (GO NEGOSYO)

- PHILIPPINE CHAMBER OF COMMERCE & INDUSTRY (PCCI)

- PHILIPPINE COUNCIL OF ASSOCIATIONS AND ASSOCIATION EXECUTIVES (PCAAE)

- PHILIPPINE HOTEL OWNERS ASSOCIATION INC. (PHOA)

- PHILIPPINE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS (PICPA)

- PHILIPPINE RETAILERS ASSOCIATION (PRA)

- PHILIPPINE WOMEN’S ECONOMIC NETWORK (PHILWEN)

- PROCUREMENT AND SUPPLY INSTITUTE OF ASIA (PASIA)

- RURAL BANKERS ASSOCIATION OF THE PHILIPPINES (RBAP)

- SHAREHOLDERS’ ASSOCIATION OF THE PHILIPPINES (SHAREPHIL)

- SUBDIVISION AND HOUSING DEVELOPERS ASSOCIATION (SHDA)

- TAX MANAGEMENT ASSOCIATION OF THE PHILIPPINES (TMAP)

- UP SCHOOL OF ECONOMICS ALUMNI ASSOCIATION (UPSEAA)

- WOMEN’S BUSINESS COUNCIL PHILIPPINES (WBCP)

Source: https://www.philstar.com/business/2020/05/28/2017180/philippines-inc-calls-congress-urgently-pass-create-bill

English

English