Thailand: New food delivery apps seeking a bite

Competition in food delivery apps is expected to intensify as a series of newcomers jump into the 35-billion-baht market, with some aiming to leverage customer insights for their other businesses.

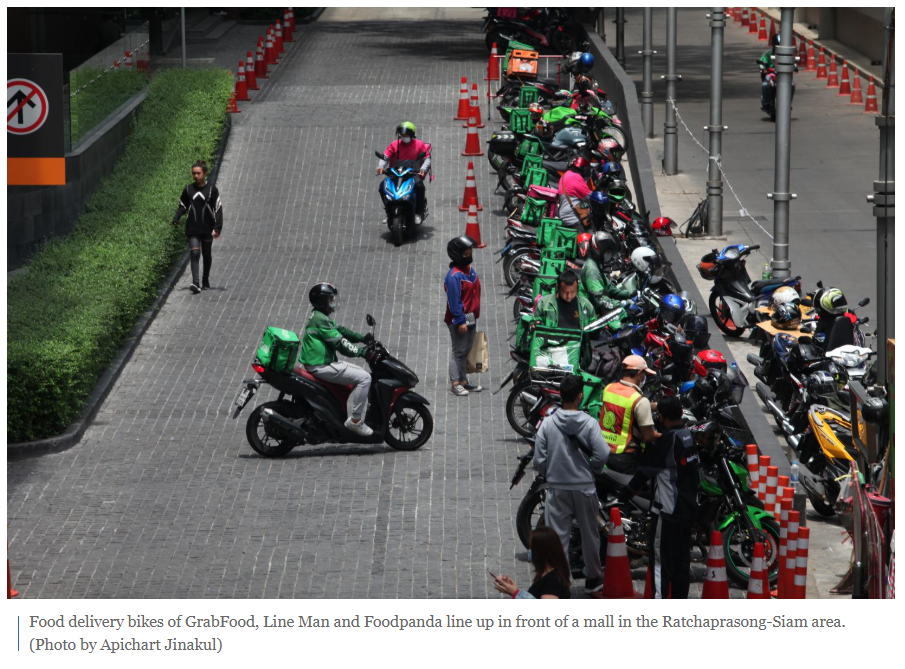

GrabFood, Get, Line Man and Foodpanda are the major food ordering apps in the Thai market. More competitors have entered the segment, including Siam Commercial Bank (SCB), which unveiled food delivery platform Robinhood on Monday.

Robinhood is waiving the gross profit (GP) fees collected from food merchants as part of its strategy to draw eateries and customers onto the platform.

“We expect to see the food ordering business getting intense in the second half as newcomers force existing large players to adjust their strategies to protect their market share,” Anantaporn Lapsakkarn, senior researcher at Kasikorn Research Center (K-Research), told the Bangkok Post.

K-Research revised its food delivery market projection to growth of 19-21% from 35 billion baht last year. Previously the centre expected the market to grow by 17% this year.

Mr Anantaporn said that although the food ordering business is still burning cash with promotions and low delivery fees to draw customers, players can leverage customer data for other businesses, including providing loans.

“Within one year, those who cannot afford to keep burning cash may disappear,” Mr Anantaporn said. “Within 3-5 years, the players who can survive are those with deep pockets.”

In the short run, the players with low delivery fees providing a variety of food choices will be able to survive. Small operators may have to focus on specific food types, Mr Anantaporn said.

Weeradej Panichwisai, a senior research manager at IT research firm IDC Thailand, concurred that the battle for the food ordering market is poised to heat up, similarly to competition in the e-commerce platform segment.

The winners will be the ones with deep pockets, he said, and they will become the dominant players.

In the ride-hailing business, only one or two players will be able to control the market eventually, Mr Weeradej said.

“Food ordering apps have been able to get off the ground due to promotions and higher demand amid the pandemic,” he said. “The market will continue to grow in the rainy season.”

Sutthikead Chantarachairoj, chief executive of Shippop, a local e-logistics aggregator startup, said demand for food ordering apps is particularly significant in provinces like Chiang Mai and Phuket.

Another food ordering platform, the hiw.asia website, has emerged with the Popman delivery service app.

Kamolprudh Jumbala, chief executive of Skootar, a delivery service provider that partners with the Robinhood app, said the food ordering market has two business models.

One is that operators ask eateries to pay for GP fees and collect low delivery fees from customers. The other is that they do not charge GP fees, but merchants will have to pay extra fees when they want to join a promotion with low delivery fees.

Source: https://www.bangkokpost.com/business/1932164/new-food-delivery-apps-seeking-a-bite

English

English