Indonesia: Jokowi Supports Central Bank Mandate to Aid Indonesia’s Growth

(Bloomberg) — President Joko Widodo is backing a push to expand Bank Indonesia’s mandate to include support for the economy, throwing his public support behind a legislative move that some analysts see as risking the central bank’s independence.

Bank Indonesia shouldn’t just manage the currency, but also should support sustainable economic growth and job creation, Jokowi, as the president is known, said Wednesday in an interview in Jakarta. After a year when Indonesia struggled with its first recession in two decades, the economy is set to grow as much as 7% in the second quarter compared to a year earlier, he added.

“Of course I support Bank Indonesia to add growth and job creation to its mandate,” he said in a discussion at the presidential palace, where anti-virus measures included masks, face shields and clear screens on the table. He added: “Bank Indonesia will remain independent.”

The president’s comments will be finely parsed by global investors, who last year were shaken by a similar attempt to increase government oversight of the central bank. Any pushback could worsen pressure on the rupiah and government bonds, which in recent months have been battered by a sell-off in emerging-market assets.

Deliberations should continue on financial-sector reform to ensure a quick response by all authorities, including the central bank, during times of crisis, Jokowi said.

The discussion hasn’t reached the issue of whether there should be a supervisory board to oversee the central bank and the Financial Services Authority, known as OJK, he added.

Indonesia is not alone in reexamining the burden-sharing arrangements that arose between governments and central banks amid the pandemic. New Zealand and Brazil have told monetary authorities to expand their mandates, while Turkey fired its monetary policy chief over disagreements on the interest rate.

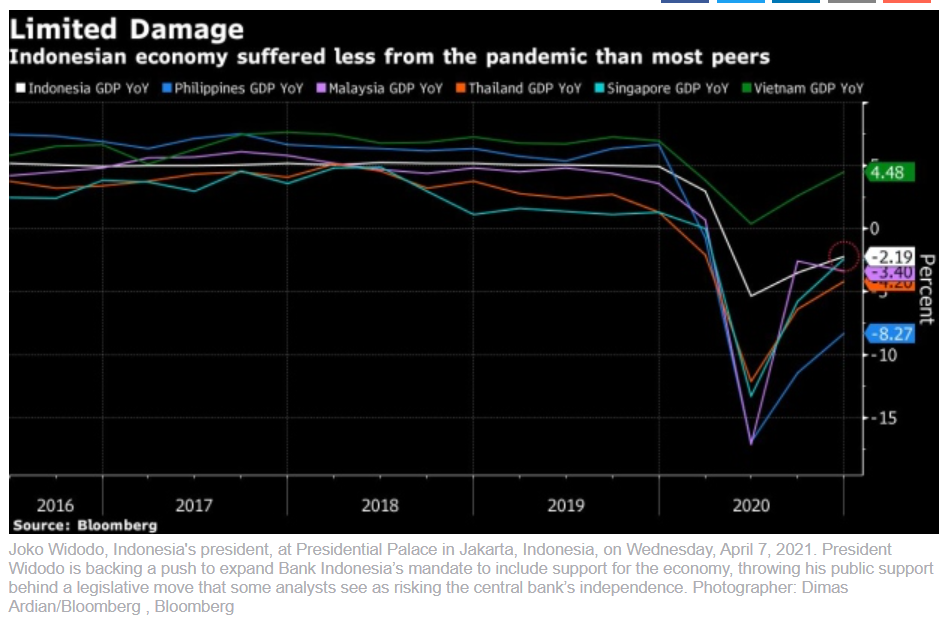

Indonesia has been able to limit the economic fallout from Southeast Asia’s worst coronavirus outbreak thanks to aggressive fiscal and monetary stimulus. Gross domestic product shrank 2.1% in 2020, Indonesia’s first annual contraction since the Asian financial crisis, but that was a shallower slump than what most countries in the region experienced.

The GDP is likely to contract 0.5% in the first three months of the year before the rebound this quarter, Jokowi said.

In addition to expanding the monetary authority’s mandate, the president is pushing for financial-sector reform that supports better coordination between Bank Indonesia, the OJK and the Deposit Insurance Agency for a faster response in times of crisis. The reform should also prepare the country to regulate the digital economy, he added.

©2021 Bloomberg L.P.

English

English