Thailand: Q1 results show fortitude in banking sector

Most SET-listed commercial banks in the first quarter remained resilient amid the floundering economy, while building higher provisions for expected loan losses from rising bad debt as new financial reporting standards are adopted and the coronavirus spreads.

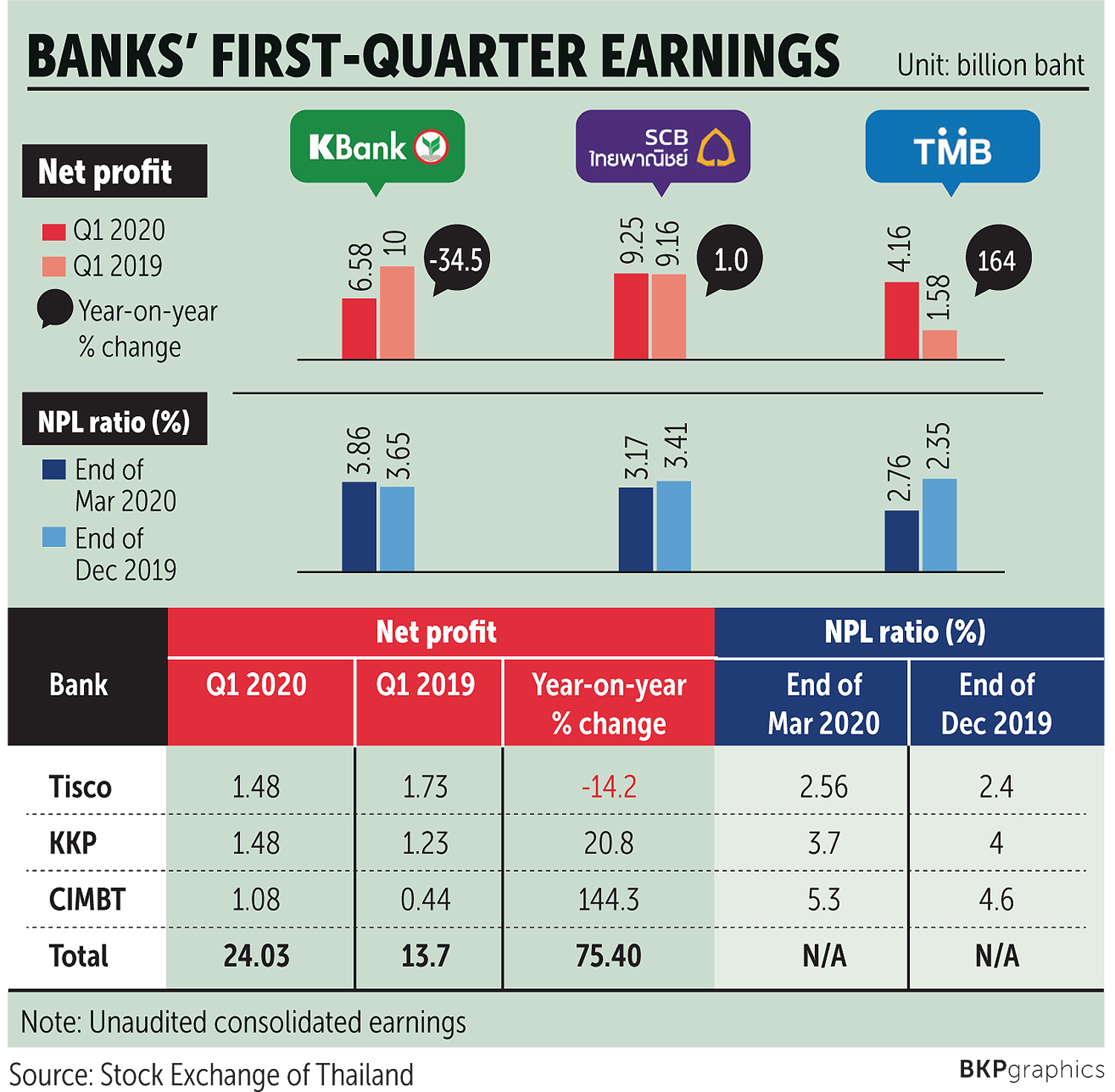

Six banks recorded an unaudited consolidated net profit for the three months to March totalling 24 billion baht, up 75.4% on the same period last year, as TMB Bank (TMB) fully recognised Thanachart Bank’s bottom line in quarterly earnings.

At time of press, quarterly earnings for Bangkok Bank, Krungthai Bank, Bank of Ayudhya and LH Financial Group were unavailable.

TMB Bank posted a 164% year-on-year surge in net profit to 4.16 billion baht, compared with 1.56 billion baht in the same period of 2019 when Thanachart Bank’s net profit was not counted. TMB is consolidating with Thanachart.

Gross NPLs amounted to 44.2 billion baht at the end of March, compared with 37.7 billion baht at the end of last year. The NPL ratio climbed to 2.76% as of March from 2.35% at the end of December.

Among the top four banks, KBank saw unaudited consolidated net profit fell by 34.5% from a year earlier to 6.58 billion baht for the January-to-March quarter, mainly due to higher loan impairment charges and other operating expenses and a sharp decline in non-interest income.

The bank has set aside provisions for expected credit loss to the tune of 4.29 billion baht for the three months to March, compared with 7.58 billion baht for loan-loss reserves in the same period of 2019, according to a filing with the Stock Exchange of Thailand (SET).

“KBank has set aside higher expected credit loss from 4.29 billion baht in the preceding period, with prudent consideration of factors in line with uncertainties from the continued economic slowdown,” the bank said.

Thai banks started to adopt TFRS9, a new standard requiring them to put aside provisions based on expected credit loss at the beginning of this year.

KBank said the ratio of gross NPLs to total loans at the end of March stood at 3.86%, up from 3.65% at the end of 2019.

KBank’s coverage ratio at the end of March fell to 138.7% from 148.6% at the end of last year.

Net interest income for the country’s largest lender by assets surged by 11.2% from a year earlier to 28.1 billion baht in the first three months, while non-interest income plunged by 39.8% to 7.37 billion baht in the same period, mainly due to volatility in the money and capital markets during the recession from the pandemic, plus TFRS9 impacts from reclassification and new measurements for investments that reflect non-interest income.

Other operating expenses increased by 9.2% from 2019 to 17.5 billion baht on debt management expenses, IT-related expenses and marketing expenses, resulting in a cost-to-income ratio of 49.31%.

Siam Commercial Bank (SCB) said net profit rose 1% from a year ago to 9.3 billion baht for January to March as an 8.9% top-line increase and an 8.1% decline in operating expenses negated higher loan impairment charges amid heightening economic uncertainties.

The bank’s loan-loss provision soared by 79.4% from 2019 to 9.7 billion baht in the three months through March, not only to cover new non-performing loan (NPL) structures but also to comply with the new accounting standard on asset impairment in the economic downturn.

Consolidated NPLs fell by 1.9% from the end of 2019 to 83.6 billion baht at the end of March, and gross NPLs fell to 3.17% of loans outstanding from 3.41% in the same period.

CIMB Thai Bank (CIMBT) posted a 144% year-on-year jump in first-quarter net profit to 1.08 billion baht, thanks to a 16.8% increase in operating income and a 38.8% decline in expected credit loss provision, the bank said in a filing with the SET.

The bank’s consolidated NPLs amounted to 13.5 billion baht at the end of March. The ratio of gross NPLs to total loans rose to 5.3% at the end of March from 4.6% at the end of 2019.

The loan-loss coverage ratio fell to 88.6% at the end of March from 94.1% at the end of December.

CIMBT’s operating income increased to 4.24 billion baht, propelled by a 193% rise in other operating income due to gains in investment.

The bank’s net interest margin dropped to 3.31% for the three months through March from 3.45% a year earlier as interest income from investments shrank.

Source: https://www.bangkokpost.com/business/1904570/q1-results-show-fortitude-in-banking-sector

English

English