Malaysia: La Nina set to support CPO price

PETALING JAYA: The coming La Nina weather phenomenon that will bring heavier than usual rainfall may determine the pace of the current upward trend of crude palm oil (CPO) prices.

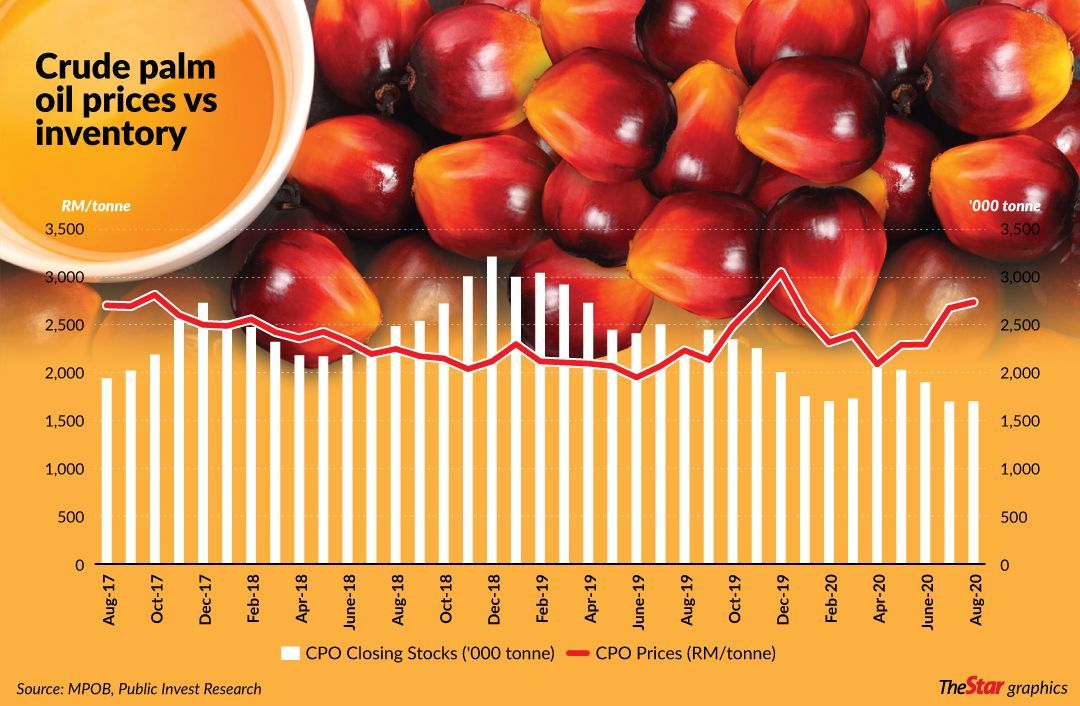

Plantation experts generally expect a 75% probability of La Nina occurring from October to December in the South-East Asian oil palm-growing regions. CPO recently rallied to trade at RM3,000 per tonne from a low of about RM2,000 per tonne in May, buoyed by the surge in the prices of its competing peer, soybean oil.

According to industry consultant MR Chandran, the prevailing high CPO price was basically due to a spike in soybean price and the anticipated lower CPO production from major producers Malaysia and Indonesia this year.

“We have witnessed a 13% rise in soybean prices over a month due to adverse weather conditions and increased use of soybean oil for conversion to biodiesel in the US.

“However, there is no doubt that the immediate impact of La Nina may lend support to CPO prices as heavy rainfall will affect the harvest of fresh fruit bunches (FFB) in the estates, resulting in the delay of crop evacuation, ” Chandran explained.

He told StarBiz that some oil palm plantations could also experience reduction in their production by about 5% to 10% as a result of flooding of the mature fields.

However, flooding is normally short term in nature, he added. Kim Loong Resources Bhd managing director Gooi Seong Heen feels that “weather will play a significant role in determining the production of agri-commodities.

managing director Gooi Seong Heen feels that “weather will play a significant role in determining the production of agri-commodities.

“La Nina is expected to happen in the next three months, which may affect soybean production that can maintain the prices of this commodity at high levels.

“To what extent, no one knows. So, it is best to keep reducing the current CPO stocks during this period as much as possible, ” said Gooi.

He noted that the price of CPO is dictated by competing edible oil prices, primarily soybean oil.

It is also strongly influenced by crude oil prices as biodiesel production also consumes CPO “if the price is right.”

“However, crude oil price is expected to remain low for quite some time in the future. While inflation will help to raise the price of CPO, this is unlikely to happen with the Covid-19 pandemic, ” he noted.

With CPO production unlikely to increase significantly for the rest of this year, Gooi is hopeful CPO prices can be maintained at current levels until the first quarter of next year.

He also said that if a Covid-19 vaccine can be found and economic activities return to the pre-pandemic 19 levels, then the demand for CPO could likely increase substantially and boost the prices further.

The average CPO price for 2020 appears to trend towards RM2,600 per tonne, Gooi said.

“Hopefully the average CPO price for 2021 will be around RM 2,700 per tonne bearing in mind that palm oil stocks should be maintained below the two-million tonne mark by end-2020.”

Malaysian Palm Oil Association CEO Datuk Nageeb Wahab, meanwhile, believes that the predicted La Nina phenomenon this year will be moderate.

“Any inclement weather will affect the production of palm fruits, especially when plantation companies are currently facing a severe shortage of workers in their estates nationwide, ” he added.

It is estimated that the labour shortage in the plantation sector will double or escalate to 62,000 by end of this year from a shortage of about 36,000 pre-Covid 19 outbreak.

For 2020, the CPO production is slated to drop to about 19.3 million-19.4 million tonnes, which is much lower than 19.8 million tonnes recorded in 2019.

Meanwhile, Public Investment Bank Bhd (PIB) has revised up its 2020 CPO price forecast to RM2,600 per tonne from RM2,500 per tonne previously. Consequently, the brokerage has also raised its earnings forecast by 5%-10% across the plantation companies under its coverage.

It also increased its price-earning multiple by one time to reflect the positive CPO price outlook in the near-term.

However, PIB maintained its “neutral” stance on the sector, citing its expectation of a softer CPO price of RM2,500 per tonne for 2021. “We suggest investors to look into small-mid cap plantation companies, which give more attractive upside compared to the big cap, ” it said.

PIB’s top picks are Sarawak Plantation Bhd , Ta Ann Holdings Bhd

, Ta Ann Holdings Bhd and TSH Resources Bhd

and TSH Resources Bhd given their more attractive valuations and stronger-than-average fresh fruit bunch production growth.

given their more attractive valuations and stronger-than-average fresh fruit bunch production growth.

English

English