Indonesia’s robust growth gives central bank room to further raise interest rates

Indonesia’s economy expanded faster than expected in the third quarter, giving the central bank room to tighten policy further as consumption stayed resilient despite price pressures and higher borrowing costs.

GDP rose 5.72 percent in the three months to September from a year earlier, the statistics office said yesterday.

That is the fastest increase in more than a year and beats the median estimate of a 5.6 percent gain in a Bloomberg survey.

Exports jumped 21.64 percent from a year earlier, and gross fixed capital formation rose 4.96 percent year-on-year, while government spending shrank 2.88 percent last quarter, the office said.

Southeast Asia’s largest economy sustained its growth momentum against a backdrop of higher fuel prices that have stoked inflation to a near seven-year high and added pressure on Bank Indonesia to keep raising interest rates.

The central bank, which has raised its policy rate by 125 basis points since August last year to 4.75 percent, is scheduled to meet on Thursday next week.

“Indonesia’s accelerating growth in the third quarter defied headwinds from higher inflation,” Bloomberg Economics ASEAN economist Tamara Henderson said in a note.

“The faster-than-expected expansion gives Bank Indonesia room to continue hiking rates to shore up the rupiah, though we also expect it to continue buying bonds,” she said.

Private consumption — which accounts for more than half of domestic output — rose 5.39 percent last quarter. Middle and upper-class consumption strengthened, while spending among the lower-income segment was supported by government social aid, Statistics Indonesia general director Margo Yuwono said.

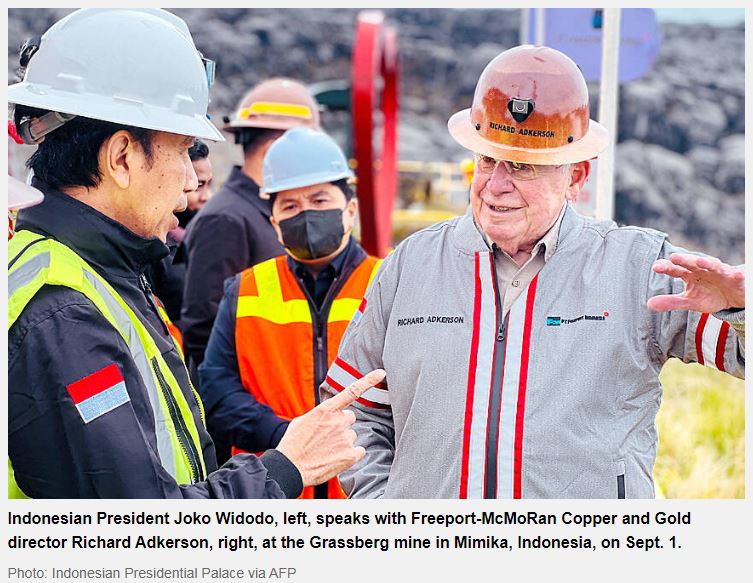

A boom in commodity exports continued to bolster the nation’s external trade, even as imports gained pace on capital goods demand to support business activities. Foreign direct investment surged to a record last quarter as the government pushed projects in nickel, copper and other resources.

A darkening outlook on the global economy and higher borrowing costs could yet weigh on Indonesia’s growth prospects. With the US Federal Reserve set on aggressive monetary tightening, the rupiah is trading near two-year lows, raising the risk of imported inflation.

The benchmark stock index extended gains after the announcement, while the local currency rose and is poised to halt five days of declines.

“A comfortable growth backdrop provides the central bank the headroom to focus on inflationary expectations and keep currency underperformance in check through further rate hikes,” DBS Bank Ltd economist Radhika Rao said.

Source: https://www.taipeitimes.com/News/biz/archives/2022/11/08/2003788472

English

English