Indonesia’s CPI Eases as Food Costs Offset Fuel Price Hike

(Bloomberg) — Indonesia’s inflation pulled back in October as gains in food prices slowed, cushioning the blow of higher pump prices.

Headline inflation rose 5.71% year-on-year, much slower than the near-6% notched in September and expected by analysts for this month. Food inflation retreated to 7.04% versus 8.69% in September, while energy costs surged 17%.

The harvest season and government market intervention helped cool the prices of eggs, poultry and chili — an essential ingredient in Indonesian cuisine. On a monthly basis, the cost fell for a third straight period in October.

“The notable drop in food-price pressures suggests headline inflation will cool off faster than we previously expected,” Barclays Plc economist Brian Tan wrote in a note. Barclays reduces its full-year inflation forecast to 4.2% for this year, from 4.3% previously.

Consumer prices in Southeast Asia’s largest economy fell 0.11% from the previous month. While the rollback in fuel subsidies pushed up monthly transport inflation to 0.35%, this was more than offset by the 1% drop in the cost of food, beverage and tobacco.

The core number, which strips out volatile and subsidized items, stood at 3.31%, also below the 3.4% market consensus.

More Hikes

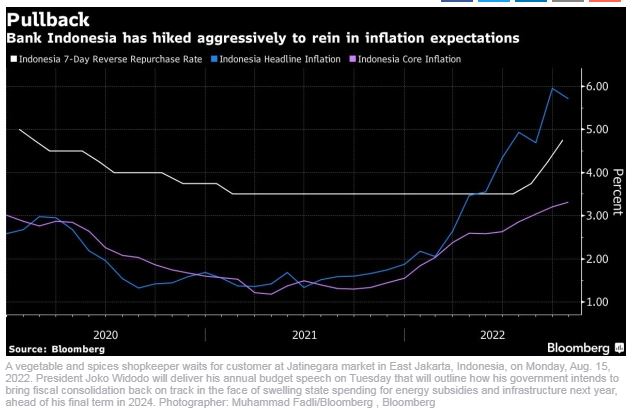

The latest data affirms Bank Indonesia’s aggressive monetary tightening, which policy makers say is necessary to anchor inflation expectations that have started “overshooting” on-ground realities.

Bank Indonesia will likely continue raising its policy rate by another 50 basis points in November, as “policymakers are more focused on inflation expectations and the US Federal Reserve and less swayed by inflation undershoots,” Tan said.

The central bank expects headline inflation to peak at 6.3% by the year-end. The core gauge is seen accelerating to 4.3% before returning within the 2%-4% target by the first half of 2023.

–With assistance from Eko Listiyorini and Norman Harsono.

English

English