Cambodia: Outstanding loans not at worrisome level: ABC

The Credit Bureau of Cambodia (CBC) released its Credit Consumer Index for the first quarter among economic uncertainty stemming from lockdowns, loan restructuring and disruption in the manufacturing sector.

The report showed that “debt past due” (DPD) over 30 days increased by 2.24 percent across the board while total loan balances grew by 6.44 percent quarter-over-quarter.

According to the Association of Banks in Cambodia (ABC), banks and microfinance institutions receive between 400,000 and 500,000 loan applications each month. Of these, about 50 percent are approved with financial houses opening approximately 200,000 new loan accounts a month.

“The ratio of approvals and applications has been very stable over the last year,” Heng Koy, general manager for the ABC, told Khmer Times. “While the DPD has definitely increased, a 25 percent increase is not near a worrisome level. Total DPD is still less than 2 percent for the whole sector.”

A total of 1.4 percent of all DPDs were in the mortgage sector, the least among all loans. It was followed by personal finance (3.14 percent) and credit cards (4.36 percent).

Koy said that several construction projects had been “paused” and the number of real estate units entering the market was “significantly down” as people temporarily left urban areas during the pandemic’s second wave.

“Nonetheless, we believe that this is only a temporary dip in homebuilding and the market will return to pre-COVID levels once the economy picks up again and borders fully re-open,” argued Koy. “Given the current efforts by the government to ensure vaccination for all Cambodians, which has resulted in Cambodia being the second-most vaccinated country just after Singapore in ASEAN, we are very optimistic that, in 2022, the economy will be fully running again and people will flow to urban areas once more. It will result in a drastic jump in housing demand as well as supply.”

The coastal region, encompassing Kampot Koh Kong, Kep and Preah Sihanoukville provinces saw a 46 percent increase in loan applications, making it the fastest-growing area for DPD.

The plateau provinces of Preah Vihear, Steung Treng, Mondulkiri and Ratanakiri saw a 30 percent increase, making that region the second-most popular for mortgage applications.

“DPD in mortgages has seen similar increases to other loan segments. The current pandemic and the resulting economic crisis has impacted all sectors to a similar extent and the housing market has not been hit worse than other sectors,” said Koy.

Cambodian coastal provinces saw the second-largest increase in loan balances, with an 8.4 percent rise over the same period last year.

The plateau areas witnessed the highest loan balances with a 9.9 percent increase.

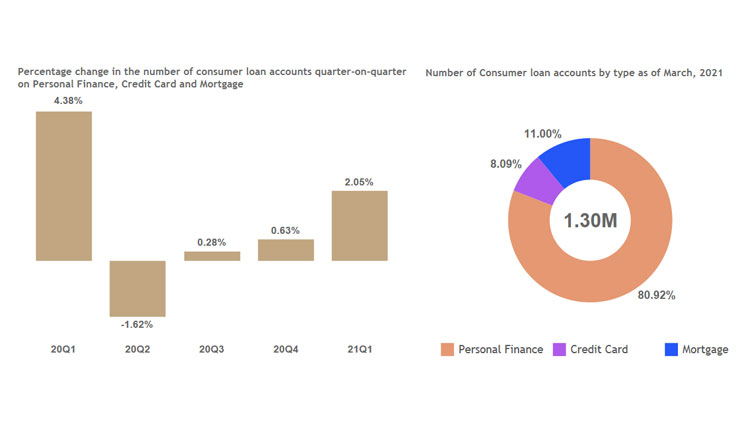

Personal finance remains by far and away the most popular loan product, accounting for 80.92 percent of borrowing products. Mortgages came in second at 11 percent. However, 51.72 percent of loan balances were carried by mortgages.

The overall value of mortgages is valued at some $5.373 billion, with the holder owing on average $37,578. Approximately 1.051 million people hold personal finance loans with individuals owing on average $4,709. Credit card debt, which saw the highest DPD at 4.36 percent and a 30 percent reduction in applications, was the smallest loan portfolio, with approximately 115,700 people owing about $539 on average.

More than 61 percent of all account holders held in excess of one loan account, according to the CBC. The total number of consumer credit applications increased by 11 percent quarter-over-quarter this year.

Source: https://www.khmertimeskh.com/50855062/outstanding-loans-not-at-worrisome-level-abc/

English

English