Malaysia: Shifting to safer investments

PETALING JAYA: The bullishness in the stock market that has spilled over from last year is starting to mellow and retail investors are starting to seek shelter in safer investment products.

The year 2021 has been highly touted as the year of economic recovery as countries start to roll out the vaccination programmes but the recent outbreaks, especially that of new Covid-19 variants, have thrown a spanner in the works.

Some countries have reinstated lockdowns and movement restrictions, including Malaysia, as they attempt to curb the spread and ramp up inoculations to achieve herd immunity targets.

While a recovery is on the cards albeit a delayed one, it is enough to make investors feel restless. A survey conducted by CGS-CIMB Research found that a lower proportion of survey participants are opting to invest directly in the domestic stock market compared to a year ago.

Only 49% ranked “directly investing in the domestic stock market” as their first choice. This is followed by investing via Amanah Saham Nasional Bhd (ASB) or the Employees Provident Fund (EPF) at 13.5%; investing via domestic unit trusts and directly in overseas stock markets were tied at third place at 8.4% each.

Investing via roboadvisers came in at 8% while about 5.8% of respondents said their most preferred choice was to invest in a unit trust that offers exposure to the overseas markets. The remaining 6.8% classified their preferred investments as “others”.

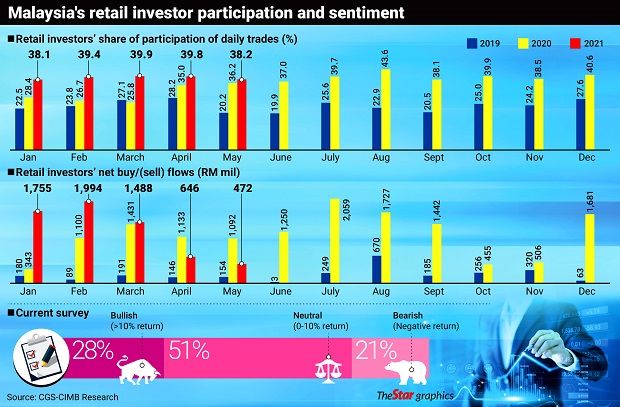

“This helps explain the slight drop in retail participation in the daily trades of the Malaysian stock exchange. This could also be due to the reopening of the economy or retail investors are shifting to less volatile investment products for exposure to the stock market via the EPF and ASB where the downside risks are better protected,” it said.

The research house also noted that roboadviser products are becoming slightly more popular for immediate exposure to the stock market, possibly due to the ease of accessibility.

The survey was CGS-CIMB’s second edition of its proprietary Retail Investors Survey, which saw a participation of 1,044 Malaysian retail investors from April 20 to May 31.

It also found that a significant rise in the overnight policy rate (OPR) or the availability of alternative investment products that offer higher returns may entice profit taking in the equity markets among retail investors, as most are deploying their savings to achieve higher returns.

The research house also noted that in terms of biggest sources of funds deployed to invest in the stock market, additional funds from lower EPF contributions and withdrawals from i-Sinar and i-Lestari, came in third after savings and income from employment and other sources.

“Based on this, we conclude that some of the stimulus packages to assist households may have partly contributed to the liquidity that has been injected into the stock market as respondents indicated that some of the cash flows from reduced EPF contribution or withdrawal schemes have been deployed to invest in the stock market recently.

“However, we note that a higher percentage of respondents compared to a year ago were funding their investment in the stock market through margin financing,” it said.

While retailers are neutral on the stock market over the next three months, CGS-CIMB said they were less bullish compared to a year ago, with 51% of them expecting a return of between 0% and 10%.

It found that the three biggest concerns of respondents are due to the domestic economy and politics, external factors and sharp falls in stocks and markets. “The survey suggests that consumer sentiment remains relatively weak, though this observation is caveated by our sample data, which is skewed towards those earning incomes higher than the population average.

“We think if the Government can achieve its reopening timeline targets as listed in the National Recovery Plan, investors could shift to recovery stocks by July or August,” the research house said, adding that its top three key picks in this theme are Malayan Banking Bhd , Genting Bhd

, Genting Bhd and Malaysia Airports Holdings Bhd

and Malaysia Airports Holdings Bhd .

.

The survey also polled 89% of respondents indicating that their current disposable incomes remained below pre-Covid-19 levels, with over half of the respondents reporting incomes at 60% or below pre-pandemic levels.

CGS-CIMB said the pandemic and implementation of movement controls to curb its spread continue to have an adverse impact on household incomes.

“A sustained reopening of the economy and erosion of slack in the labour market are important precursors to a recovery in household incomes.

“While we expect Malaysia’s unemployment rate to gradually improve to 4% by end-2021F (from 4.7% in Mar), this would still be significantly higher than end-2019’s rate of 3.3%,” it said.

According to MIDF Research’s fund flow report, retailers have been the only net buyers of Malaysia’s equity market to date to the tune of RM7.32bil.

Local institutions and foreign investors were net sellers at RM3.97bil and RM3.34bil respectively.

The FBM KLCI tracked its regional peers yesterday as it slumped 16.81 points or 1.06% to 1,572.24 points.

The hawkish tone from the Federal Reserve last week, which signalled that it could raise interest rates in 2023 instead of 2024, crushed markets yesterday as they surfed in a sea of red amidst the weak sentiments.

Source: https://www.thestar.com.my/business/business-news/2021/06/22/shifting-to-safer-investments

English

English