Malaysia: Markets in turmoil as oil price crashes

PETALING JAYA: Ongoing worries over the economic fallout from the Covid-19 outbreak and a plunge in global crude oil prices hammered asset classes in Malaysia with the stock and the palm oil markets landing body blows from the global rout.

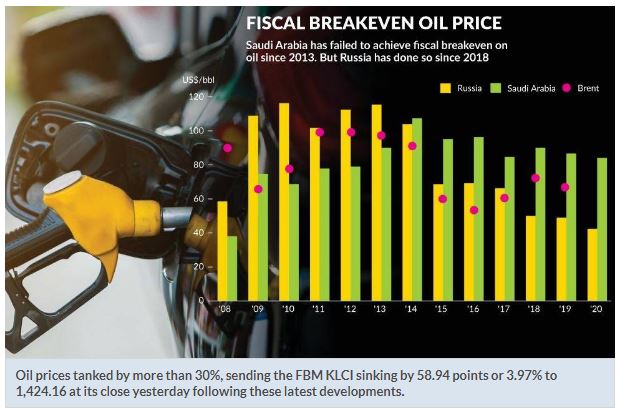

Oil prices tanked by more than 30%, sending the FBM KLCI sinking by 58.94 points or 3.97% to 1,424.16 at its close yesterday following these latest developments.

Saudi Arabia, the biggest oil producer in the world, is planning to increase oil output next month, well above 10 million barrels a day as it responds aggressively to the collapse of its Opec+ alliance with Russia.

The price war in the oil markets saw crude oil prices slump by the most in at least 20 years, offering unprecedented discounts in Europe, the Far East and the United States to entice refiners to purchase Saudi crude at the expense of other suppliers.

Local oil and gas counters took the brunt of the selling and that weighed on the sentiment of the market.

Bursa Malaysia has suspended the short selling activities of multiple oil and gas stocks yesterday following a sharp plunge in their share prices.

The top four most actively traded counters were oil and gas stocks and they saw tremendous selling pressure that sent share prices of some limit down in trading.

That prompted the suspension of the proprietary day trading and intraday short selling of multiple oil and gas stocks.

The affected counters include DAYANG ENTERPRISE HOLDINGS BHD , Velesto Energy Bhd, HIBISCUS PETROLEUM BHD

, Velesto Energy Bhd, HIBISCUS PETROLEUM BHD , BUMI ARMADA BHD

, BUMI ARMADA BHD , Serba Dinamik Holdings Bhd, Dialog Group Bhd

, Serba Dinamik Holdings Bhd, Dialog Group Bhd , Coastal Contracts Bhd

, Coastal Contracts Bhd , Wah Seong

, Wah Seong Corp Bhd, and MUHIBBAH ENGINEERING (M) BHD

Corp Bhd, and MUHIBBAH ENGINEERING (M) BHD .

.

Reports said that Goldman had cut its second and third quarter Brent forecast to US$30 per barrel, and said that prices could dip into the US$20s range soon.

“It certainly feels like the end of the world is upon us with everything happening in the past few weeks: from the government to the coronavirus and now oil prices, ” said a dealer.

The sudden shock to the system with the abrupt fall in oil prices had prompted Ambank Research to downgrade the oil & gas industry to an “underweight” from an “overweight”.

“If Saudi Arabia restores its capacity of 12 million barrels per day, we expect crude oil price to easily crash below US$30 per barrel. We are lowering forecasts given the rising excess oil capacity that is likely to flood global markets amid weak demand softened by the covid-19 pandemic, ” it said.

With the fall in oil prices and other commodities such as crude palm oil (CPO) and the strengthening of the US dollar on increased safe haven demand, the ringgit weakened 0.68% to 4.2072 at press time to near the lows of when the political crisis struck Malaysia.

Kenanga Research said in its report that its ringgit’s forecast to the US dollar this year-end is at 4.20.

“The ringgit continues to be pressured as investors turned edgy, resulting in foreign fund outflows. The local note was also weighed by the lingering Covid-19 jitters and continued growth slowdown in key major trading partners specifically China, ” it said.

CPO futures plunged as well, continuing its downtrend that was established since Jan 10,2020 and lost 8% at press time to RM2,255 per tonne.

The broader market back on the Bursa Malaysia was very weak with losers vastly outnumbering gainers by 11 to one.

Some 6.66 billion shares worth RM3.63bil were traded yesterday.

The top loser was CARLSBERG BREWERY MALAYSIA BHD that fell RM1.34 or 4.58% to RM27.94 as investors sold the stock ahead of the cabinet announcement that includes high profile lawmakers from PAS.

that fell RM1.34 or 4.58% to RM27.94 as investors sold the stock ahead of the cabinet announcement that includes high profile lawmakers from PAS.

On the other end of the spectrum, NESTLE (M) BHD was the top gainer and it rose by 80 sen or 0.57% to RM140.80.

was the top gainer and it rose by 80 sen or 0.57% to RM140.80.

The sudden shock to the system with the abrupt fall in oil prices had prompted AmBank Research to downgrade the oil & gas industry to an “underweight” from an “overweight”.

“If Saudi Arabia restores its capacity of 12 million barrels per day, we expect crude oil price to easily crash below US$30 per barrel. We are lowering forecasts given the rising excess oil capacity that is likely to flood global markets amid weak demand softened by the covid-19 pandemic, ” it said.

With the fall in oil prices and other commodities such as crude palm oil (CPO) and the strengthening of the US dollar on increased safe haven demand, the ringgit weakened 0.68% to 4.2072 at press time to near the lows of when the political crisis struck Malaysia.

Kenanga Research said in its report that its ringgit’s forecast to the US dollar this year-end is at 4.20.

“The ringgit continues to be pressured as investors turned edgy, resulting in foreign fund outflows. The local note was also weighed by the lingering Covid-19 jitters and continued growth slowdown in key major trading partners specifically China, ” it said.

CPO futures plunged as well, continuing its downtrend that was established since Jan 10,2020 and lost 8% at press time to RM2,255 per tonne.

The broader market back on the Bursa Malaysia was very weak with losers vastly outnumbering gainers by 11 to one.

Some 6.66 billion shares worth RM3.63bil were traded yesterday.

The top loser was Carlsberg Brewery Malaysia Bhd that fell RM1.34 or 4.58% to RM27.94 as investors sold the stock ahead of the cabinet announcement that includes high profile lawmakers from PAS.

On the other end of the spectrum, Nestle (M) Bhd was the top gainer and it rose by 80 sen or 0.57% to RM140.80.

Source: https://www.thestar.com.my/business/business-news/2020/03/10/markets-in-turmoil-as-oil-price-crashes

Thailand

Thailand