Belt and Road shields Myanmar from Beijing’s capital crackdown

BEIJING’S recent crackdown on outbound investments does not affect Myanmar because of its involvement in the Belt and Road Initiative (BRI). The sectors targeted by the restriction do not concern investment projects here, which are mostly infrastructure and energy-related.

The Chinese government is blacklisting businesses which violate foreign investment rules as part of a broader crackdown on “irrational and unauthentic” overseas acquisitions, stated China’s state-run China Daily on September 14.

In recent months, the Chinese government has stroke against highly acquisitive private enterprises and has criticised some of the most renowned companies which acquired massive foreign assets.

The Financial Times argued on August 9 that the crackdown on overseas investments has resulted in uncertainty in private sectors as to what M&A activities are permitted.

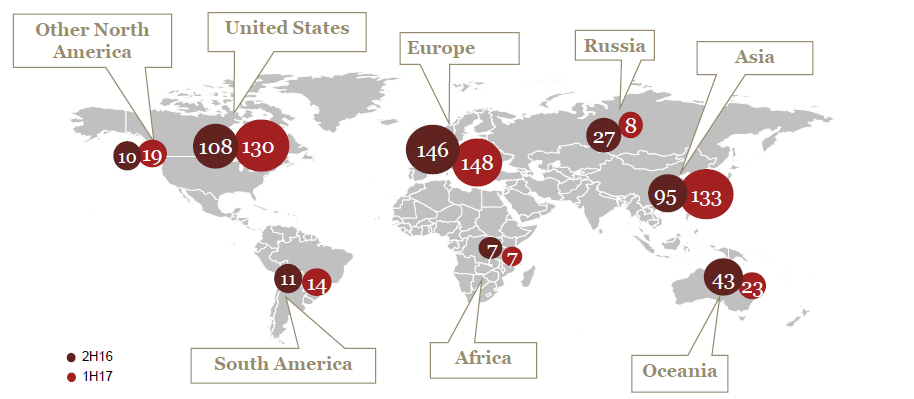

Outbound M&A deal volume by region of destination 1H17 versus 2H16. Asia saw the biggest increase in deals. Photo: PwC China and Thomson Reuters

Chinese M&A leaders – conglomerate HNA Group, real estate and entertainment giant Dalian Wanda, insurance leader Anbang and consumer conglomerate Fosun – have been targeted by “well-placed leaks and state media innuendo”, according to the FT. Anbang’s chair Wu Xiaohui has been detained by the authority since June.

Data from Dealogic suggested that HNA Group, Dalian Wanda and Anbang were among the top six overseas buyers. The three giants, together with Fosun, accounted for almost a fifth of China’s overseas purchases in 2016.

The Myanmar Times has not found direct involvement of the four companies in any large-scale investments in Myanmar.

No impact on Myanmar

Experts told The Myanmar Times that Beijing’s crackdown on acquisitive conglomerates to restrict capital outflows does not target Belt and Road projects and is not expected to affect investments in Myanmar. In contrast, M&A activities linked to President Xi Jinping’s signature foreign policy are surging.

Jovi Seet, senior executive director of mergers and acquisitions at PwC Myanmar, said that China’s interest in the country has not dampened.

… the capital restriction can turn out to be a positive thing for Myanmar, as it potentially directs more attention and financial discipline into the much-needed infrastructure sectors …

– Jovi Seet, PwC Myanmar

“Chinese authorities have formally laid down new rules on overseas investments, making explicit its restriction on ‘irrational’ acquisition of assets in certain sectors. China’s capital control on outbound investments is primarily targeted at sectors such as real estate, entertainment and sports,” Mr Seet noted.

The BRI focuses on strategic infrastructure projects to bridge the infrastructure gaps and stimulate economic growth in countries involved in the scheme, according to the PwC director.

“We are beginning to see a gradual increase in China outbound activities in recent months. It has been reported that the value of Chinese overseas M&A deals jumped in the third quarter following several large transactions and many of the deals tied to the BRI.

“I am hoping that the capital restriction can turn out to be a positive thing for Myanmar, as it potentially directs more attention and financial discipline into the much-needed infrastructure sectors in Myanmar,” he added.

Hilary Lau, a corporate and commercial lawyer and partner at the law firm Herbert Smith Freehills echoed a similar view: the restrictions on overseas investments are meant to limit only certain industries such as hospitality and entertainment.

“Energy and infrastructure transaction are still encouraged by the Chinese government. Belt and Road projects are also encouraged by the government and are policy-driven. Hence, I don’t think the crackdown will have much impact on Belt and Road transactions or projects,” Mr Lau explained. Resorts, hospitality and entertainment sectors may “slow a bit” but other areas which are encouraged will continue to go ahead.

The Belt and Road countries should continue to be hot areas for investment because Chinese government is clearly pushing forward BRI investments.

– Hilary Lau, Herbert Smith Freehills

Some countries will be more affected than others, depending on the sectors in which Chinese investments have been targeted. For those affected, PwC observed that M&A transactions have already slowed and Chinese investors have become “more cautious and less bullish”. Investors are now looking to China’s 19th Party Congress this month for the government’s policy regarding outbound investment.

Thomson Reuters data revealed that Chinese acquisitions in the 68 countries officially linked to the BRI totalled US$33 billion as of August 14, surpassing the $31 billion tally for all of 2016. Asia saw the biggest increase in deals out of all the regions, with an overall number of M&A the second highest, after Europe.

Source: https://www.mmtimes.com/news/belt-and-road-shields-myanmar-beijings-capital-crackdown.html

English

English