Malaysia: Impact Of Pandemic On Economy And Recovery Policy

KUALA LUMPUR (Bernama) – The coronavirus or COVID-19 outbreak, which is said to have originated at a wet market in Wuhan, China, has spread all over the world like lightning and was categorised as a pandemic by the World Health Organisation (WHO) on March 11.

To date, the virus has infected over a million people in more than 180 countries and caused over 80,000 deaths. In Malaysia itself, more than 3,000 people have tested positive for COVID-19 and 63 people have succumbed to it.

According to a study by JP Morgan and projections by WHO, Malaysia’s COVID-19 positive cases may peak in mid-April with over 6,000 people infected.

The Malaysian government has already taken proactive measures to curb its spread by imposing the Movement Control Order (MCO) from March 18 to 31. However, the MCO period was later extended to April 14.

Although the MCO compliance stands at 95 percent, case numbers and deaths are continuing to rise. The COVID-19 pandemic will certainly have an impact on the global economy, including Malaysia’s.

COVID-19 has shocked the world economic structure which is now in a state of uncertainty. Recently, the International Monetary Fund announced that the pandemic will cause a global recession this year which could be worse than the one triggered by the subprime mortgage crisis of 2008. The latter was caused by the contraction of liquidity in the banking system in the United States after its real estate bubble burst.

The economic crisis ensuing from COVID-19 involves practically all the countries of the world and recovery is expected to take a long time. As long as new positive cases of infection are reported, the economic ecosystem will continue to be disrupted.

Studies by the Organisation for Economic Cooperation and Development and World Bank have projected a 2.4 percent contraction in GDP (Gross Domestic Product) growth for the world. Bloomberg reported zero percent or negative GDP growth in the worst-case scenario.

COVID-19 will also have a negative impact on the labour market. The International Labour Organisation has predicted that 25 million workers throughout the world may lose their jobs.

Malaysia, which is a small country dependent on other nations such as the US and China, is also expected to feel the pinch. According to a report by the Malaysian Institute of Economic Research, Malaysia’s GDP growth will contract by 2.61 percent in 2020.

Bank Negara Malaysia (BNM) said in a recent statement that Malaysia’s economic growth will be in the -2.0 percent to +0.5 percent range. It also estimated that 951,000 people will lose their jobs.

The Malaysian Global Innovation and Creativity Centre predicted that about 40 percent of small- and medium-sized enterprises will have to wind up their operations if the COVID-19 chain of infection persists for three to six months.

In the face of COVID-19, the government must focus on two objectives: one, focus on the necessary protective and safety precautions to break the chain of infection and two, reduce the negative economic effects by implementing recovery policies involving active fiscal and monetary policy targets.

The fiscal policy targets are related to government spending and taxation while the monetary policies are related to interest rates, liquidity and control of money supply.

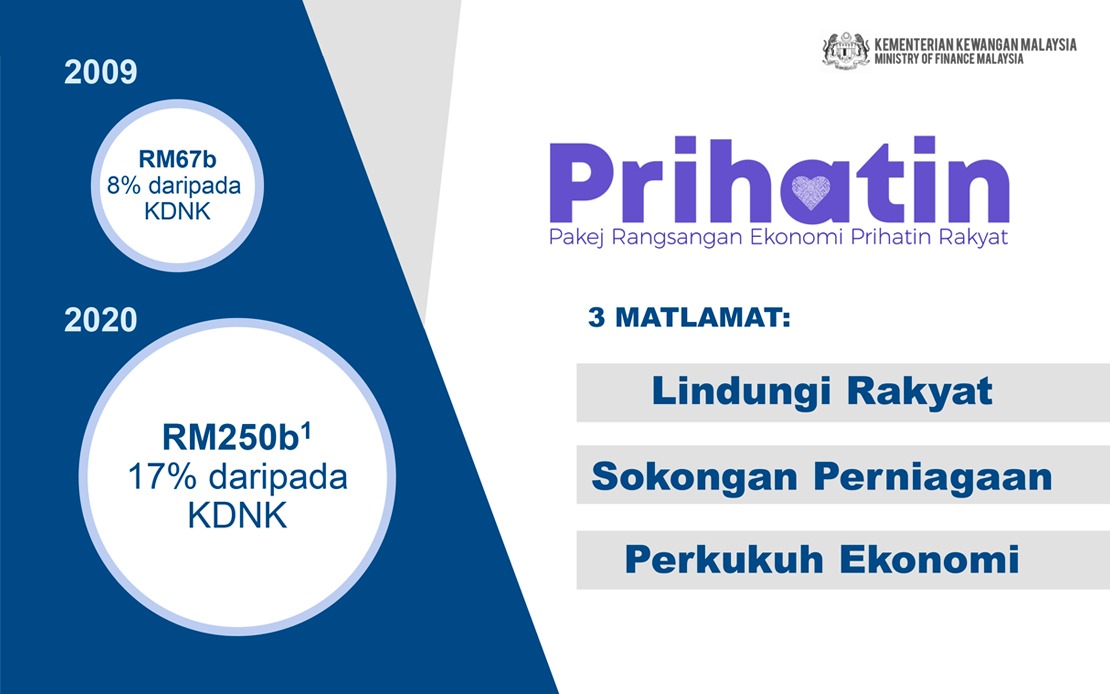

In terms of fiscal policy, the government has announced a series of economic stimulus packages to help individuals and companies affected by the COVID-19 crisis.

On March 19, the RM20 billion economic stimulus package (PRE 2020) was launched to help industries that were directly hit by the first wave of the COVID-19 outbreak, such as hotels and transport companies.

After the outbreak entered the second wave and the MCO was imposed, more individuals and businesses were impacted. The supply chain is disrupted because almost the entire sector has stopped working. Some production firms have also stopped operations and worse still, laid-off workers as they are unable to bear the costs.

PRIHATIN’s main objective is to protect the welfare of the people, support businesses and strengthen the economy. However, the stimulus packages will cause the nation’s fiscal position to worsen. To add to that, the global economic crisis has caused oil prices to tumble down to US$25-US$30 a barrel. In comparison, oil prices were around US$60 a barrel when Budget 2019 was tabled. When government revenue from oil drops, it will cause an increase in deficits.

In terms of monetary policy, BNM has cut the Overnight Policy Rate or OPR by 25 basis points to 2.5 percent and reduced the statutory reserve requirement ratio or SRR by 100 basis points to two percent.

These cuts will reduce loan costs, improve liquidity and stimulate economic activities. Apart from that, the restructuring and rescheduling of the six-month moratorium will ensure that the capital and financial market returns to stability. It will also help individuals and businesses facing financial problems and liquidity constraints.

It is difficult to predict when the economy will fully recover as long as COVID-19 positive cases continue to rise and no vaccines are discovered to treat the disease.

Nevertheless, the government’s fiscal and monetary policies complement one another and will help to revive the economy by increasing aggregate demand such as public and private consumption and investment. This will help to stimulate economic growth through the multiplier effect and reduce the hike in the unemployment rate.

(This article expresses the personal views of the writer.)

Translated by Rema Nambiar

BERNAMA

English

English