Thailand: Stimulus splurge feeds equity investor optimism

Recap: Stock markets ended the week with upbeat momentum as investor sentiment was lifted by hopes that the coronavirus pandemic is peaking, and by stimulus efforts of governments across the globe.

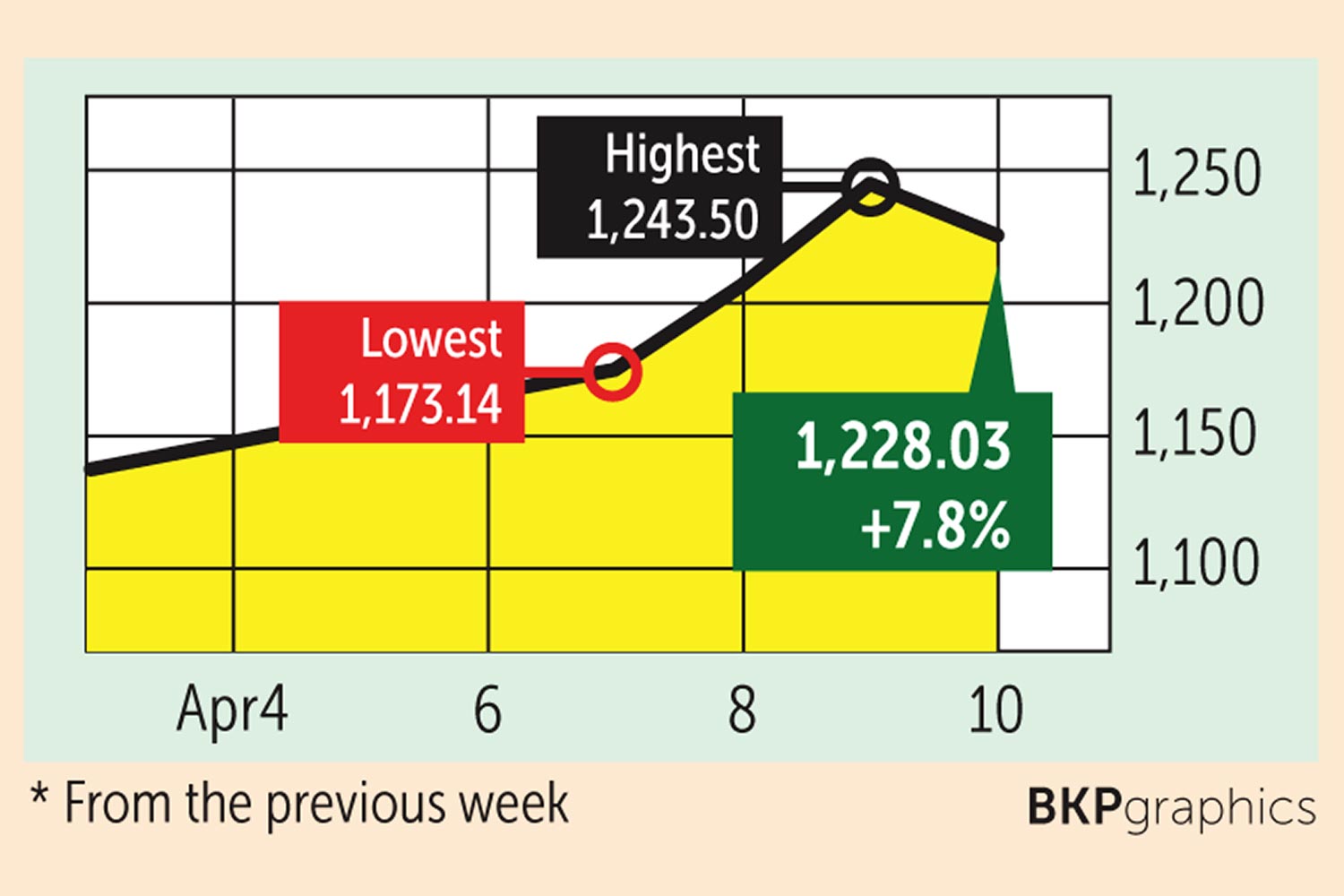

The SET index moved in a range of 1,173.14 and 1,243.50 points this week before closing yesterday at 1,228.03, up 7.8% from the previous week, in turnover averaging 82.31 billion baht a day.

Retail investors were net buyers of 5.9 billion baht, brokerage firms bought 3 billion and institutional investors bought 2.77 billion worth of shares. Foreign investors were net sellers of 11.7 billion baht.

Newsmakers: In its most dramatic move yet, the US Federal Reserve announced a $2.3-trillion assistance programme for local governments and businesses affected by the coronavirus pandemic. It said it would work with banks to offer 4-year loans to companies of up to 10,000 employees and directly buy the bonds of states, counties and cities nationwide.

- Global trade could plummet by a third this year due to the pandemic, the World Trade Organization said, warning the deepest recession “of our lifetimes” could be on the horizon.

- Thousands of relieved citizens streamed out of Wuhan on Wednesday after authorities lifted months of lockdown at the coronavirus epicentre, offering some hope to the world despite record deaths in Europe and the US.

- US Senator Bernie Sanders suspended his presidential campaign on Wednesday, clearing the way for rival Joe Biden to win the Democratic nomination and challenge incumbent President Donald Trump in November.

- British Prime Minister Boris Johnson is out of intensive care and responding well to treatment for Covid-19, doctors said.

- Japanese Prime Minister Shinzo Abe on Tuesday declared a state of emergency for Tokyo, Osaka and five other prefectures to curb the spread of Covid-19, after an alarming rise in cases in urban areas.

- Taiwan demanded an apology from the World Health Organization chief after he accused the island’s government of leading personal attacks against him. The WHO has been accused of ignoring potentially valuable medical advice from non-member Taiwan for fear of upsetting China.

- Boeing is suspending production of its 787 Dreamliner aircraft “until further notice” due to the impact of the pandemic on workers and suppliers.

- The office-sharing giant WeWork is suing SoftBank, claiming the Japanese tech investment group breached its contractual obligations by backing out of a $3-billion rescue plan for the company after the collapse of its IPO.

- Samsung Electronics expects higher first-quarter profits as millions of people working from home in lockdowns turn to cloud data services, pushing up demand for its chips.

- Malaysia yesterday extended movement and travel restrictions for another two weeks, until April 28, as it tries to contain an outbreak that has left it with the most infections in Southeast Asia at more than 4,200.

- Chinese inflation in March was 4.3% year-on-year, its slowest pace since last October, falling from 8-year highs due to a drop in food and oil prices as the country gradually lifts virus lockdowns.

- The ban on all commercial flights into Thailand has been extended to April 18, as the government ramps up efforts to prevent clusters of Covid-19 infections among travellers from abroad.

- The Joint Standing Committee on Commerce, Industry and Banking predicts that 7 million workers will be out of jobs by June because of shutdowns from the pandemic.

- The Tourism and Sports Ministry said first-quarter tourism revenue fell nearly 40% of 222 billion baht from a year earlier to 335 billion baht.

- The cabinet on Tuesday approved 1.9 trillion baht in borrowing to help people and businesses including the extension of 5,000-baht monthly handouts to as long as six months. Low-interest loans and a six-month debt moratorium for SMEs are also part of the package.

- The country’s six largest commercial banks have passed on cost savings after the Bank of Thailand lowered their required contribution to the Financial Institutions Development Fund, trimming prime lending rates by 40 basis points.

- More than 140,000 employees lost their jobs last month due to the fallout from the Covid-19 pandemic, according to the Department of Employment.

- Consumer prices could contract by up to 1% this year as the escalating spread of Covid-19 has weakened overall domestic demand, forecasters say.

- Exports risk shrinking by up to 8% this year as the pandemic ravages global supply chains and economies, says an exporters’ group.

- The net asset value of mutual funds managed by local asset management firms declined of 824.6 billion baht in the first quarter, with TMBAM Eastspring registering the biggest loss of 272.3 billion baht, says the Association of Investment Management Companies.

- The Covid-19 pandemic will hit demand, supply and prices of condos in Phuket as 90% of buyers are foreigners from heavily affected countries: China, Hong Kong and Singapore, says the property consultant Knight Frank Phuket Co.

- The government is being advised to waive the daily minimum wage requirement for six months to help entrepreneurs maintain employment during the pandemic.

- Even as the pandemic escalated locally, Thailand’s fast-moving consumer goods (FMCG) industry worth 800-900 billion baht grew in the first two months of this year, says Nielsen Thailand.

- Grab Thailand has scrapped an app usage fee it started imposing last Tuesday on parcel delivery service (GrabExpress) and on-demand purchases and delivery service (GrabAssistant) after criticism online.

- Despite global oil prices dropping considerably over the past month to nearly US$20 per barrel, PTT Exploration and Production (PTTEP) can survive the downturn because of low production costs and high liquidity, says chief executive Phongsthorn Thavisin.

Coming up: Australia will release March business confidence on Tuesday. The Bank of Canada will announce its interest rate decision on Wednesday, Australia will release April consumer confidence and the US will release March retail sales.

- On Friday, all eyes will be on China’s first-quarter GDP data, while the Reserve Bank of India will release its monetary policy meeting minutes.

Stocks to watch: SCB Securities recommends defensive and fundamental stocks offering high dividend yields, such as DIF, for which it forecasts an 8.5% rise in 2020 net profit to 11.3 billion baht. Other good stocks with share prices lower than fair value include AMATA, PTTGC, SCC and WHAUP.

Among global stocks, international analysts recommend Samsung Electronics as the boom in remote working technology demand is spurring demand for its chips.

DBS Vickers Securities Thailand recommends accumulating stocks with good fundamentals. Suggested picks are BJC, CPALL, DIF and GPSC. For dividend stocks, it recommends KKP, TISCO, LH, TPRIME, LALIN, AIMIRT, WHART, DIF and JASIF.

Technical view: Maybank Kim Eng Securities Thailand sees support at 1,187 points and resistance at 1,260. Finansia Syrus Securities sees support at 1,180 and resistance at 1,250.

Source: https://www.bangkokpost.com/business/1897675/stimulus-splurge-feeds-equity-investor-optimism

English

English