Thailand – NESDB: Flat quarter-on-quarter growth as exports cool down

Third-quarter economic growth surprised, with a flat reading from the previous quarter, the weakest since the first quarter of 2014 when the economy shrank 0.4%, as exports and tourism cooled.

The National Economic and Social Development Board (NESDB) reported Monday that the country’s GDP showed no growth in the third quarter from the second, on a seasonally adjusted basis, after growing 0.9% in the second quarter and 2% in the first quarter.

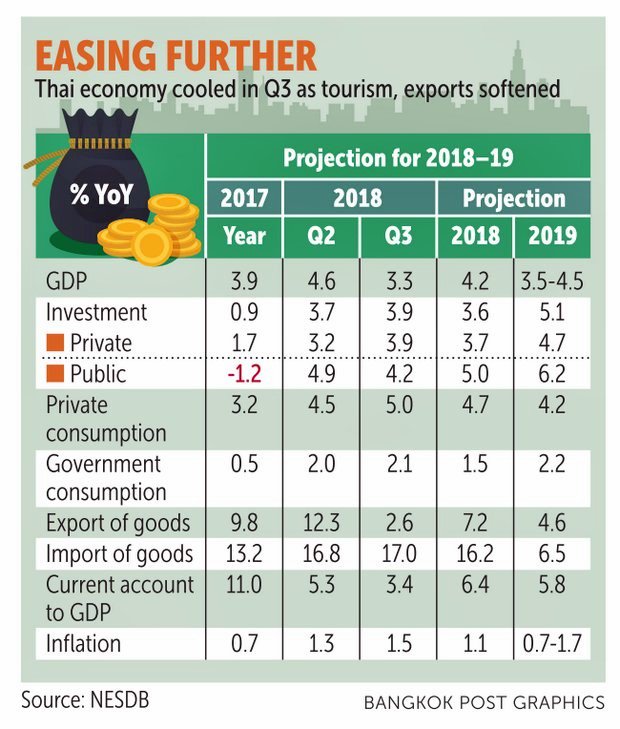

On an annual basis, growth was 3.3% from July to September, easing from the second quarter’s 4.6% and the revised 4.9% growth in the first quarter, the highest in five years.

For the first nine months, the economy grew by 4.3% over the same period last year.

Weak economic performance in the third quarter prompted the state planning agency to downgrade its 2018 GDP growth forecast to 4.2% from the previous 4.2-4.7% range. Exports are expected to rise 7.2% this year, rather than 10%.

For 2019, the NESDB expects GDP growth of 3.5-4.5%.

Thosaporn Sirisamphand, secretary-general of the NESDB, said exports in dollar terms had decelerated from the previous quarter due to the high base effect, the economic slowdown in major trading partners, and the adaptation of foreign entrepreneurs to escalating trade tensions from protectionism measures between the US and China.

Export value in the third quarter of this year was recorded at US$63.4 billion (2.09 trillion baht), up by 2.6%, slowing from 12.3% growth in the previous quarter.

The manufacturing sector slowed down from the previous quarter, edging up by only 1.6%, slowing from 3.2% in the previous quarter.

Hotels and restaurants sector slowed down, associated with the downward trend in the number of tourists. Hotels and restaurants sectors expanded by 6.5%, slowing from a 9.4% increase in the previous quarter.

Foreign arrivals totalled 9.06 million for the quarter, up by 1.9%, slowing from 8.4% in the previous quarter. This was mainly due to the contraction in the number of tourists from China (8.8%), following the boat capsizing near Phuket in July. Russian tourists fell 7.2% for the period, in part because of the Fifa World Cup taking place in their country during June to July.

The majority of European tourists switched their destinations toward Russia, reflecting the drop in the number of tourists from Europe by 1.5% in the third quarter 2018, following the 1.9% contraction in the second quarter.

However, Mr Thosaporn said private consumption and private investment trended upward in the third quarter.

Private consumption expanded by 5% year-on-year, the highest growth in the past 22 quarters, up from 4.5% in the previous quarter while private investment grew by 3.9%, up from 3.2% in the previous quarter.

The agency raised the forecast for private investment to 4.7% this year from 4.1% made on Aug 20. But it revised down the overall investment to 3.6% this year from the previous projection of 4.4%, with that of the private sector cut down to 3.7% from 3.9% and that of the government investment to 5% from 7.3%.

“The 4.3% growth for the first nine months is considered relatively high,” said Mr Thosaporn.

He said the deepening trade war between China and the US will continue further affecting Thai economic growth prospects next year and pressure the overall global economy and world trade. This leads the agency to forecast next year’s economic growth of 4% next year, ranging 3.5-4.5%, with export growth estimated at 4.6%.

Tim Leelahaphan, an economist with Standard Chartered Bank Thai, said third-quarter GDP growth underperformed due mainly to slower growth in the export and tourism sectors, which offset growing traction in private consumption and private investment.

Tim Leelahaphan, an economist with Standard Chartered Bank Thai, said third-quarter GDP growth underperformed due mainly to slower growth in the export and tourism sectors, which offset growing traction in private consumption and private investment.

Economic growth prospects remain optimistic, with GDP growth projected to expand by 4.3% this year and 4.5% in 2019, said Mr Tim.

“Political parties are likely to start their election campaigns in December and have more than 60 days to campaign. We expect this to provide a short-term boost to growth via campaign-related activity and rural spending,” he said.

“We remain neutral on the export outlook, given the uncertain impact of the US-China trade disputes. We are also watching whether recent government measure announcements can reverse a slowdown in the tourism sector caused by a boat accident in Phuket in July, and attract foreign travellers during the peak season.”

Kasikornbank president Predee Daochai said this year’s economic growth is likely to come below 4.4% because of slower than expected growth in exports on the back of the Sino-US trade row.

But the bank still maintains a 5-7% loan target, while the non-performing loan ratio is not expected to change, said Mr Predee.

Bank of Thailand governor Veerathai Santiprabhob said the rate-setters will review economic growth forecasts for this year and the next at 4.4% and 4.2%, respectively, on Dec 19.

Economic growth has tilted slightly into a downward trend as the country relies heavily on exports, and the impact from the tit-for-tat tariff between the world’s top economies will be more stark in 2019, said Mr Veerathai. The central bank needs to monitor global economy and trade, particularly after the US-Sino trade dispute has dealt a blow to some export products such as rubber and electronics, he said.

The trade spat could be a boon to Thailand’s outbound shipments and economy as the country can ship more products to substitute products from China or the US, and see production relocation from China.

“Even though Thailand’s economic fundamentals are strong enough to cushion the global financial market’s volatility, I would like to warn operators not to be complacent as wild swings in foreign exchange remains possible, as was seen last year. Such volatility stems from external factors that are beyond control and change quickly, so risk management will be crucial well into next year,” said Mr Veerathai.

The stalled economic growth in the third quarter could be largely attributed to exports and services, weighed by the trade rift between the US and China, and the slowdown in the electronics and tourism industries, said Don Nakornthab, senior director at the central bank.

The private consumption pickup from improving income and employment of the non-farm sector, and the stronger private investment partly offset external impacts.

Economic growth in the final three months would improve from the third quarter’s, but economic uncertainties are escalating due to the US trade and protectionism policies, he said.

Source: https://www.bangkokpost.com/business/news/1578862/nesdb-flat-quarter-on-quarter-growth-as-exports-cool-down

English

English