Thailand: Office occupiers find new ways to adapt

More than a year into the pandemic, Bangkok’s office market is changing before our eyes. Despite the slower market activity, new office building supply continues to increase every quarter, with new projects consistently being announced.

The Bangkok office market has recorded a direct impact from Covid-19, with the overall occupancy in the second quarter falling to 88.7%, the lowest since 2013 and down from 93.1% in 2019. At the same time, the market is poised to see the first oversupply in a decade.

Office occupiers, meanwhile, are finding new ways to adapt to the uncertain times ahead.

Most companies are focusing on returning to normal office settings, despite the wider adoption of hybrid working models, where employees share time between traditional office settings and working remotely, according to the latest CBRE Future of Office survey.

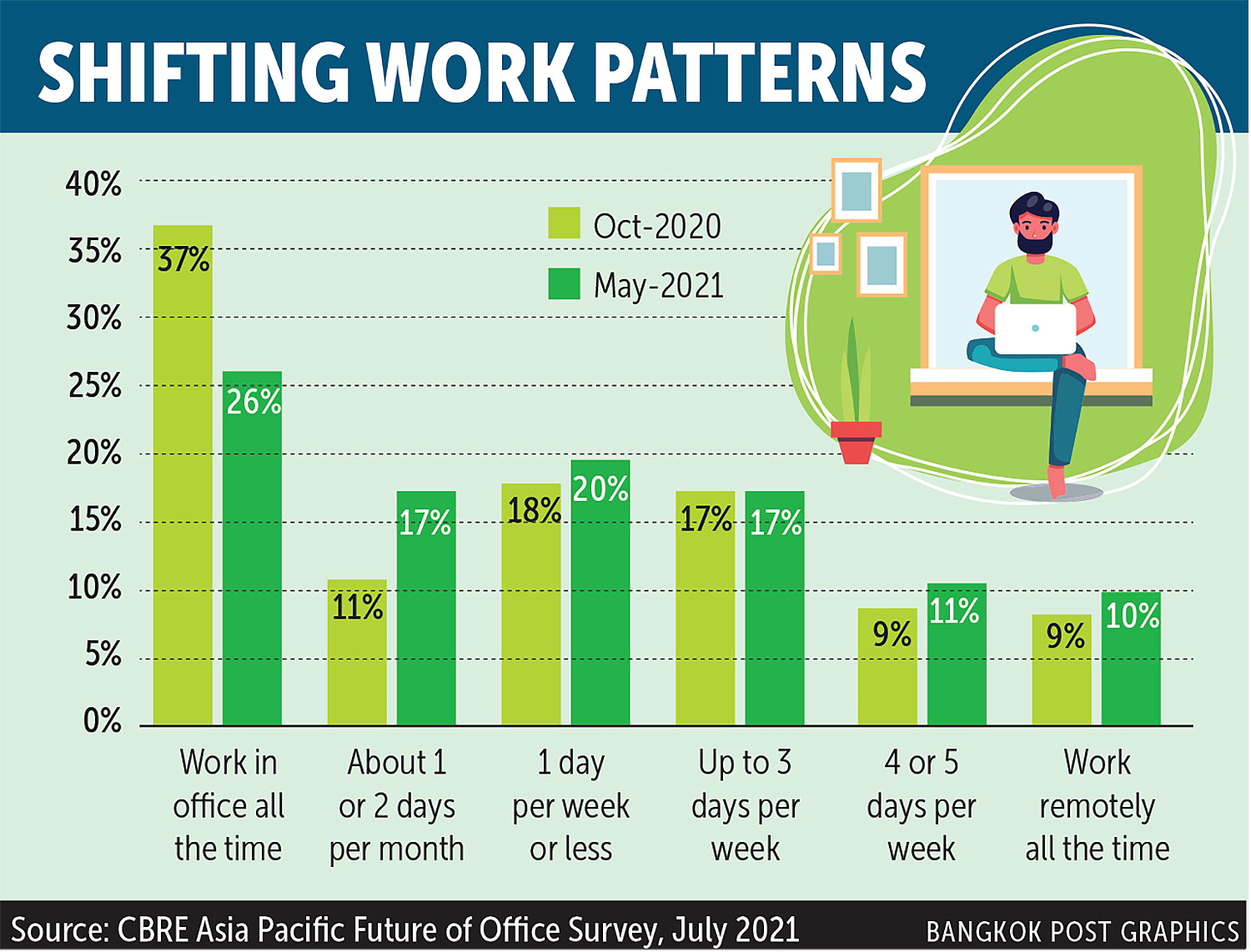

Comparing the survey results from October 2020 with those of May 2021, the biggest shift occurred when employers were asked if they expected their people to “work in the office all the time” — just 26% responded affirmatively compared with 37% in the earlier survey.

With occupiers now enjoying better bargaining power, CBRE has observed that over the next six months their focus will be on renewing current leases as well as renegotiating rent and lease terms to reflect market disruptions. This could include requiring greater flexibility in contracts, such as allowing subleasing.

One-third of survey respondents are planning to increase their use of flexible office space, including co-working or serviced offices, as it will provide them with more flexibility in the contract and shorter lease terms.

Another key trend is the flight to quality. Some occupiers are taking advantage of the vulnerable market situation to move into better buildings with more attractive deals. At the same time, they are shifting towards being more cautious in their decision-making as well as focusing on more flexible contracts to improve security in a volatile market environment.

Meanwhile, a new supply pipeline of approximately 1.2 million square metres in Bangkok over the next three years will put even more pressure on landlords. Even after the Covid-induced market downturn, the market could see a new challenge coming from the steady increase in office supply even as occupiers shift their work patterns.

Despite these challenges, demand for office space persists, driven by more widespread adoption of hybrid work models with emphasis on collaboration space, and employers focusing on traditional office settings.

CBRE is observing major changes in the Bangkok office market. Nonetheless, we believe the market will embark on a slow recovery post-pandemic and will continue to rebound alongside the Thai and global economies.

Ingfah Damrongchaitham is an analyst at Research and Consulting, CBRE Thailand. She can be reached at [email protected]

Source: https://www.bangkokpost.com/business/2175155/office-occupiers-find-new-ways-to-adapt

English

English