Experts say M’sia not a manipulator

PETALING JAYA: The surprising move by the United States to include Malaysia in its currency manipulator watch list may be a tactic to subtly force Malaysia to import more from the world’s biggest economy.

Sunway University Business School economics professor Yeah Kim Leng told StarBiz that this could be a strategy by the US to reduce its significant trade deficit with Malaysia.

Malaysia was not the only country added into the monitoring list. Four more countries were also included – Ireland, Italy, Vietnam and Singapore – joining China, Japan, South Korea and Germany.

This has raised concerns on whether the US is extending its “trade witch hunt” on its other trading partners apart from China.

However, Bank Islam chief economist Mohd Afzanizam Abdul Rashid has called for calm among Malaysians and within the investment community, considering the US Treasury’s tone on Malaysia in its recent report.

He also said that investors should not be too alarmed about the potential impact on the Malaysian financial markets, discounting the possibility of a massive capital outflow.

In order to allay fears, Bank Negara has also issued a statement on the matter, indicating that there are no consequences for the Malaysian economy from the inclusion in the monitoring list.

Based on official figures from the International Trade and Industry Ministry, the US experienced a trade deficit of RM25.79bil with Malaysia in 2018, up from RM23.41bil in 2017.

Malaysia’s exports to the US rose 2.3% to RM90.73bil last year, registering the highest value since 2008. However, the country’s imports from the US fell slightly by 0.5% to RM64.94bil.

“I see this as an indirect warning by the US for Malaysia to strengthen its ringgit and also to import more products from the US.

“The decision to put Malaysia on the watchlist is totally unjustified, as the ringgit’s movement has largely depended on the market forces. Our current account surplus is also below 3%, hence this is puzzling,” said Yeah.

The number of countries on the US watch list expanded after Treasury Secretary Steven Mnuchin lowered the threshold for qualification. Countries with a current-account surplus equivalent to 2% of gross domestic product (GDP) are now eligible for the list, down from 3%.

Other thresholds include persistent intervention in markets for a nation’s currency, and a trade surplus with the US of at least US$20bil. Countries that meet two of the three criteria are placed on the watch list.

Malaysia met two of the three criteria, namely significant bilateral trade surplus with the US and material current account surplus.

In its report to the US Congress, the Treasury stated that the monitoring list consists of “major trading partners that merit close attention to their currency practices and macroeconomic policies”.

On Malaysia, US Treasury said the country has maintained a significant bilateral goods trade surplus with the US since 2015.

It also pointed out that Malaysia’s current account surplus has narrowed substantially over the past decade on higher consumption and investment, falling to 2.1% of GDP in 2018.

US Treasury said that Bank Negara has over the last few years intervened in both directions in foreign exchange markets.

“Treasury estimates that in 2018, the central bank made net sales of foreign exchange of 3.1% of gross domestic product to resist depreciation of the ringgit.

“Malaysia’s external rebalancing in recent years is welcome, and the authorities should pursue appropriate policies to support a continuation of this trend, including by encouraging high-quality and transparent investment and ensuring sufficient social spending, which can help minimise precautionary savings,” it said in the report.

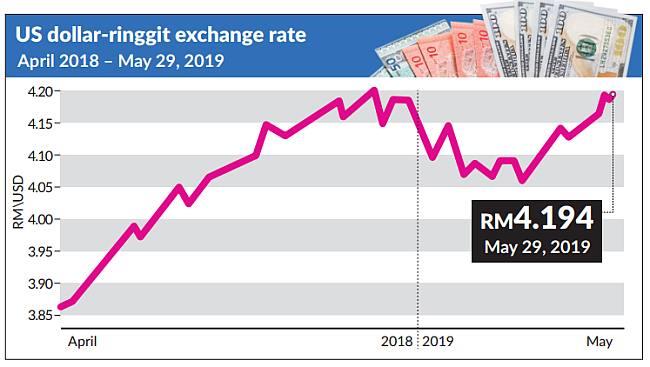

Following the news flow on Malaysia’s inclusion in the watch list, the ringgit fell to its lowest level in six months. As at press time, the ringgit has depreciated by 0.17% to 4.1940 per US dollar.

Bank Islam’s Mohd Afzanizam told StarBiz that the government is expected to continue working towards increasing high-quality investments and ensuring sufficient social spending, as recommended in the US Treasury report.

“The continuation of the infrastructure projects would result in minimal surplus current account balance. In that sense, we should not be too alarmed whether it would result in massive capital outflows.

“Malaysia’s current account surplus balance has narrowed substantially from 17.2% of GDP in 2008 to 2.1% of GDP in 2018. Therefore, the rebalancing by Bank Negara has been significant,” he said.

Mohd Afzanizam added that the ringgit is undervalued. “Therefore, it should appreciate over time,” he said.

AmBank Group chief economist Anthony Dass said Malaysia should not be labelled as a currency manipulator, as Bank Negara’s intervention in the currency markets was meant to stabilise the ringgit.

Over the past decade, he said the most common reason for Bank Negara’s intervention was because of a sharp or sudden decline in the ringgit’s value.

“Even if Malaysia is seen as a currency manipulator, the US law targeting manipulators requires them to spend a year negotiating a solution before it can retaliate. Should the US Treasury designate Malaysia as a currency manipulator under a 2015 law, it is supposed to spend a year trying to resolve the problem through negotiations.

“If those talks fail, the US can take a number of small steps in retaliation, including stopping the US Overseas Private Investment Corp, a government development agency, from financing any programme in Malaysia,” said Dass.

Bank Negara has since refuted US Treasury’ claim of Malaysia being a potential currency manipulator.

“Malaysia supports free and fair trade, and does not practise unfair currency practices. Malaysia adopts a floating exchange rate regime. The ringgit exchange rate is market-determined and is not relied upon for exports competitiveness.

“The fact that the ringgit has over the years faced multiple episodes of significant appreciation and depreciation points to the flexibility of the exchange rate.

“As a small and highly open economy, Malaysia’s current account of the balance of payments is affected by both internal and external developments, including cyclical and structural factors,” stated Bank Negara in a statement yesterday.

RHB Research Institute said in a note that Malaysia is unlikely to be named as a currency manipulator, despite the inclusion. “The impact on Malaysia and its currency should be limited,” it said.

Source: https://www.thestar.com.my/business/business-news/2019/05/30/experts-say-msia-not-a-manipulator/#PJzPaGVvcJjD0PSv.99

English

English