Vietnam: Non-cash payments to change status of digital economy

From Q1 2021 to Q1 2022, the number of online transactions in Vietnam increased twofold, and transaction value increased by three times. These are important factors that help develop the digital economy.

Lai Viet Anh, deputy head of the E-commerce and Digital Economy Agency under MOIT, said that while many business fields faced difficulties because of the Covid-19 pandemic, non-cash payments still witnessed a two-digit growth rate.

In the first four months of 2022, non-cash payments increased in both quantity (69 percent) and value (27.5 percent), maintaining growth during the pandemic.

Anh believes there is still much space for cashless payments. In Vietnam, the number of clients using COD (cash on delivery) in e-commerce remains high, at 71 percent.

Among cashless payment methods, transferring via bank accounts prevails, while payments via e-wallets and intermediary service providers remain low, which means more room for them to develop services.

Nguyen Ba Diep, founder of MoMo e-wallet, said users are not only using apps for payments, but also for entertainment. That is why MoMo has developed new features or games to attract more customers.

In addition to promoting non-cash payments, e-wallets also act as a digital transformation service provider to petty merchants and businesses.

MoMo is running a mini app model which allows partners to embed their apps on MoMo’s app.

After three months of using the model for 7Eleven, the number of transactions has increased by five times. Just within three months, 90,000 users registered for membership, and 90 percent of them were new customers brought by the app.

The transactions by new users have helped increase revenue by 50 percent.

Dang Thi Huong Giang from NAPAS (National Payment Services), said that 66 percent of Vietnamese adults have bank accounts. As of the end of 2021, 120 million bank cards had been issued in Vietnam, and 1.3 million cards had been opened under the eKYC mode. Vietnam now has 40 licensed intermediary payment service providers with 20 million e-wallet accounts.

Non-cash payments have witnessed impressive growth. The inter-bank electronic payment system in Q4 2021 increased by 32 percent in transaction value compared with the same period in the previous year.

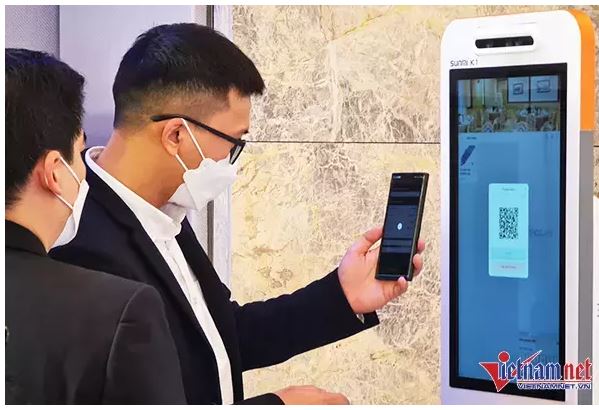

Payments on the internet increased by 48.4 percent in the number of transactions and 32.7 percent in value. Meanwhile, mobile payments saw the highest growth rate (97.7 percent in number of transactions and 86.7 percent in value) and the number of transactions with QR codes by 56.6 percent.

Manh Ha

Source: https://vietnamnet.vn/en/non-cash-payments-to-change-status-of-digital-economy-2043121.html

English

English