Malaysia: Q1 high for EPF

PETALING JAYA: The Employees Provident Fund (EPF) has posted its highest quarterly gross investment income of RM19.29bil for the first quarter ended March 31, 2021 amid the uncertainties from the ongoing Covid-19 pandemic.

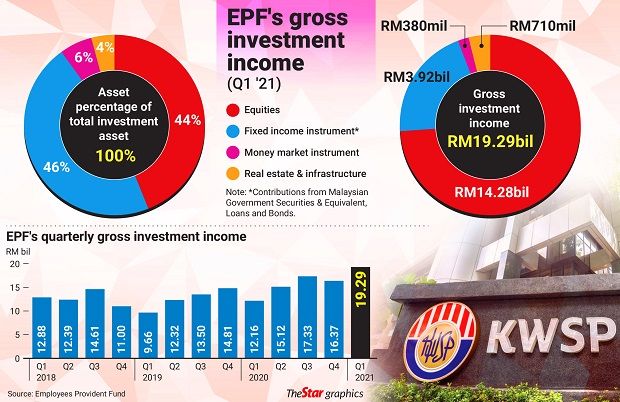

It was a 58.63% jump year-on-year (y-o-y) from RM12.16bil last year and a 17.84% quarter-on-quarter (q-o-q) increase as compared to RM16.37bil for the three-month period ended Dec 31, 2020.

The latest quarterly gross investment income alone surpassed the full year performance of 2009 and its preceding years.

The stellar performance came mainly from equities, which accounted for RM14.28bil or 74% of the gross investment income while fixed income instruments contributed a stable income of RM3.92bil.

Income from real estate and infrastructure, as well as money market instruments, came in at RM710mil and RM380mil respectively.

After the cost write-down on listed equities, which is a prudent measure practiced by the EPF to ensure that its long-term investment portfolio remains healthy, the fund recorded a net investment income of RM19.24bil.

EPF chief executive officer Datuk Seri Amir Hamzah Azizan (file pic above) said the fund’s solid performance for the first quarter was a spillover from the global economic recovery that began in the second-half of last year.

“We believe that the vaccination rollouts as well as supportive fiscal and monetary policies worldwide will play a key role in facilitating economic activities and growth.

“The inflationary concerns did not derail the positive trend in the equity markets and we took advantage of the opportunity to reposition our holdings in stocks that are fundamentally strong but undervalued, ” he said in a statement.

Amir added that while the EPF remains cautious for the coming quarter given the downside risks of the new highly transmissible Covid-19 variants, he assured members that the EPF continuously take the necessary measures to protect members’ savings, supported by its strong governance framework as it strives to meet the mandate and strategic targets of providing members with a sustainable retirement.

“Our disciplined investment approach and robust liquidity management guided by the Strategic Asset Allocation (SAA) has been successful in minimising the impact of the substantial disbursements on the EPF’s portfolio, allowing it to sustain a steady performance in these trying times.

“This reflects the fund’s commitment to safeguarding our members’ retirement savings by preserving and enhancing the value of those savings, while ensuring that their short-term needs are met without compromising their long-term interests, ” he said.

EPF’s investment assets stood at RM981.71bil as at end March 2021, of which 36% was invested overseas.

The diversification in different asset classes, markets, and currencies continued to provide income stability and added value to the fund’s overall returns.

During the first quarter, the EPF’s overseas investments generated an income of RM11.15bil, or 58% of the total gross investment income recorded, mainly driven by foreign equities.

By asset class, fixed income instruments made up 46% of investments while equities comprised 44%.

Money market instruments and real estate and infrastructure made up 4% and 6% respectively of investments.

EPF said the portfolio reflected its diversification strategy to optimise returns within tolerable risk limits as guided by the SAA, which has proven to be resilient in the face of any challenging market environment, especially during the COVID-19 pandemic crisis.

To date, a total of RM57.97bil of i-Sinar withdrawals have been approved for 6.49 million applicants, out of which RM50.93bil have been disbursed, while RM20.80bil has been paid out to 5.27 million members under the i-Lestari facility.

EPF’s i-Sinar and iLestari facilities were introduced last year to allow affected members to make withdrawals that would help provide some measure of financial relief.

Riding on the expectations of a global recovery this year, Socio-Economic Research Centre executive director Lee Heng Guie told StarBiz that 2021 would be a better year from a macro perspective in terms of sustainable global recovery and global equity markets’ performance.

“Countries like the United States are showing steady signs of recovery from the pandemic and that will help to support the global equity markets.

“It is indeed a very good start in 2021 for the EPF with the jump in gross investment income that largely came from equities, about half from overseas investments.

“Hopefully, this set of numbers registered in the first quarter can be sustained throughout the year, underpinned by the income from EPF’s foreign equity portion, ” he said, adding that this would also have a positive spillover of the domestic equity market.

Despite the periodic volatilities on the back of concerns of the rising Covid-19 cases in recent weeks that led to a lockdown, Lee said the benchmark index FBM KLCI is still holding on.

While these may tamper the macro outlook and some recovery play stocks, he noted that there would not be any significant impact on the overall domestic equity market.

“It is still very much dependent on the overseas performance, particularly the Dow Jones, ” he said.

Source: https://www.thestar.com.my/business/business-news/2021/06/09/q1-high-for-epf

English

English