Indonesia CPI Eases as Subsidies Take Edge Off Commodities Rally

(Bloomberg) — Indonesia’s inflation came in weaker than expected in February as government subsidies helped cushion the blow of surging commodity prices on consumers.

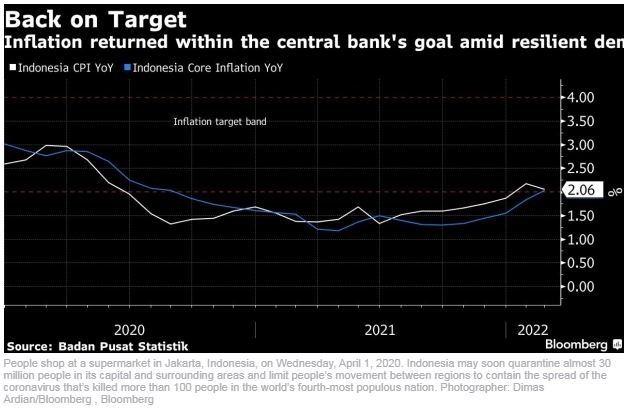

Consumer prices rose 2.06% year-on-year, below the median estimate of 2.2% in a Bloomberg survey of economists. Prices also shrank by 0.02% on a monthly basis as price caps on cooking oil and a surplus of poultry and eggs production tamed food inflation, according to the central statistics agency on Tuesday.

Core inflation, which strips out government-controlled and volatile prices, stood at 2.03% last month. It rose at its fastest pace since August 2020 and was back within the central bank’s 2%-4% target range. That means domestic demand is “relatively resilient,” despite the record spikes in Covid-19 infections and the deflationary period is temporary, according to PT Bank Danamon Indonesia economist Wisnu Wardana.

Inflation could soon start to accelerate closer to 3%, said Radhika Rao, senior economist at DBS Bank in Singapore. The government is considering raising retail gasoline prices now that oil has breached $100 a barrel to ease the burden of subsidy on the budget.

Maybank estimated that a 15%-20% increase in retail fuel prices could add as much as 1 to 1.5 percentage points to inflation, which would push the headline number above the central bank’s target range.

English

English