Asian markets gain, China growth 28-year low

Asian markets on Monday built on last week’s rally as investors cheered a report that China had offered to eliminate its massive trade surplus with the US, while data showed Chinese economic growth hit forecasts last year.

Regional equities picked up where they finished on Friday after Bloomberg said Beijing had pledged to ramp up spending on US goods over the next five years.

While there was some scepticism over the offer, observers said it indicated that talks between the economic superpowers were heading in the right direction.

The news provided further support to shares, which were already being buoyed by hopes the two sides would be able to resolve the tariffs spat, which has hammered world markets for almost a year.

China’s top economics negotiator is due to visit Washington later this month for more talks as the end of a 90-day truce agreed between US President Donald Trump and Chinese President Xi Jinping draws closer.

“For now markets are going ahead with the growing perception that there is a lot of willingness by both parties to make a deal,” said National Australia Bank senior strategist Rodrigo Catril.

“But as the March 1st deadline approaches, the market is also likely to demand more concrete evidence that a deal looks more likely than not.”

May’s Plan B

Shanghai closed 0.6 per cent higher and Hong Kong rose 0.4 per cent in the afternoon, while Tokyo ended 0.3 per cent stronger.

Sydney rose 0.2 per cent, Singapore added 0.4 per cent and Taipei put on 0.5 per cent with Wellington and Jakarta also up.

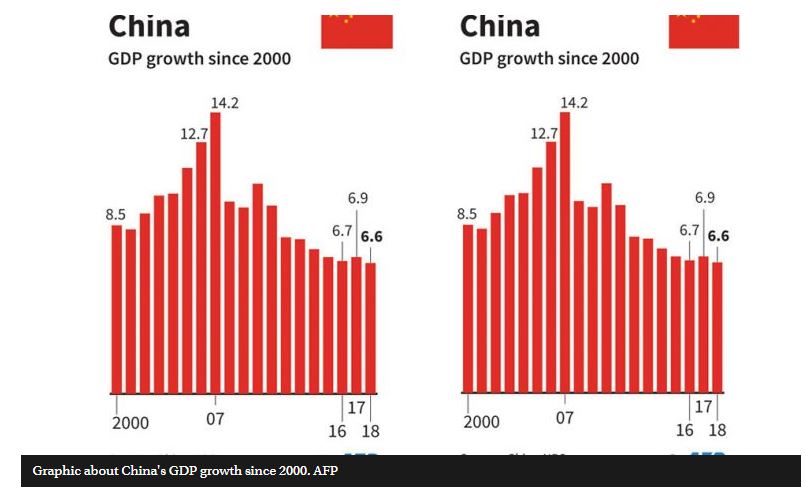

China released figures showing the economy expanded at the 6.6 per cent clip expected in an AFP survey, but that represented its slowest pace since 1990, when it was hit by outrage over the June 4 Tiananmen Square crackdown a year earlier.

And in a sign of the battle Beijing faces in getting things back on track, October-December growth came in at 6.4 per cent, the worst quarterly figure since the global financial crisis 10 years ago.

The data come as China struggles to address a chronic debt burden while at the same time fighting the damaging trade war with the US.

It also reinforces the need for officials to press on with stimulus measures, such as the tax cuts announced last week and moves to make it easier for banks to lend.

“While the government is putting policy responses in place, we anticipate that these will need to be ramped up over the course of the year,” Stephen Chang, portfolio manager for Asia at Pacific Investment Management, said in a note.

Next on traders’ radar is British Prime Minister Theresa May’s revised plan for exiting the EU, with her original proposal left in tatters after being roundly rejected by MPs last week.

Britain will leave the EU on March 29 without a deal unless MPs can force a delay or get their act together in time and come up with an alternative plan that Brussels is also happy with.

Despite the uncertainty, the pound was holding up against the dollar in Asian trade.

Source: https://www.phnompenhpost.com/business/asian-markets-gain-china-growth-28-year-low

English

English