Thailand: Which new habits could last a lifetime?

‘Prediction is very difficult, especially about the future,” quipped Niels Bohr, the Nobel Prize-winning physicist. It’s a statement that certainly applies to anyone making forecasts, and particularly investors at this time.

Stock markets will continue to be buffeted by pandemic-related news. Successful investing in consumer stocks over the next couple of years, however, will depend on developing a vision of post-pandemic consumption patterns with the help of a clear framework.

Where lifestyle changes are permanent, extrapolating the trends of the past year could well be fruitful. On the flipside, riding a “reversion to the mean” might be the right investment approach for those businesses poised to rebound, once Covid restrictions are eased and where old behaviours could return.

And, of course, avoiding those stocks where the market is wrongly assuming that lockdown dynamics extend long into the future will be crucial.

Here are some observations to help navigate the likely dramatic swings in the public health outlook, and within the stock market, that we may experience over the next few months.

No “clean break”: Markets embraced the Pfizer/BioNTech vaccine efficacy announcement last November, with sectors and companies that had suffered most from lockdowns performing particularly well. However, it has subsequently become clear that there will be no clean break from the pandemic, no single moment when we declare victory.

New variants that reduce vaccine effectiveness are the clearest obstacle, but there are also issues of vaccine rollout logistics and the duration of immune response.

It is also difficult to imagine a rapid reintegration of travel between countries where Covid-19 has been heavily suppressed and those that are on a path to herd immunity.

Hence the scenario is of a gradual relaxation of restrictions, with occasional setbacks and significant variations between countries.

Short-term price movements may be misleading: Consumer spending patterns may be quite erratic in the evolving environment. In particular there is likely to be significant pent-up demand for all types of experiences when restrictions are eased.

A surge in travel in the summer of 2021 seems highly probable in countries where vaccine rollouts have reduced the public health risk. This surge in demand will meet reduced capacity and could drive significant price increases for flights and hotel rooms.

A leg-up in spending on experiences could crowd out spending in other areas; therefore, the summer months may give a false impression of consumption patterns post-pandemic. High savings rates in countries like the US suggest there is more money to go around overall, but there may still be some misleading short-term movements.

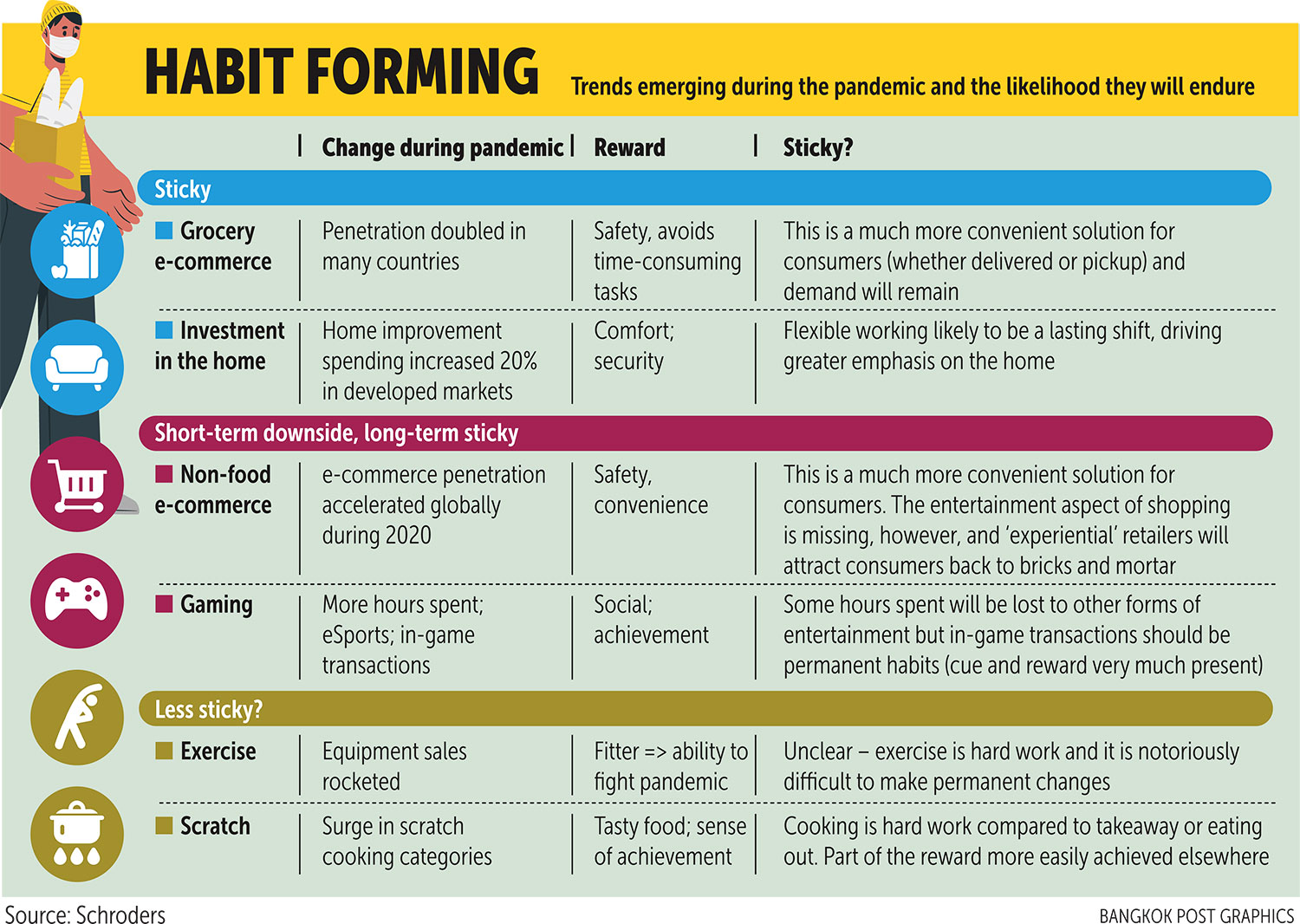

HABIT FORMATION

Investors need a clear vision of the long-term direction of spending patterns. That means understanding the factors that drive habit formation.

The academic literature suggests it can take up to 254 days to form a habit (“How are Habits Formed: Modelling habit formation in the real world”, European Journal of Social Psychology, October 2010). Since most consumers have now been dealing with pandemic-related restrictions for at least that long, one might conclude that our new routines are here to stay.

However, there is more to habit than purely repetition over an extended period of time. Behavioural experts also talk about a “habit loop”, which has three components: “contextual cue”, the behaviour itself, and the reward.

As the public health situation normalises, key parts of the habit loop will be broken: some of the cues forced by the pandemic (home schooling, etc) will be absent. And, importantly, the reward may be more easily achieved via pre-pandemic behaviours.

Much has been written about how the pandemic has accelerated digitisation trends including e-commerce, video conferencing and connected gaming. Other notable changes include increased interest in health and wellbeing, scratch cooking, and investment in the home.

Using the habit framework outlined above, the changes that are most likely to be “sticky” are the ones that bring a reward that can’t easily be replicated once restrictions are eased.

If investors can correctly anticipate what happens to post-pandemic behaviour, it will allow them to build “positive growth gaps” in their forecasts for companies benefiting from these trends. They’ll also be able to avoid ones where the market is wrongly extrapolating ephemeral changes.

It is these positive growth gaps that drive share price outperformance. If a company achieves results that are superior to those expected by consensus and those priced in by the market, then its share price is likely to outperform.

The impact of these trends on revenues is obvious. The biggest rewards, however, will come from identifying companies that have been able to change the way they do business with a potential lasting positive impact on profitability and returns.

A great example is in sneakers and athletic apparel. Brand owners have historically distributed their products through bricks-and-mortar retailers.

These legacy retailers have taken a significant amount of the profits and yet, in many cases, failed to effectively merchandise the product.

For years the brand owners have been building their own stores and e-commerce sites, and developed elaborate app ecosystems to attract customers from the legacy retailers. While they had made steady progress, it was expensive and held back profitability.

With Covid, many customers found their own way to the brand owners’ websites and apps. With the shift to e-commerce platforms likely to be permanent, we expect to see a step change in profitability and returns.

Sales of running and workout gear may decelerate in 2021 compared to 2020. This, however, is less relevant than the change in the way these companies are now able to do business.

GROCERY SHIFT

On the flip side, the increased penetration of grocery e-commerce is a headache for traditional food retailers. They see no business model that is superior to having a customer drive to the store, pick their own goods, check them out and drive them home.

Any change to this model adds labour and costs them money in a very low-margin business. This is why many had dragged their feet on making e-commerce widely available prior to the pandemic.

Unfortunately for them, it will be impossible to put the toothpaste back in the tube (so to speak). While some consumers will always prefer to pick their own food (particularly fresh food), the convenience of e-commerce will prove to be a more important reward for most.

Grocers are scrambling to automate as much of the picking process as possible, but this requires capital expenditure and has a long lead time. They are also trying to take the delivery cost out of the equation by incentivising “click and collect”, but this will not be the preference of many consumers.

The laws of economics suggest that eventually the incumbents will be able to charge enough to make reasonable returns on e-commerce, but eventually is a long time and in the meantime, profitability will be under pressure.

Investors will need to develop a framework to judge how enduring the lifestyle changes seen during the pandemic will be. Then, through modelling their long-term impact on company fundamentals — to identify positive growth gaps — they should make good investments.

Source: https://www.bangkokpost.com/business/2118743/which-new-habits-could-last-a-lifetime-

English

English