Thailand: Recovery still stalled

We have significantly reduced our outlook for Thailand’s economic growth given the surge in Covid-19 cases in the third quarter and subsequent disruption to activity.

The country has been facing its worst outbreak since the onset of the pandemic, with cases surging to over 20,000 a day in August, far above previous outbreaks and reflected in surging deaths. Authorities have imposed strict measures to curb the spread, which could be extended past the end of August, given the continued upward climb of daily cases and the country’s low vaccination rate (only 7.5% of the population is fully vaccinated as of Aug 16).

The initial use of vaccines, such as Sinovac, which has proved less effective against the Delta variant spreading in Thailand, may mean that vaccination rates will have to rise even higher to reach herd immunity.

All this will stall the modest economic recovery, which had slightly surprised to the upside in the second quarter. As such, we have lowered our real GDP growth forecast for the full year to 1.9%, from 3.0% earlier. Elevated downside risks persist given the challenges authorities have faced curtailing the latest outbreak.

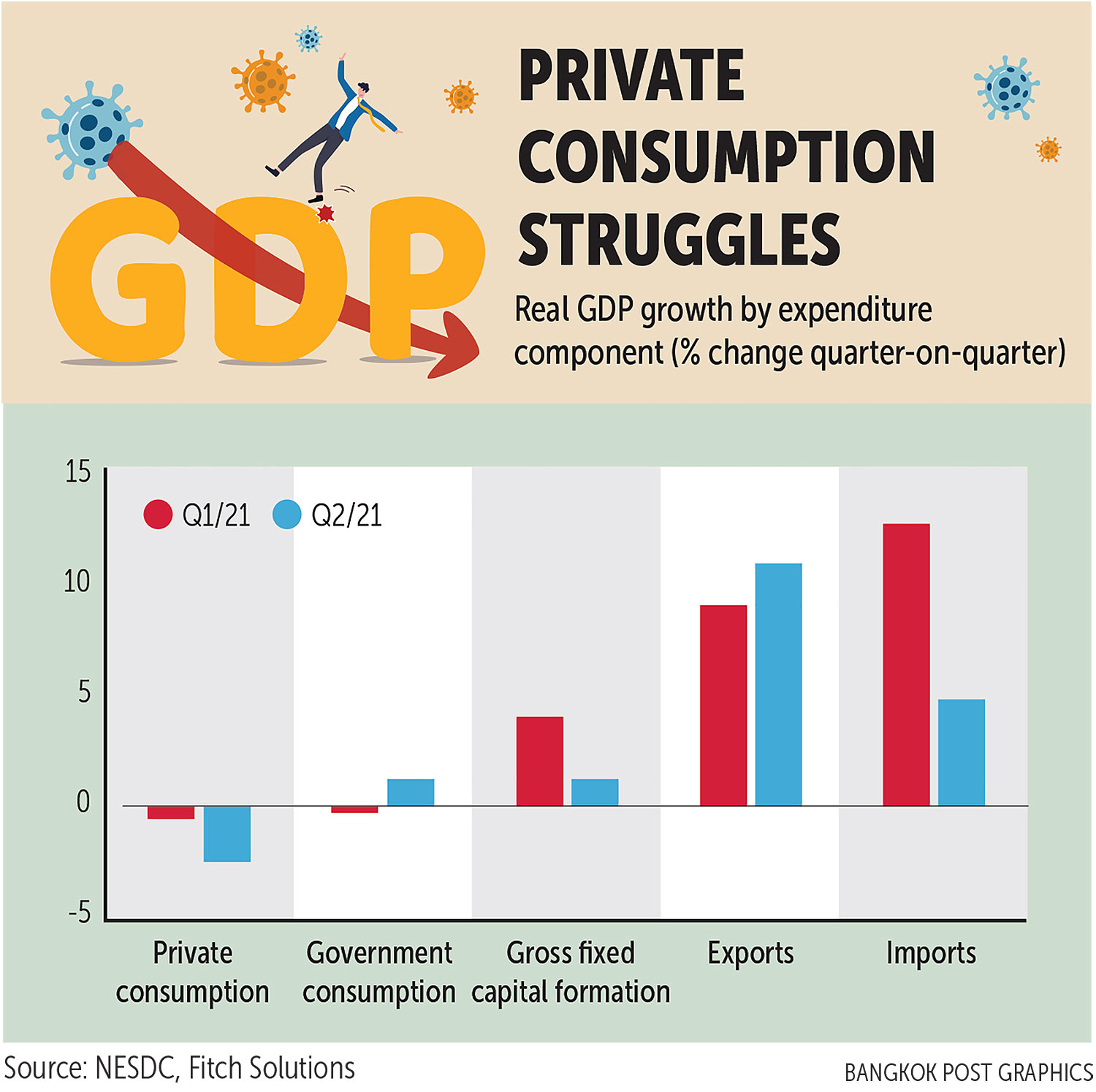

Real GDP growth in the second quarter was 7.5% year-on-year, outperforming Bloomberg consensus expectations of 6.6%. While annualised growth was distorted by large base effects (the economy contracted 12.2% in the second quarter of 2020), quarter-on-quarter readings showed a pickup in activity from 0.2% in the first quarter to 0.4% in the second.

The main drivers of the recovery were exports and government consumption, growing by 10.8% and 1.2% respectively from the first quarter. Gross fixed capital formation (GFCF) also rose by 0.5%, albeit slowing from the 4.0% growth rate in the first quarter.

In particular, there were signs of some rebound in tourism activity, with accommodation and food services activity growing 19% from the first quarter, when such activity registered a 20.4% decline.

CONSUMERS TAPPED OUT

However, private consumption displayed persistent weakness, contracting by 2.5%, following an 0.6% decline in the first quarter. The disruptions from some tightening of mobility measures likely weighed on retail activity. This bodes poorly for growth in the third quarter, which will be further hampered by more stringent restrictions. Consequently, we have revised down our outlook for private consumption from growth of 1.0% to flat.

Consumer confidence has also been on a downward trajectory, with the index falling from 47.8 in January to 40.9 in July, its lowest reading since February 1999 during the aftermath of the Asian financial crisis.

The erosion of household incomes and continued job insecurity has weighed on household sentiment and resulted in a higher propensity to save. Indeed, consecutive quarters of negative growth in private consumption underscore the challenges facing the domestic demand outlook, including households’ low share of national income and high levels of indebtedness (household debt-to-GDP stood at 77.8% in the first quarter, up from 68.6% in the fourth quarter of 2019).

Government handouts announced in June will provide some boost to household expenditure, but the sharp decline in consumer confidence is unlikely to reverse until the pandemic threat has significantly abated. As such, we do not expect private consumption to prove much of a boost to the economy over the coming quarters.

We maintain our forecast for government consumption growth of 1.8%, following an average of 1.6% year-on-year growth in the first half of 2021. While base effects will prove less favourable in the second half, we anticipate a ramp-up in government expenditure given the need to use budgeted funds for fiscal 2021 ending on Sept 30.

Moreover, government spending on healthcare and on support measures for the economy are likely to be bolstered. The announced $4.5-billion stimulus package in June focuses on support for households but we expect further packages to be announced over the coming months.

Given the strong showing in the first half, in which it grew an average 7.7% year-on-year, we have revised up our forecast for GFCF growth from 3.4% to 4.5%. We expect investment activity to slow over the coming quarters given some tempering of business optimism.

Purchases of capital goods are likely to slow as manufacturing output has stalled in recent months. In July, manufacturers reported solid external demand but continued weakness domestically, leading to lower capital purchases and spare capacity.

As such, we believe private fixed investment could ease through the second half. That said, public fixed investment will likely remain strong to support job creation and bolster domestic activity.

EXTERNAL RECOVERY

We forecast net exports to contribute 2.6 percentage points to headline growth in 2021, having subtracted 5.3 points in 2020. The export recovery has been driven by strong goods demand, which has accelerated as the global economy has opened up.

We remain positive on the export sector given manufacturers are still reporting healthy external orders and buoyant global demand for autos, machinery and electrical equipment. However, we note signs of a slowdown in China and supply-chain constraints remain prominent headwinds to activity.

In addition, the nascent recovery in international tourism is likely to stall or be significantly disrupted by the lockdowns in place through July and August, although Phuket and Phangnga are still open to tourists. As such, we forecast export growth of 10% in 2021.

However, our downwardly revised outlook for household consumption, and front-loaded purchases of capital goods in the first half, mean that import growth will also cool, coming in at 6%.

We forecast economic growth to pick up to 3.9% in 2022 as restrictions are gradually eased and tourism makes some recovery. However, the economy is unlikely to return to its pre-pandemic trajectory, with more indebted private and public sectors likely to weigh on domestic demand over the long term.

Source: https://www.bangkokpost.com/business/2170263/recovery-still-stalled

English

English