Malaysia: Inflation inching up

PETALING JAYA: With most economists expecting inflation to increase in the coming months, all eyes are on the government’s plan to mitigate the impact on consumers’ purchasing power.

As about 20 million Malaysians get ready to celebrate Hari Raya Aidilfitri in less than three weeks, concerns of costlier basic necessities in the market have been raised.

Against the backdrop of a still-fragile economy and soft labour market that has been hit by a high unemployment rate and pay cuts, Malaysians will need to brace themselves for higher living costs as the economy moves away from months of deflation.

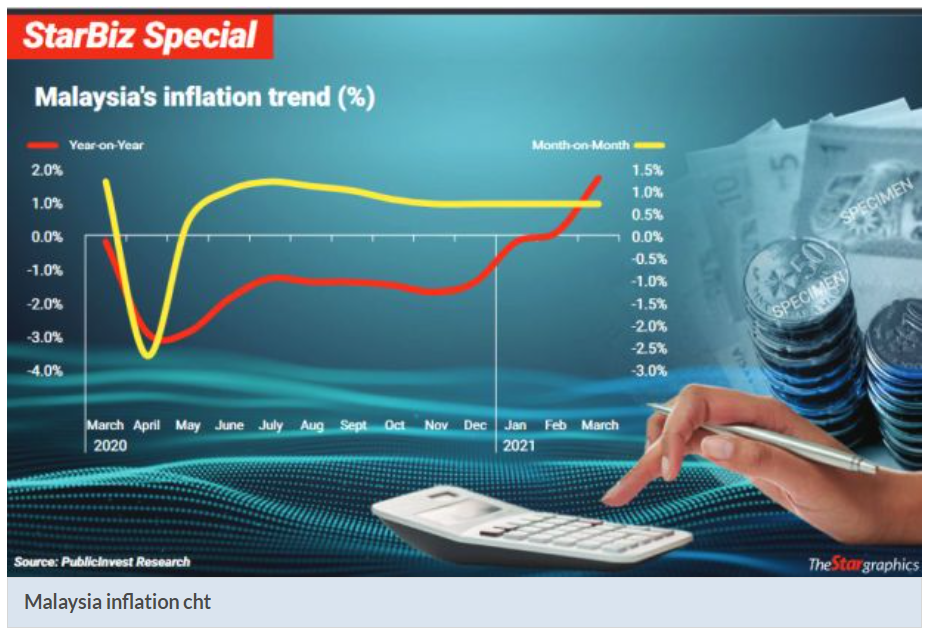

In March 2021, the headline inflation accelerated to a 34-month high of 1.7% year-on-year.

Alliance Bank chief economist Manokaran Mottain (pic below) said inflation would continue to pick up in the next two to three months.

The low base effect is a key reason, as petrol and diesel prices are much higher compared with the levels seen a year ago, despite government subsidy.

Rising global crude oil (Brent grade) prices from US$20 (RM82) a year ago to about US$65 have resulted in the higher petrol and diesel prices.

Manokaran told StarBiz that the weak ringgit would also cause inflation to inch up and make imported products such as food and intermediate goods more expensive.

“The bulk of our intermediate goods procured by the industry are being imported.

“Apart from that, as consumer demand recovers, especially with the higher purchasing drive during the Ramadan and Hari Raya period, we would also naturally see higher inflation, ” he said.

To address the impact of inflation, Manokaran urged the government to strengthen price control enforcement to prevent unscrupulous traders from taking advantage of consumers.

He also suggested a targeted cash handout for vulnerable Malaysians such as the bottom 40% (B40) population, considering that the country has yet to fully recover from the adverse impacts of Covid-19.

“The government’s ability to spend on fiscal injection is limited, however this does not mean that all avenues have been exhausted. Plugging leakages on the government’s expenditure would provide us with the cash to be transferred to the B40 individuals, for example, ” he said.

Manokaran agrees that a lower petrol and diesel price would help put more cash into consumers’ pockets.

“Transportation costs will come down, and this should prevent prices of goods in the market from going up sharply, ” he said.

Currently, the government has fixed the RON95 and diesel prices at RM2.05 and RM2.15 per litre respectively.

MIDF Research economist Mazlina Abdul Rahman (pic below) said at the current Brent crude oil price, RON95 should be priced at about RM2.30 per litre or about 25 sen more than the current price paid at petrol pumps.

She noted that the government’s subsidy has helped to contain the inflationary pressure on transportation costs.

“At current limit, the petrol costs have been markedly subsidised by the government.

“The decision to lower the limit (below RM2.05 for RON95 and RM2.15 for diesel) will depend on global price movements and must be evaluated carefully.

“It should not adversely affect the government’s coffers to a point where it could be difficult to provide assistance to the rakyat and businesses when there’s a need amid such an uncertain environment, ” she said.

Mazlina pointed out that at the current price limit of RM2.05 for RON95, it is more than 50% higher than the average price of RON95 recorded for April-May 2020.

Petrol price changes will be reflected in the transport component of the consumer price index (CPI) basket, which holds 14.6% of the total weightage.

The transport component is the third largest after food and non-alcoholic beverages (29.5%) and housing and utilities (23.8%).

Inflation is likely to surge temporarily in the coming months, particularly in the second quarter of 2021, according to Mazlina.

“Transport inflation is expected to be in the double digits for the near months, which will push the overall headline figure close to 5% for the second quarter.

“Besides the transport component, we could also anticipate some increase in prices of food and non-alcoholic beverages besides other festive-related items for April and May due to higher demand following Ramadhan and Hari Raya celebrations.

“Cash handouts via blanket EPF withdrawals and Raya bonus for civil servants for instance, provide support for the estimate, ” she said.

With higher inflation, Mazlina expected many Malaysians to be worse-off financially.

This includes working Malaysians who did not get salary increments or those who got an increment lower than the pace of inflation.

In late March, Bank Negara said Malaysia’s 2021 headline inflation is projected to average between 2.5% and 4% due to cost factors. However, underlying inflation is expected to remain subdued between 0.5% to 1.5% amid continued spare capacity in the economy.

Theoretically, central banks raise their benchmark interest rates to tackle rising price pressures.

However, TA Securities Research said it is not necessary for the central bank to immediately increase the overnight policy rate (OPR).

“Indeed, monetary policy is to remain accommodative with the objective to support a sustainable economic recovery while ensuring that price pressures remain manageable.

“The third Monetary Policy Committee (of Bank Negara) meeting this year is on May 6, with expectation that OPR will remain at 1.75%, ” the research house said in a note yesterday.

Kenanga Research also expected Bank Negara to keep the OPR unchanged.

“Nevertheless, we continue to believe there is still room for Bank Negara to cut the OPR to an all-time low of 1.5% should the local Covid-19 situation worsen and the movement control order is reimplemented.

“We remain cautious over the 2021 inflation outlook due to rising local Covid-19 cases, as well as a shortage of vaccines as Malaysia kicked off the second phase of its Covid-19 vaccination programme, ” it said.

Source: https://www.thestar.com.my/business/business-news/2021/04/27/inflation-inching-up

English

English