Thailand – Tris: Neutral outlook for estates based on accelerating FDI

Thailand’s industrial estate sector has a neutral outlook based on prospects of growing inflows of foreign direct investment (FDI) into Asean economies and the progress of the Eastern Economic Corridor (EEC) project, says Tris Rating.

FDI inflows are projected to resume in the post-Covid-19 era, supported by the region’s relatively strong competitiveness, said Tris. Asean economies are young and have a large labour force and a well-established supply chain of East Asian multinational companies, said Tris.

In 2019, net FDI inflows into Asean economies registered US$175 billion, some 10% of total global FDI, according to Tris. The amount increased almost twofold from $108 billion in 2010, with a 6.5% average annual growth.

The emergence of potential economies, namely Cambodia, Laos, Myanmar and Vietnam, coupled with the growing hegemonic power of Beijing, have brought Chinese capital into the region.

“We expect the geopolitical situation between the US and China to add more investment opportunities to the region,” said Tris.

The enactment of the EEC Act of 2018 has also increased land sales. The US-China trade war provides a tailwind to support land demand, said Tris.

For example, Great Wall Motor Company Ltd, a key Chinese auto manufacturer, together with tyre suppliers, recently relocated to Thailand.

The EEC spans three eastern provinces — Chachoengsao, Chon Buri and Rayong — covering 8.1 million rai.

But land sales have fallen sharply in 2020 with the pandemic leading to travel restrictions, disrupting industrial land sale operations.

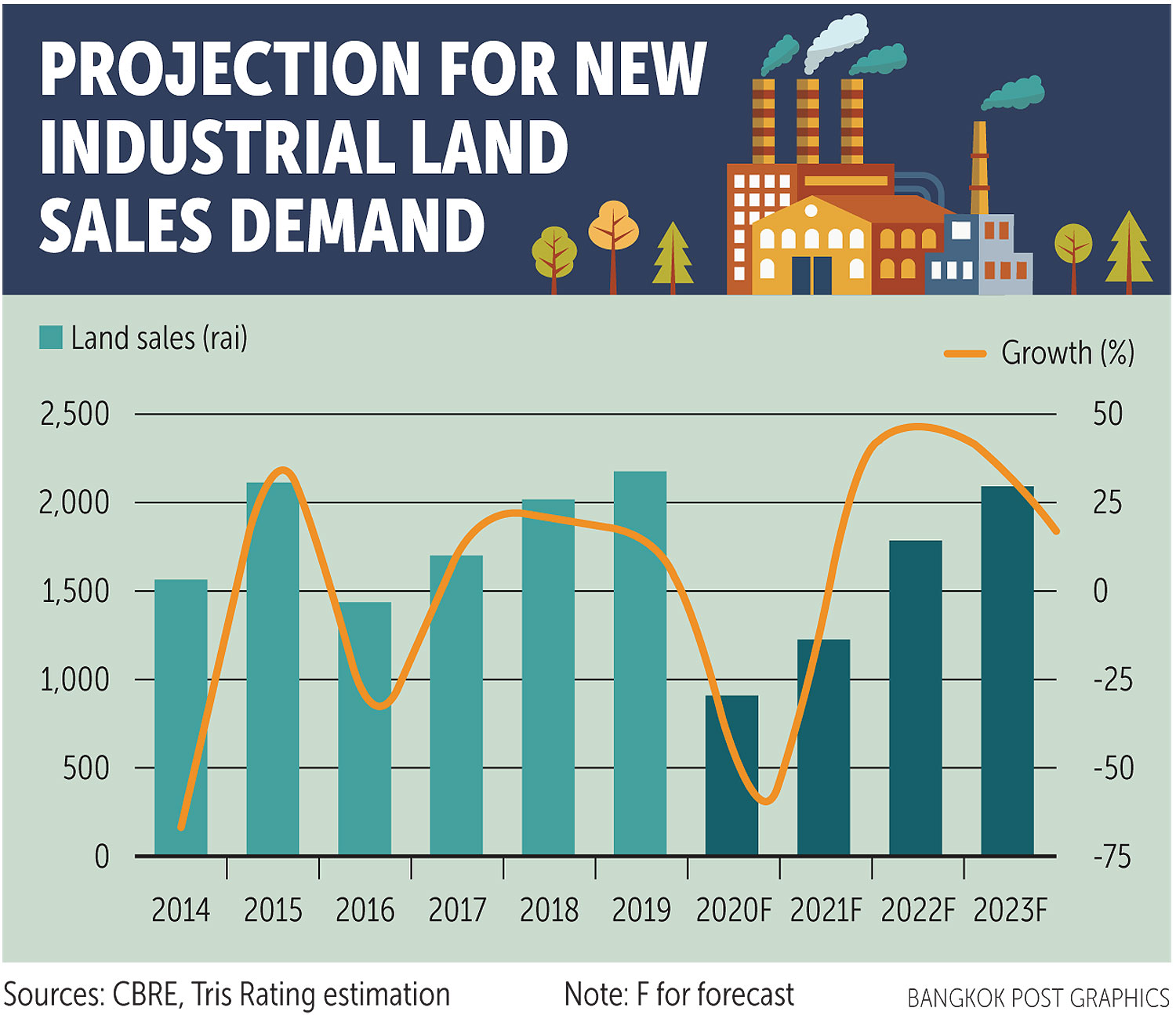

“In our base case, we project industrial land sales at 900 rai in 2020, a drop of 60% from 2019 due to travel restrictions and the economic collapse caused by the pandemic,” said Tris. “We foresee the impact of Covid-19 as being short term because of the relatively strong economic fundamentals of Asean and Thailand. However, the speed of economic recovery depends on how the pandemic is contained, as this is crucial for global demand recovery.”

For the past six years, the industrial property occupancy rate (OR) has been hovering under 80%. The OR dropped significantly from 97.9% in 2012 to 79.4% in 2014 and has since remained flat, according to Tris.

This sharp drop was caused by the economic slowdown subduing demand, while land supply growth accelerated during this period, said Tris.

However, land supply continued to grow faster, with OR in 2019 registered at 77.6%.

“We envisage this trend to continue into the post-pandemic era. We do not expect a strong recovery in 2021, and forecast land sales at 1,250 rai,” said Tris. “We expect this to clearly pick up during 2022-2023, when we forecast around 1,800-2,100 rai of industrial land to be sold. The progress of key infrastructure in the EEC will be an additional support factor in boosting land sale demand.”

FLAGSHIP PROJECT

The success of the EEC in promoting R&D and the high-tech industry will support industrial development and elevate the country’s structural competitiveness in the medium term, said Tris.

The EEC is a flagship project for the Thailand 4.0 strategy, meant to improve technology and innovation development.

The share of high-technology export value has been under 25% since 2011, while expenditure on R&D reached 1% of GDP in 2018, according to Tris.

“The level of R&D is fairly low compared with countries that industrialised during the same period as Thailand, including Singapore, South Korea and Malaysia,” said Tris. “The completion of key infrastructure and sustainable, well-managed water resources will help boost investor confidence and encourage further investment from high-tech multinationals relocating to the EEC.”

Through a financing strategy of public-private partnership, key infrastructure is expected to be operating by 2025, including a high-speed rail linking Suvarnabhumi, Don Mueang and U-tapao airports, a renovation of U-tapao airport, Map Ta Put industrial port phase 3 and Laem Chabang port phase 3.

The high-speed rail linking three airports and the renovation of U-tapao airport are regarded as enhancing connectivity and urbanisation, while the development of Map Ta Put and Laem Chabang will improve industrial port capability, said Tris.

“Another key success for the EEC in our view is well-managed water resources,” said the rating agency.

Water resource scarcity has long been a risk in eastern Thailand. Rising water demand not only comes from industrial activities, but also from agricultural activities and increasing urbanisation in the three EEC provinces.

Total water demand for these provinces is expected to account for more than half of the whole eastern region, according to the Office of Natural Water Resources’ demand projection for the next 20 years.

“Water resource scarcity can affect manufacturing operations and lead to political tensions among stakeholders,” said Tris. “Together with the volatile impact of the drought season, water resource scarcity is a challenge and an opportunity for the Thai government and industrial estate developers.”

Source: https://www.bangkokpost.com/business/2035555/tris-neutral-outlook-for-estates-based-on-accelerating-fdi

English

English