Malaysia: Banks in for higher earnings

PETALING JAYA: Higher earnings are envisaged in the banking sector this year compared with last year, albeit some pressure in the second half, underpinned by the gradual opening of more economic sectors and improved vaccination rates among the populace.

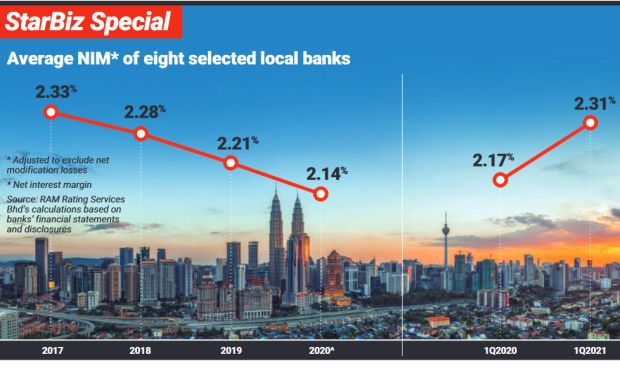

Analysts said the net interest margin (NIM) for the sector would likely improve, with the key benchmark interest rate expected to be maintained at 1.75%, which would translate to higher earnings.

Lower loan loss provisioning would also be a plus point for the sector this year, as most banks have front-loaded their provisioning in 2020, they noted.

NIM is a measure of the difference between the interest income generated by banks and the amount of interest paid out for deposits.

RAM Rating Services Bhd co-head of financial institution ratings Wong Yin Ching (pic below) told StarBiz that while banks’ earnings are envisaged to improve this year along with NIM recovery, banks’ profit performance is anticipated to remain pressured by still elevated, albeit lower impairment charges.

Most banks are also expected to continue setting aside more pre-emptive provisions this year when loans are on payment “holiday,” she said.

The latter refers to the six months opt-in loan moratorium.

“We project banks’ credit cost ratio to come in at 60-70 basis points (bps) this year compared with last year’s 84 bps based on the average of eight selected local banks under our coverage.

“NIM had been severely crimped by the aggregate 125 bps cut in the overnight policy rate (OPR) last year, further compounded by sizeable modification charges.

“After having plunged 14 bps to 2.07% in 2020, the average NIM of the eight banks rebounded strongly to 2.31% in the first quarter of this year and will likely hover at this level, given that the majority of deposits have already repriced at lower rates, Wong added.

Even as the headwinds intensify, she believed that Malaysian banks’ strong balance sheets would enable them to withstand the challenging operating landscape.

Wong, for now, is maintaining a loan growth forecast of 3% for this year.

In May, loan growth rose 3.9% year-on-year. Loan expansion in the first five months of the year was driven by households while business loan growth remained anaemic.

She said the extension of government incentives for car and property purchases till end-2021 is envisaged to provide some support to home and auto loan growth when the economy reopens.

CGS-CIMB Securities equities research analyst Winson Ng has projected a core net profit growth of 9.4% for banks this year after a 10.8% drop in 2020.

Banks’ net profit in the second half could be close to or slightly lower than the core net profit in the first half on the back of stable NIM and a potential increase in provisions.

“We also anticipate an expansion of 5bps in interest margins in 2021, given that OPR is expected to be stable this year.

“The risks for an uptick in gross impaired loan (GIL) ratio will still persist due to Covid-19. We project that the GIL ratio will increase from 1.56% at end-December 2020 to 2% at end-December 2021,” Ng said.

He added that the earnings catalysts for the sector this year would be lower loan loss provisioning and higher NIMs on the back of a stable OPR.

OCBC Bank (M) Bhd country chief risk officer Thor Boon Lee, (pic below) however, feels that earnings could be impacted in the second half of the year.

He said this is likely to happen due to management overlays that banks take as part of their pre-emptive provisioning and also, the impact of modification losses arising from fixed-rate loans.

“The quantum will depend on the latest opt-in moratorium numbers. This will, of course, vary from bank to bank.

“Given the current economic conditions, there will likely be slower demand for loans.

“There will no doubt be challenges to the banking sector both in terms of the current moratorium and also, once this is all over, the management of the resumption of installments post-moratorium.

“This is key to ensuring that these loans do not become non-performing. The economy will need to be on a progressive path to reduce these uncertainties,” he said.

Thor expects banks to balance between loan and deposit balances to ensure that NIMs are held up going into the second half of the year.

With the lockdowns commencing in June and the enhanced movement control order (EMCO) earlier in many parts of Selangor and Kuala Lumpur in July, AmBank Research analyst Kelvin Ong expects third-quarter earnings to be softer compared with the second and first quarter of this year.

“This is due to the anticipation of slower loan momentum while the implementation of the moratorium is likely to see banks further topping up their provision buffers (overlays),” he said.

The EMCO has been lifted in many parts of Selangor and Kuala Lumpur and is back to Phase One of the National Recovery Plan.

“We do not expect these additional overlays to be substantial in amount, unlike the front-loading of provisions seen in 2020.

“In the fourth quarter, earnings are expected to be stronger with the anticipation of gradual opening of more economic sectors after the completion of vaccinations covering a higher percentage of the population.

“Overall, we expect banks to deliver stronger earnings in 2021 compared to 2020,” Ong added.

He expects GIL ratio to be either stable or a slight uptick from the present 1.6%.

Source: https://www.thestar.com.my/business/business-news/2021/07/19/banks-in-for-higher-earnings

English

English