Thailand, Indonesia dominate Vietnam’s car imports

Thailand and Indonesia hold the lion’s share of Vietnam’s car imports amidst challenges as the country seeks to prioritize local manufacturing.

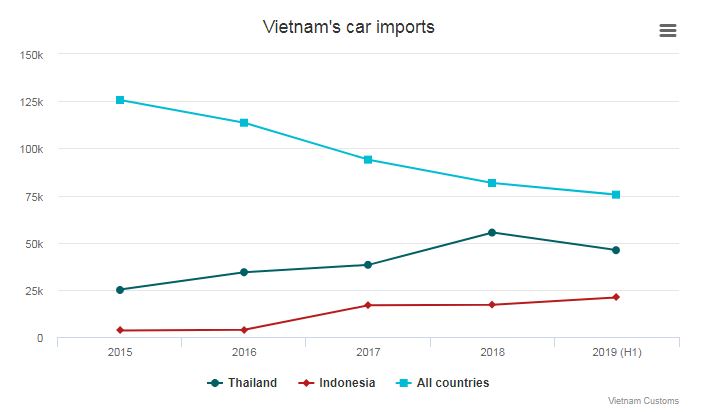

The two countries accounted for 88.7 percent of Vietnam’s total car imports in the first six months of this year, latest data from Vietnam Customs show. Imports of cars with 9 seats or less from Thailand and Indonesia have been on the rise in the last four years.

From 2015-2018, imports from Thailand have surged 2.2 times to 55,300, while that from Indonesia have risen by five times to 17,100.

Car imports to Vietnam in the first half of last year hit roadblocks when the government issued a decree with tougher conditions, requiring importers to provide certain certificates to ensure quality and countries of origin. Sales of imported cars in the period fell 49 percent year-on-year, according to the Vietnam Automobile Manufacturers’ Association (VAMA).

But both Thailand and Indonesia exporters persevered through the difficult period. After acquiring the necessary certificates from the two governments, their exports to Vietnam rose again in the second half of last year, reaching almost 72,400 automobiles for the whole year, worth around $1.3 billion.

“This shows that Vietnam is a key market for Thailand and Indonesia, which have far more developed car industries, and that’s why their exporters had tried hard to go through challenges to meet Vietnam’s new import requirements,” said the director of a carmaker in Vietnam who asked not to be named.

Ibnu Hadi, Indonesian ambassador to Vietnam, said at an event last month in Hanoi that Indonesia will seek to triple the value of car exports to Vietnam from $200 million last year to $600 million this year.

But difficulties lie ahead for the two countries as experts anticipate Vietnam will impose more polices to limit car imports and support local manufacturers.

Under Vietnam’s taxation commitments with ASEAN, from 2018, cars imported from other ASEAN countries enjoy zero percent tariffs if at least 40 percent of their value is produced within ASEAN.

Local auto firm Truong Hai Auto Corporation (Thaco) in May asked the government to inspect zero tariff application on cars imported from ASEAN.

The firm’s CEO Phan Van Tai had noted then that meeting the “40 percent localization rate is very difficult, especially for high-end passenger cars.”

He also argued that Vietnam should remove its special consumption tax on car parts produced in the country to strengthen the local supporting industry and reduce the prices of made-in-Vietnam cars. “Thailand and Indonesia have been supporting car manufacturing for years, while this has only happened recently in Vietnam.”

Vietnam’s supporting industry for car manufacturing remains weak compared to other countries in the region. There are only 358 such businesses in the country’s auto industry compared to 2,500 in Thailand. Vietnam imports over 90 percent of its auto parts, according to the Ministry of Industry and Trade.

Source: https://e.vnexpress.net/news/business/industries/thailand-indonesia-dominate-vietnam-s-car-imports-3958026.html

English

English